- IE Week: industry leaders clash over H2, CCS, renewables

- Asian nations establish 'practical' carbon neutrality alliance

- Nel grows in US while others struggle in nascent H2 market

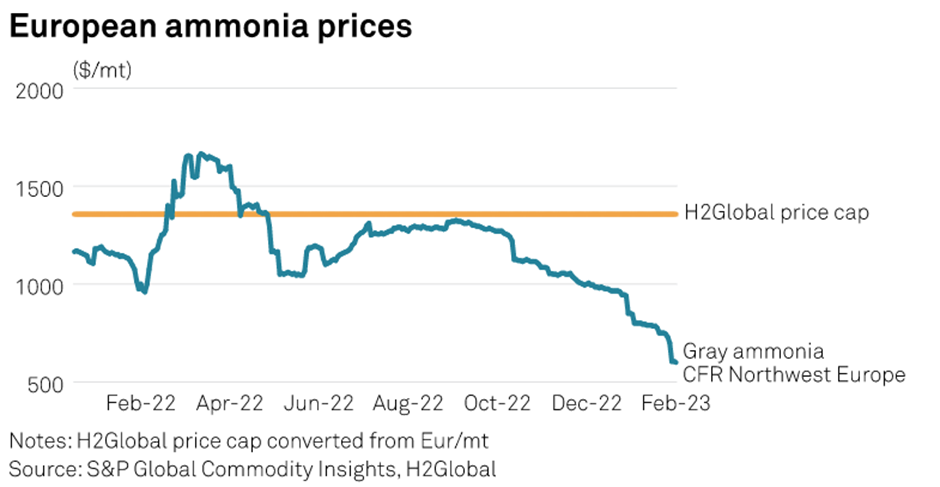

International Energy Week returned to London in late February, with BP boss Bernard Looney taking to the stage to defend his company's revived enthusiasm for fossil fuel investments. Elsewhere the event was notable for a strong focus on CCS, perhaps unsurprising given the still-strong presence of oil companies at what used to be International Petroleum Week. A lively debate saw BNEF founder Michael Liebreich take a swipe at the green hydrogen economy (more properly called "importing fertilizers," he said), while the CEO of Morocco-UK power cable developer Xlinks lambasted Looney's lack of green ambition. Over the Channel, Germany's first green ammonia import tender under its H2Global scheme closed, with a price cap of Eur1,282/mt, around double the market price for conventional ammonia, but still below price spikes seen at the height of the gas crisis last year.

In Asia Pacific 11 countries have launched the Asia Zero Emission Community to pursue "practical pathways" to carbon neutrality via coordinated steps such as developing hydrogen supply chains. Partner countries include Australia, Indonesia, Japan, Malaysia, the Philippines, Singapore, Thailand and Vietnam. India meanwhile is about to issue guidelines for its green hydrogen subsidies, providing implementation details for the country's $2.4 billion National Green Hydrogen Mission. Japan's government institute JOGMEC and China's national oil company Sinopec have both called for support of carbon capture, utilization and storage projects to generate carbon credits under domestic carbon market mechanisms. Finally the world's second largest hydropower station, the 16-GW Baihetan facility in China, has been completed.

In the US, Norwegian hydrogen company Nel has reached a final investment decision on an electrolyzer manufacturing plant expansion in Wallingford, Connecticut, taking the plant from a 50 MW/yr capacity, already the largest in the US, to 500 MW/yr. The expansion would raise that capacity to 500 MW by 2025, distributed between PEM and alkaline-based electrolyzers. Meanwhile two prominent companies leading the US hydrogen economy reported lackluster financial growth over 2022. Plug Power missed its annual growth target by half, while fuel cell truck builder Nikola reported a deficit that has now deepened to $2 billion. In a SEC filing, Nikola said there is "substantial doubt" it will have enough funds to meet its financial obligations over the next year -- Henry Edwardes-Evans

EMEA

SPGlobal.com

Starting gun sounds for global 'race to the top' in hydrogen economy: IE Week panel

EU ETS price approaching viable commercial level for CCS projects: Equinor

Clean energy growth helps stymie pace of global carbon emissions in 2022: IEA

Premium content (available exclusively on Platts Dimensions Pro)

Europe's CCS ambitions at risk as US pulls ahead: industry experts

First tender under Germany's H2Global green hydrogen derivative imports scheme closes

Asia Pacific

SPGlobal.com

Japan, 10 other Asian countries agree to pursue 'practical' carbon neutrality

China completes construction of world's second-largest hydropower station

India to issue guidelines for green hydrogen subsidies 'very soon'

Premium content (available exclusively on Platts Dimensions Pro)

Japan pushes for early development of CCS-based carbon credits across carbon schemes

Sinopec calls for inclusion of CCUS methodology in domestic voluntary carbon market

South Korea carbon allowance prices see slight bounce, sentiment still bearish

North America

SPGlobal.com

Washington's new 'cap-and-invest' carbon market holds first auction

Northwest hydro outlook trending below normal on drier February; prices climb

Premium content (available exclusively on Platts Dimensions Pro)

Norway's Nel ASA reaches final investment decision on Connecticut electrolyzer plant expansion

Tesla to harness Texas wind for EV charging as retail electric business expands

Nikola, Plug Power report gloomy financial progress over 2022

Chart of the week:

Germany's H2Global green ammonia import tender price cap gives an indication of the ground left to cover through subsidies for the scheme

Quotes of the week:

"Personally, I thought it was a real shame that Bernard Looney was up on the stage earlier today saying that by 2030 he was still going to be investing 50% of BP's capital in climate-destroying hydrocarbons. That lacks a massive amount of ambition." - Xlinks CEO Simon Morrish

"The US and Europe have been increasing their policy support for CCUS projects . . . International policy deployment should be the reference for developing localized CCUS tax incentives and subsidy schemes that fit into our carbon neutrality targets." - Ma Yongsheng, chairman of China's Sinopec Group

"We are an early-stage company with a history of losses, expect to incur significant expenses and continuing losses for the foreseeable future, and there is substantial doubt that we will have sufficient funds to satisfy our obligations through the next 12 months from the date of this report." –Nikola's annual report filed to the Securities Exchange Commission

Price of the week:

Won 12,950/mtCO2e ($9.88/mtCO2e)

South Korea's current year allowance or KAU carbon price saw a slight pickup on March 2 driven by compliance buyers' demand, but overall sentiment remained bearish. Platts, part of S&P Global Commodity Insights, has just launched its KAU price assessment