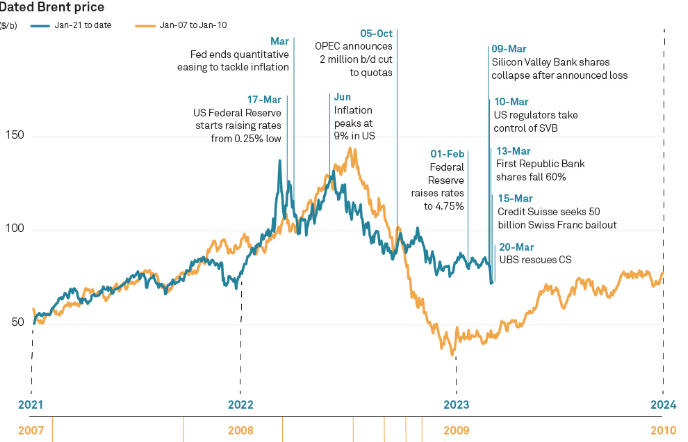

Infographic: Bank turmoil hits oil markets but fears of 2008 repeating itself look overdone

Oil traders were weighing the prospect March 20 of a new global banking crisis similar to 2008 hitting hydrocarbons demand, but a backwardated market structure signals prices could be more resilient to financial turmoil.

The sudden collapse of Silicon Valley Bank in the US and emergency takeover of Credit Suisse with the help of Switzerland's central bank have helped to push crude lower. Platts -- part of S&P Global Commodity Insights -- assessed Dated Brent at $71.705/b on March 20. The measure is down almost 15%, or $11/b, since SVB's shares collapsed after it announced losses on March 9, triggering regulators to seize control a day later.

The sudden fall in oil prices is reminiscent of the events marking the beginning of the last major banking crisis when HSBC in February 2007 unexpectedly revealed losses from the US subprime mortgage market. Eventually the collapse of Wall Street investment banks and an unprecedented $700 billion bailout of banks by the US federal government would trigger a period of extreme volatility in energy markets.

Crude hit a record $147.02/b on July 11, 2008, just months before US mortgage lending giants Freddie Mac and Fannie Mae were bailed out. However, oil traders argue it's too soon to predict the current uncertainty hitting banks turning into an economic contagion on a scale of what was seen in 2008.

"So far it doesn't look like the same kind of situation [as 2008] but we don't know what we don't know," said Trafigura Chief Economist Saad Rahim, speaking at the FT Commodities Global Summit in Lausanne.

Rahim's caution was also shared by Vitol, the world's largest independent oil trader.

"Energy markets remain vulnerable to both economic and geopolitical risks," said Vitol CEO Russell Hardy in a trading update on March 20. "The extreme volatility of energy markets during 2022 highlighted the importance of prudent physical and financial risk management; accordingly, we will continue to manage our business and financial position carefully and conservatively."

Vitol sees oil demand growing by 2 million b/d this year driven thanks to the continued return of China and air transport outweighing any concerns of a full-blown banking crisis. Hardy's cautious optimism is also reflected in market structure.

"The oil market backdrop to the 2008 financial crisis was vastly different to that of today's financial intrigue," said Joel Hanley, global oil director at S&P Global Commodity Insights. "Crude oil prices had generally been on the rise since the end of the 1990s and this came to a head, fueled by a weak dollar from 2006 onwards, when Brent crude futures rose over $147/b in July 2008."

According to Hanley, market structure in 2008 was in very steep contango, with front-month Brent at deep discounts to the following month, leading to full land storage and hitherto unseen levels of floating storage being used.

"At one point, 22 VLCCs of crude were floating off the UK coast alone, which does not speak of a strong physical market," Hanley said. "The currency and sentiment-led overheating of the commodities markets were not always backed by physical demand, leading to a crash in oil prices of over $100/b before the end of 2008. It was then that OPEC acted to remove barrels from the market and stabilize prices. The current market has a firmer sense of economic growth and demand underpinning it, with supply volatility more likely to cause upside than down."

For others like Goldman Sachs, quick action to limit the fallout from SVB and the underlying strength of economies in major consuming countries will help markets avoid a hard landing.

"Our economists still believe that the US and Europe will avoid recession given relatively elevated capital buffers in the banking system, and ongoing policy support," the bank said in a recent note.

