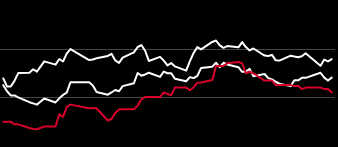

What's next for oil following China's announcement of its 2024 targets?

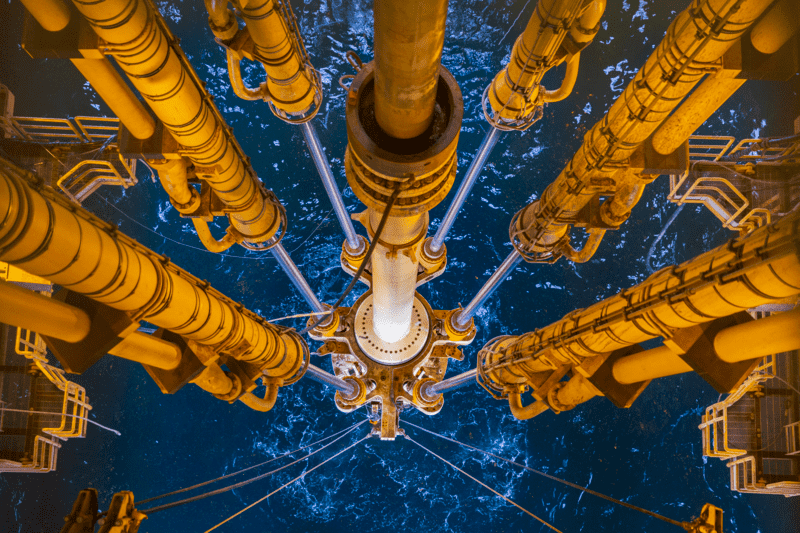

Economic power-house China has set out 10 targets for 2024, which is pro-growth for oil demand, keen on energy security, and prioritizing accelerated industry modernization and development of new productive forces.In this episode of Platts Oil Markets podcast, Managing Editor for refined oil products, Wanda Wang has invited China experts Grace Lee, Asia analyst from the AltView team, Sijia Sun, Associate Director, China Oil Market, and Oceana Zhou, Oil Market Specialist, to discuss the oil-market related highlights following China’s "Two Session" meetings -- the biggest annual political gathering in the country, which happened over March 4-11.More listening options: