- US hydrogen announcements gather pace

- Japan's emissions trading system set for April start

- EC publishes long-awaited green hydrogen definitions

US power company Constellation Energy detailed its plans last week to build a $900 million clean hydrogen production facility in the Midwest, to be powered by 250 MW of nuclear energy. The facility, which will produce what is sometimes referred to as "pink" hydrogen, will capitalize on the Inflation Reduction Act's hydrogen production tax credits at $3/kg and nuclear production tax credits of $40/MWh to $44/MWh. On the Gulf Coast, meanwhile ExxonMobil took a step forward with its massive blue hydrogen facility planned for Baytown, Texas when it selected Topsoe to provide the facility's hydrogen production systems and Honeywell to provide carbon capture equipment. The facility is expected to be the largest hydrogen plant in the world once it opens in 2027 or 2028.

In Asia Pacific, Japan is set to launch a voluntary emissions trading system in April, with the goal of introducing a fully fledged system in 2026. The move is backed by some 679 companies that have committed to carbon neutrality. In close alignment, India is also set to launch a carbon market this year, with a hybrid compliance/offset market to be fully established by 2026. To counter over-supply of certificates, Indian policymakers are contemplating a market stabilization fund. In hydrogen, meanwhile, a demonstration project in Bolivar, South Australia plans to export renewable hydrogen to Indonesia by end-2023 using metal hydride containers.

What counts as green hydrogen? After waiting for over a year, project developers and investors in Europe finally have an answer, after the European Commission published its long-awaited definitions in a Delegated Act. And the answer is: it depends. Depending on the power mix of the grid, electrolyzers may be subject to so-called "additionality" rules requiring green hydrogen to be powered by new renewable installations. The rules are complex, but vital to underpinning investment decisions and state support for renewable hydrogen projects. The Parliament and Council now have two months to review the proposal. In the more-established arena of carbon markets, EU ETS allowance prices neared Eur100/mt on strong option interest and technical support – Henry Edwardes-Evans

North America

SPGlobal.com

Rising capital deployment to boost US green hydrogen investments: analysts

ExxonMobil selects Honeywell, Topsoe to decarbonize Gulf Coast hydrogen plant

Platts Dimensions Pro

GTI Energy unveils new methane emissions protocols as US gas industry seeks consensus

Constellation to build $900 million green hydrogen production facility

California regulators approve $31 million for two ZEV manufacturing projects

Asia-Pacific

SPGlobal.com

Japan set to launch emissions trading system in April

India works on market stabilization fund details for upcoming carbon market

Voluntary carbon credit buyers recalibrate market strategies, tighten scrutiny

Premium content (available exclusively on Platts Dimensions Pro)

South Australian demo renewable hydrogen project to export to Indonesia end-2023

INDIA DATA: Dec thermal power output rises 10% on year

China solar PV association warns of potential loss in market share in 2023-27

EMEA

SPGlobal.com

EC proposes phasing in 'additionality' rules on renewable hydrogen to 2028

EU carbon prices inch closer to symbolic Eur100/mtCO2e mark

Premium content (available exclusively on Platts Dimensions Pro)

Sweden faces power supply-demand mismatch as decarbonization pioneers flock in

Orsted awards carbon capture contract for FlagshipONE green methanol plant in Sweden

Fertiglobe signs contract for low-carbon ammonia in UAE as part of showcase for COP28

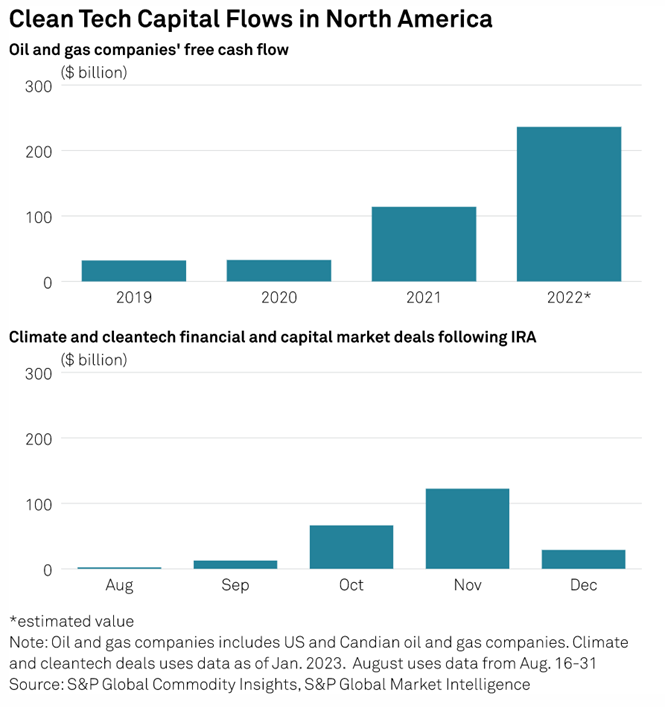

Chart of the week:

Quotes of the week:

"Hydrogen and CCUS are markets where China has not yet captured the strategic advantage. With the new incentives in the US and EU, western markets won't be playing catch-up to attain self-sufficiency and could conceivably occupy as important a space in the green hydrogen supply chain that China does in the solar and battery supply chains." --Conway Irwin, director of the Financial and Capital Markets group at S&P Global Commodity Insights

"These strict rules can be met but will inevitably make green hydrogen projects more expensive and will limit its expansion potential, reducing the positive effects of economies of scale and affecting Europe's capacity to achieve the goals set in RePowerEU." -- Industry group Hydrogen Europe on the EC's renewable hydrogen definitions

Price of the week:

Eur97.85/mtCO2e

EU ETS allowance prices on Feb. 16 were the highest since August. Prices have remained above Eur90/mtCO2e since Feb. 1