Click to see full-size graphic

OPEC+ has so far rebuffed any suggestion the current uncertainty concerning banks requires a rethink of its plan from last year to cut 2 million b/d from supply. However, should prices dip below the $70/b threshold it may be forced to act. Crude at these levels would also compromise the effectiveness of price caps imposed by G7 members on Russian oil.

Delegates told S&P Global on March 20 the group, which is due to hold a meeting of its Joint Ministerial Monitoring Committee next month, is likely to wait for more data to emerge before jumping to any conclusion.

In its latest oil market outlook published March 14, just days after the collapse of SVB, the OPEC Secretariat downgraded its estimate of how much crude the producer group would need to pump to balance the market, despite increasing its forecast for Chinese demand.

The call on OPEC crude will average 28.77 million b/d in the first quarter of 2023, dipping to 28.62 million b/d -- below the 28.91 million b/d that the bloc produced in February -- lending support to potential further output cuts, with output from non-OPEC producers expected to rise more than previously thought.

It added that rapidly changing economic conditions continue to warrant a cautious approach to managing oil production volumes.

"Given the ongoing high level of uncertainty with regard to the timing and extent of a full global economic recovery to pre-pandemic levels in all sectors, the OPEC and non-OPEC countries participating in the [Declaration of Cooperation] continue to carefully monitor market developments," the secretariat said.

OPEC has allied with Russia and several other key oil producers on a series of output cuts, the latest of which are scheduled to last through the end of 2023.

News

Eni is to combine its North Sea oil and gas business with upstream independent Ithaca Energy, majority-owned by Israel's Delek, in a deal set to give the Italian company a 37.3% stake in the "satellite" entity, the companies said late April 23. The deal, first publicly mooted in late March, follows quickly on from Eni's acquisition of London-based Neptune Energy in January, which included an operating stake in the UK's highest producing gas field, Cygnus. The combination should result in 2024 production of over 100,000 b/d of oil equivalent, with a roughly equal weighting between oil and gas, and the potential to reach 150,000 boe/d by the early-2030s, the companies said. The deal continues a strategy for Eni of creating "satellite" joint ventures offshore Norway and Angola, although Delek is expected to remain the largest shareholder in this instance, with a 52.7% stake upon completion. The deal excludes Eni's East Irish Sea and carbon capture and storage projects, with the Italian company remaining the primary investor in flagship government-backed CCS project HyNet North West. Ithaca produced just over 70,000 boe/d in 2023, of which 66% was oil, and had warned its production from the current business would drop to 56,000-61,000 boe/d this year, reflecting the cancellation of several new projects due to the UK tax regime. It has struggled to make headway with the major West of Shetland Cambo oil project -- previously the target of environmental protests -- after entering the project in April 2022 with the purchase of Siccar Point Energy. Eni had production of around 50,000 boe/d offshore the UK in 2023. "The Satellite Model is a strategic response to the challenges and opportunities of energy markets, creating focused and lean companies able to attract new capital to create value through operating and financial synergies and the acceleration of growth," Eni said. "The combination will allow Eni to continue pursuing its successful growth on the UK continental shelf, thereby strengthening its commitment to the UK." Ithaca Executive Chairman Gilad Myerson said: "The synergistic combination with Eni's highly cash-generative UK continental shelf portfolio has the ability to unlock our long-life organic growth opportunities, creating a combined entity with substantial scale and longevity." Expanded asset base The combined entity will have reserves and contingent resources of some 658 million barrels of oil equivalent, including stakes in 37 producing assets, among them six of the UK's 10 largest fields -- Rosebank, Cambo, Schiehallion, the Mariner area, the Elgin-Franklin complex and the J-Area, the companies said. Ithaca already held stakes in Elgin-Franklin and the J-Area, which are thus increased by the combination. Elgin-Franklin, operated by TotalEnergies, is a significant contributor of both gas to the UK and liquids sold under the Forties crude brand, while the J-Area, operated by Harbour Energy, contributes to Ekofisk crude loadings; Forties and Ekofisk are key grades in the Platts Dated Brent price assessment process. Platts is part of S&P Global Commodity Insights. Ithaca is also Equinor's partner in the Rosebank oil project under development in the West of Shetland area, which has similarities to Cambo, while the Equinor-led Mariner field contributes UK heavy crude oil. The combination entails issuing to Eni new Ithaca shares equivalent to 38.5% of the enlarged entity, with Delek selling 3% of the enlarged share capital to ensure 10% or more remains in public hands on the London Stock Exchange. Dated Brent was assessed at $88.73/b on April 23, up $1.18 on the day, while the month-ahead UK NBP gas contract was assessed by Platts at 71.35 p/th.

