The path forward for Dated Brent

Since its inception in the 1980s, Dated Brent – the energy industry's most used benchmark – has been nothing if not adaptable.

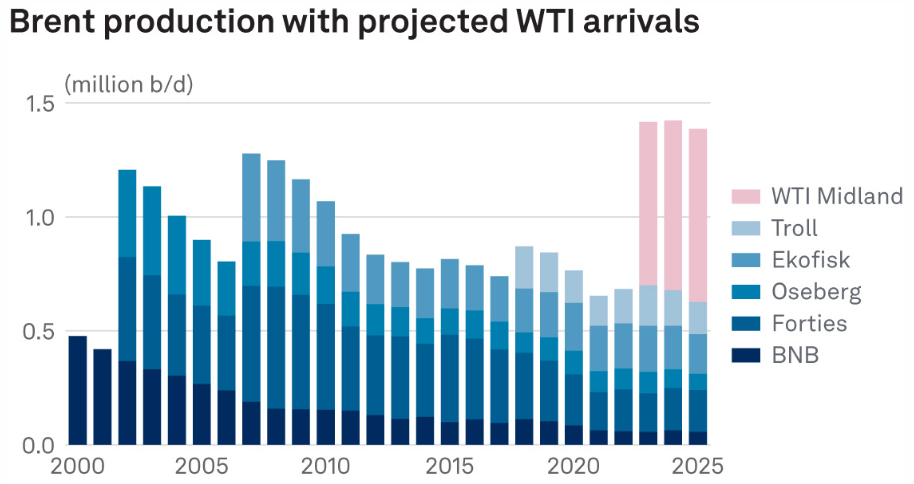

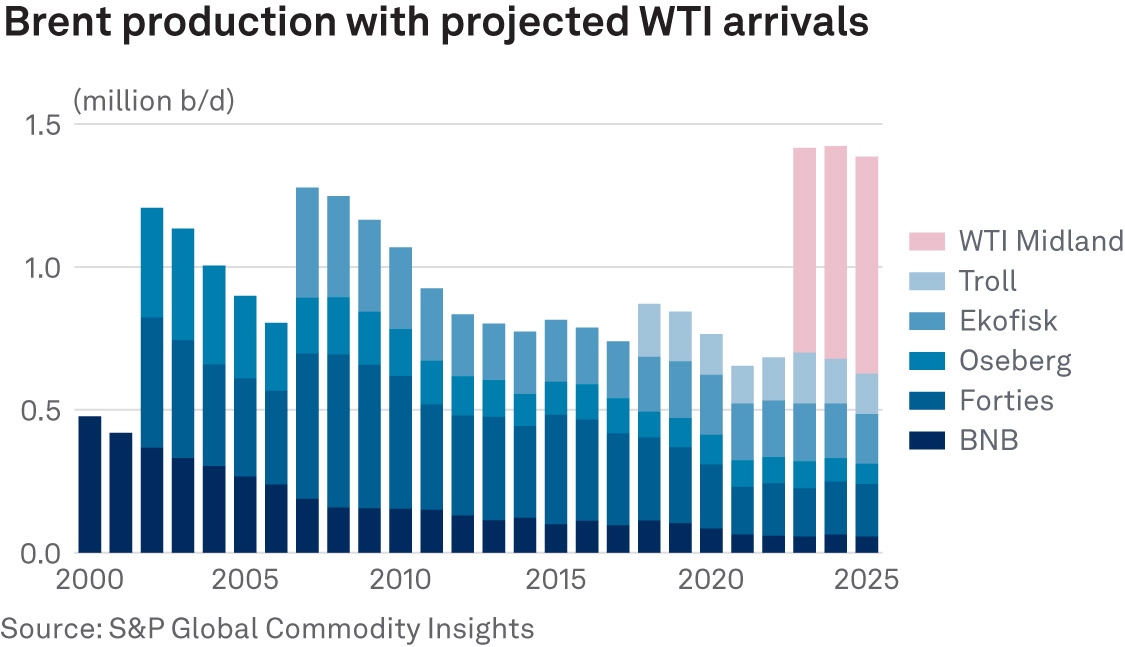

What started as a single flow of oil from the gigantic Brent field has become a diverse amalgam of five different crude oil grades loading in the North Sea. Over the years, extra grades have been added to the Dated Brent basket – Forties, Oseberg, Ekofisk, and most recently Troll – and adjustment mechanisms, such as quality premiums and a sulfur de-escalator, have allowed the grades to seamlessly adapt to the benchmark they have joined.

