- JERA seeks blue ammonia to co-fire 1-GW coal plant

- Middle East goes big on transition talk in COP28 run-up

- Fears of IRA-induced US-EU 'trade wars' diminish

In Asia-Pacific, Japanese power generator JERA has signed MOUs with Norway's Yara and the US' CF Industries to develop some 500,000 mt/year of blue ammonia for 20% co-firing at its 1-GW No. 4 Hekinan coal-fired unit. Japan estimates ammonia demand for power generation at 3 million mt/year in 2030 and expects it to grow to 30 million mt/year in 2050, equivalent to 1.5 times the current international trade of ammonia as a fertilizer. Meanwhile, China's power consumption rose 3.6% year on year to 8,637 TWh in 2022, easing sharply from over 10.3% growth in 2021. Installed generation capacity rose 7.8% to 2,564 GW, with hydro, solar and wind capacity rising 6%, 28% and 11% respectively. China's total installed generation capacity of renewable energy now exceeds 1,200 GW.

Energy transition news abounded in the Middle East at Abu Dhabi Sustainability Week, with national oil company ADNOC signing several agreements across carbon capture and ammonia cracking into hydrogen, renewables company Masdar developing projects in Azerbaijan, and -- closer to home for our European readers -- BP targeting FIDs on three 100-MW scale hydrogen projects in Europe this year. News was less good for the transition in the UK, with would-be battery maker Britishvolt going into administration after failing to secure a buyer, and electrolyzer manufacturer ITM Power posting yet another profit warning as it reviews its operations after supply chain issues and macroeconomic headwinds disrupted its planned scale-up.

The US's Inflation Reduction Act passage last year sparked concerns of a US-EU trade war as some feared that the bill could redirect investment flows from one continent to the other. But these fears may have been overblown, analysts now say. Think tanks and industry groups see the risk of trade disputes diminishing, given the high degree of coordinated discussion between EU and US officials, and shared recognition that a trade war would harm both sides. However, the EU is still aiming to combat potential market distortions created by the IRA. At the World Economic Forum last week, European Commission President Ursula von der Leyen said the EC's proposed Net-Zero Industry Act was designed to fend off attempts to lure production capacity away from the EU – James Burgess

Asia-Pacific

SPGlobal.com

CHINA DATA: 2022 power demand growth eases to 3.6% in 2022 from 10.3% a year earlier

Japan's JERA awards Yara, CF Industries in tenders for up to 500,000 mt/year ammonia supply

Western Australia: A test bed for the new global hydrogen economy

Premium content (available exclusively on Platts Dimensions Pro)

Voluntary carbon credit prices to rise 57% by 2030: Shell report

Topsoe to enable China's first commercial green ammonia plant with 390,000 mt/year capacity

India's renewable hydrogen policy aims for 10% of global market by 2030

EMEA

SPGlobal.com

Big oil bets big on green hydrogen as Shell to operate Oman project

UK battery developer Britishvolt goes into administration

From hydrogen to SAF, Essar eyes cleaner and bigger UK energy footprint

Premium content (available exclusively on Platts Dimensions Pro)

Trafigura emphasizes value of carbon removal credits, vows to increase investments

BP looking to FID three green hydrogen projects in Europe by end-2023

North America

SPGlobal.com

EU to counter US climate plan with new green industry law, clean tech funding

Analysts, stakeholders tamp down US-EU trade war worries over EV tax credits

Platts Dimensions Pro

Anaergia touts 'precedent-setting' RNG supply deal with Canada's largest refinery

US corporations inch direct air capture technology forward with CO2 deals

Hydrogen blending not viable in most pipeline systems: report

Chart of the week:

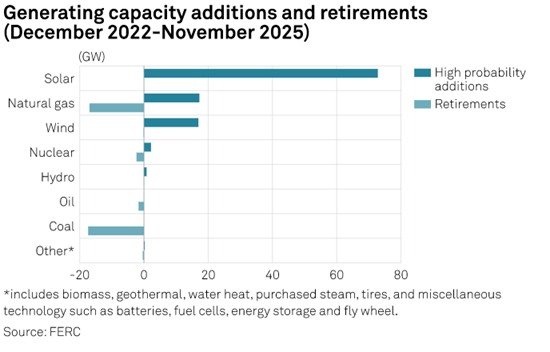

US wind and solar will account for 16% of total generation in 2023, doubling from five years ago, according to the EIA. Coal is forecast to fall 2 percentage points to 18% of the mix in 2023, while gas is expected to fall from 39% to 38%

Quote of the week:

"The risk of an [EU-US] trade war is relatively low and largely depends on unintended consequences, including miscalculation as policymakers and stakeholders grapple with changing rules of the road." -- Benjamin Salisbury, director of research and senior policy analyst at Height Capital Markets

Price of the week:

$73,000/mt

Platts, part of S&P Global Commodity Insights, assessed seaborne lithium carbonate and lithium hydroxide at $73,000/mt CIF North Asia Jan. 17, up 116% year on year