News

Russia, one of the world’s largest oil suppliers, has increasingly turned to non-Western firms to transport its crude to overseas buyers during its ongoing war with Ukraine . With a dual goal of undermining Russia’s war chest without creating significant disruptions to global supplies amid inflation pressure, G7 countries and their allies have banned tanker operators, insurers and other services firms from facilitating seaborne Russian crude exports unless the barrels are sold for no more than $60/b. The price cap regime, which came into force Dec. 5, 2022, does not directly cover tankers flagged, owned and operated by companies outside the G7, the EU, Australia, Switzerland and Norway, and not insured by Western protection and indemnity clubs. While such ships tend to be older and less maintained, their share in Russia’s crude exports market has been rising in recent months amid strengthening prices of Urals -- the OPEC+ member’s flagship crude grade -- and tightening sanctions enforcement by the West. Non-price-capped tankers have a larger market share in shipping Russia’s Pacific crude exports, according to analysis of S&P Global Commodities at Sea and Maritime Intelligence Risk Suite data. Crudes such as Sokol, Sakhalin Blend, and Eastern Siberia–Pacific Ocean grades are more often involved in these trades than Russian barrels from Baltic or Black Sea ports like Urals. Tanker operators in Greece, Europe’s top shipowning nation, managed to keep their traditionally strong market position in Russia in the first few months since the price cap took effect before giving ways to their peers in the UAE, Russia, China and Hong Kong. (Latest update: April 5, 2024)

News

Recording changes to Russian oil exports and EU oil imports since the war in Ukraine Russia’s war in Ukraine has triggered a major upheaval in the global oil markets, forcing Moscow to find alternative buyers and Europe to source new supplies as Western sanctions seek to clamp down on Moscow’s vital oil revenues. With an EU embargo and the G7 price cap on Moscow's oil now fully in place, Russian seaborne crude exports have remained largely resilient as displaced volumes of its discounted oil flow East. Russian oil product exports have also mostly held up with new buyers in Africa absorbing Russian diesel and other fuels now banned from Europe. (Latest update: April 3, 2024)

News

Initiative driven by demand for batteries from vehicles, energy storage IOC aims to be carbon-free by 2046 Tie-up comes as India supports NEV buildup Japan's Panasonic Energy and state-run Indian Oil Corp aim to finalize details for a joint-venture to manufacture cylindrical lithium-ion batteries in India as early as June to September, the Japanese battery maker said April 1. Both companies will engage in "a feasibility study regarding the utilization of battery technology to facilitate the transition to clean energy in India," Panasonic said, and have signed a binding term sheet with details to emerge "by the summer of this year." The initiative by the companies "is driven by the anticipated expansion of demand for batteries for two- and three-wheel vehicles and energy storage systems in the Indian market", it said. The collaboration comes as India takes steps to build up infrastructure for manufacturing and supporting new energy vehicles, especially in its interim budget for 2024-25. Following the budget announcement, Chinese automaker SAIC Motor and India's JSW Group plan to install a production capacity of 200,000 vehicles/year in India, focusing on NEVs, with ramping up to start from the end of 2024. In China, NEV is a term used to designate automobiles that are fully or predominantly powered by electricity and include battery electric vehicles as well as plug-in hybrid EVs and fuel cell EVs. IOC's tie-up with Panasonic will support the energy company's goals to be a zero-carbon emitter by 2046. India's lithium-ion battery manufacturing industry is expected to grow at a compound annual growth rate of 50% from 20 GWh in 2022 to 220 GWh by 2030, data from the India Brand Equity Foundation showed. Platts assessed prices for battery grade lithium carbonate at $14,350/mt CIF North Asia March 28, flat from the previous session, S&P Global Commodity Insights data showed, while lithium hydroxide stood at $14,000/mt CIF North Asia, also unchanged from the session before. Platts Connect: News & Insights (spglobal.com)