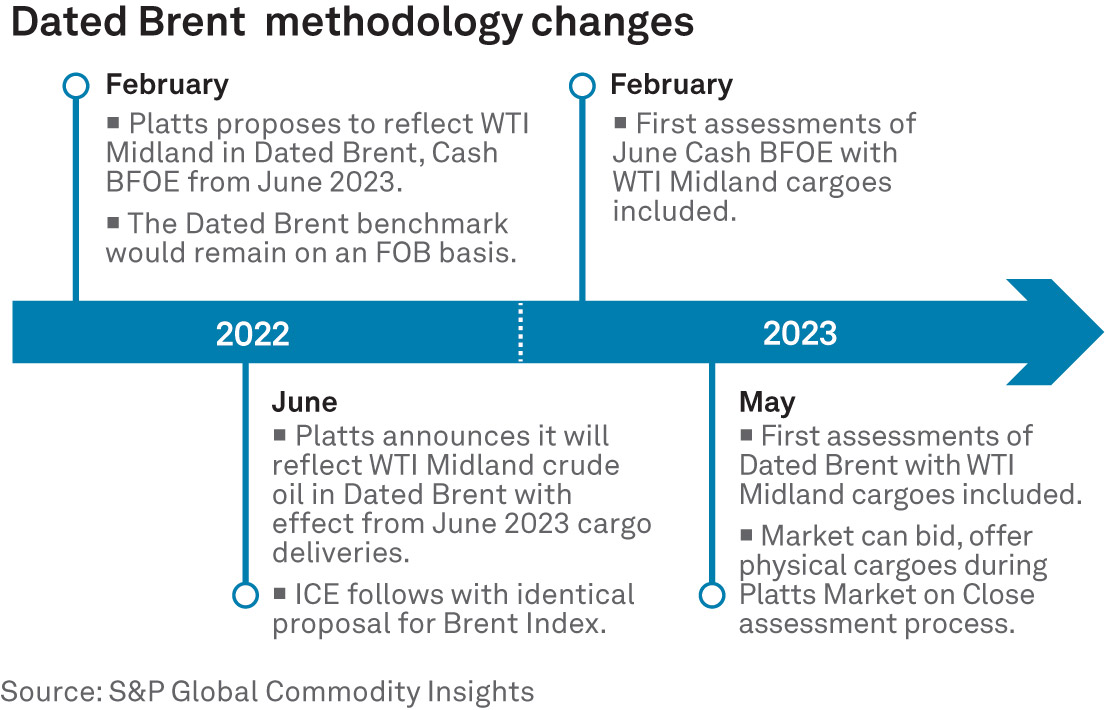

The most recent step in the evolution of Dated Brent was the 2019 introduction of CIF (cost, insurance and freight) cargoes, which allowed delivered values for those North Sea grades to be netted back and compared with FOB (free-on-board) values.

Every evolutionary step has increased the robustness of the benchmark by increasing the number of deliverable cargoes and boosting diversity of supply.

Dated Brent itself is a crucial element of the wider Brent complex, which consists of the world's most important physical and financial crude oil benchmarks. The ICE Brent futures market allows fast, easy access for hedging or investment, while physical forwards and weekly contract for differences (CFD) swaps help market participants manage their price risk and physical exposure on light, sweet crude in the global markets. These established, liquid markets have contributed to Dated Brent becoming the price reference for over half the world's crude oil and up to 40% of the world's waterborne cargoes.

In recent years, however, the Brent complex has been moving slowly toward a crossroads. The North Sea is a mature production basin, certainly for the type of light sweet crude that has traditionally underpinned Brent. While there are large new streams of crude still coming online in the region, most notably Norway's giant Johan Sverdrup, these grades look rather different to the current basket. They are generally denser and more sulfurous, and as a result often priced at quite a different – and lower – level than the existing basket.

While such grades have the advantage of geographical and logistical characteristics that would be a good fit with the current basket, they do not typically compete with the Brent basket for attention among Europe's refineries. The more natural fit in this regard is the US crude WTI Midland, which Platts, part of S&P Global Commodity Insights, announced in June 2022 would be included in the Brent complex from June 2023.

Since the easing of crude export restrictions from the US in 2015, WTI Midland, a light sweet crude, has become a familiar, regular, and accepted part of the European, and indeed global, refinery slate. Its similar quality to the Brent basket means that it competes for buyers with Brent on a daily basis in Europe.

The crude, from the Permian Basin, makes its way through a variety of pipelines to various terminals along the Texan US Gulf Coast, where it can be then sold into the local market or shipped to customers around the world.

Given the similarity in quality between WTI Midland and the Brent basket, it may appear an easy fit, but challenges remain. The implementation of WTI into Dated Brent is relatively straightforward, with WTI Midland being assessed on a CIF Rotterdam basis before being netted back to a FOB North Sea level for easy comparison with the North Sea grades.

More adaptation is needed in the Cash BFOE market. Cash BFOE is the forward market for Brent, and allows companies with physical trading capabilities in the North Sea to purchase Exchange of Futures for Physical (EFP), Cash BFOE partials and full Cash BFOE cargoes in order to access actual cargoes of BFOE crude loading in the specified future contract month.

If a participant is long a Cash BFOE cargo for a given month they will be nominated a FOB cargo of Brent Blend, Forties, Oseberg, Ekofisk, or Troll at least one month prior to the loading date for that cargo. From June 2023, companies will be able to also nominate cargoes of WTI Midland loading from terminals approved by Platts.

For over 30 years, cash forward contracts have been underpinned by Shell's SUKO 90 general terms and conditions. However, with the introduction of WTI Midland into Platts Dated Brent, Cash BFOE and related assessments from June 2023, new terms and conditions have been sought by the industry to incorporate WTI into cash contracts.

The SUKO 90 trading terms were first published in 1990 to manage Shell's own trades in the then 15-day Brent market and soon became the industry standard. Since then, they have necessarily gone through several adaptations to incorporate new grades, cargo sizes and date ranges as the market and assessment have evolved.

While SUKO 90 has served well as the Brent cash standard, market participants have signaled that a major rewrite or a whole new set of terms will be needed to accommodate WTI Midland's inclusion from 2023. While three companies – Shell, BP and Vitol – initially wrote new terms to incorporate WTI Midland into Cash BFOE, it now appears as if it will be either Shell or BP's terms which will prevail, with 2023 trades being done on both terms in September 2022.

The terms are similar on some key points such as the incoterm for WTI Midland nominations – CIF – but do differ on several issues, such as transfer of title, stipulations on freight calculations, delivery dates, cargo slots in US terminals, and sulfur penalties.

According to market participants surveyed by Platts, however, the gaps between the sets of terms are narrowing, and there is a high degree of confidence that one unified set of terms will be agreed before the end of the year.

Once this is finalized, the path will be clear for the full introduction into the Brent complex of WTI Midland. The change will bring with it the potentially biggest boost to deliverable cargoes into Brent in a generation, a steady stream of oil of a similar quality to the existing basket, and a new diversity in terms of geography and participants.

The stage is set for an exciting new era for a trusted benchmark.

This article was first published in the October 2022 edition of Commodity Insights magazine

Commodity Insights Magazine

We dig deep into the wealth of S&P Global Commodity Insights data and intelligence to examine emerging trends, opportunities and challenges in the steel and metals markets

Launch the report

News

Russia, one of the world’s largest oil suppliers, has increasingly turned to non-Western firms to transport its crude to overseas buyers during its ongoing war with Ukraine . With a dual goal of undermining Russia’s war chest without creating significant disruptions to global supplies amid inflation pressure, G7 countries and their allies have banned tanker operators, insurers and other services firms from facilitating seaborne Russian crude exports unless the barrels are sold for no more than $60/b. The price cap regime, which came into force Dec. 5, 2022, does not directly cover tankers flagged, owned and operated by companies outside the G7, the EU, Australia, Switzerland and Norway, and not insured by Western protection and indemnity clubs. While such ships tend to be older and less maintained, their share in Russia’s crude exports market has been rising in recent months amid strengthening prices of Urals -- the OPEC+ member’s flagship crude grade -- and tightening sanctions enforcement by the West. Non-price-capped tankers have a larger market share in shipping Russia’s Pacific crude exports, according to analysis of S&P Global Commodities at Sea and Maritime Intelligence Risk Suite data. Crudes such as Sokol, Sakhalin Blend, and Eastern Siberia–Pacific Ocean grades are more often involved in these trades than Russian barrels from Baltic or Black Sea ports like Urals. Tanker operators in Greece, Europe’s top shipowning nation, managed to keep their traditionally strong market position in Russia in the first few months since the price cap took effect before giving ways to their peers in the UAE, Russia, China and Hong Kong. (Latest update: April 5, 2024)

News

Recording changes to Russian oil exports and EU oil imports since the war in Ukraine Russia’s war in Ukraine has triggered a major upheaval in the global oil markets, forcing Moscow to find alternative buyers and Europe to source new supplies as Western sanctions seek to clamp down on Moscow’s vital oil revenues. With an EU embargo and the G7 price cap on Moscow's oil now fully in place, Russian seaborne crude exports have remained largely resilient as displaced volumes of its discounted oil flow East. Russian oil product exports have also mostly held up with new buyers in Africa absorbing Russian diesel and other fuels now banned from Europe. (Latest update: April 3, 2024)

News

Initiative driven by demand for batteries from vehicles, energy storage IOC aims to be carbon-free by 2046 Tie-up comes as India supports NEV buildup Japan's Panasonic Energy and state-run Indian Oil Corp aim to finalize details for a joint-venture to manufacture cylindrical lithium-ion batteries in India as early as June to September, the Japanese battery maker said April 1. Both companies will engage in "a feasibility study regarding the utilization of battery technology to facilitate the transition to clean energy in India," Panasonic said, and have signed a binding term sheet with details to emerge "by the summer of this year." The initiative by the companies "is driven by the anticipated expansion of demand for batteries for two- and three-wheel vehicles and energy storage systems in the Indian market", it said. The collaboration comes as India takes steps to build up infrastructure for manufacturing and supporting new energy vehicles, especially in its interim budget for 2024-25. Following the budget announcement, Chinese automaker SAIC Motor and India's JSW Group plan to install a production capacity of 200,000 vehicles/year in India, focusing on NEVs, with ramping up to start from the end of 2024. In China, NEV is a term used to designate automobiles that are fully or predominantly powered by electricity and include battery electric vehicles as well as plug-in hybrid EVs and fuel cell EVs. IOC's tie-up with Panasonic will support the energy company's goals to be a zero-carbon emitter by 2046. India's lithium-ion battery manufacturing industry is expected to grow at a compound annual growth rate of 50% from 20 GWh in 2022 to 220 GWh by 2030, data from the India Brand Equity Foundation showed. Platts assessed prices for battery grade lithium carbonate at $14,350/mt CIF North Asia March 28, flat from the previous session, S&P Global Commodity Insights data showed, while lithium hydroxide stood at $14,000/mt CIF North Asia, also unchanged from the session before. Platts Connect: News & Insights (spglobal.com)

News

(Latest update March 28, 2024) OPEC+ ministers face the challenge of managing a slumping oil market as they discuss crude production for 2024. The following infographic highlights some key issues to watch out for during the upcoming talks. Related feature : OPEC+ committee meets as output cut policy finally boosts prices (subscriber content) Click for the full-size infographic