- Clean hydrogen was CERAWeek's hottest commodity this year

- Shell admits climate, energy transition threat to business

- Japan commits $1.58 billion to Australia's HESC clean hydrogen project

Stakeholders from across the global energy industry gathered in Houston last week for the CERAWeek energy conference by S&P Global to align with one another as the industry embarks on a new chapter of the energy transition. Emerging transitional commodities and technologies, such as hydrogen and carbon capture, took center stage as energy companies continue calculating how they can best take advantage of the clean energy incentives within the Inflation Reduction Act. Green hydrogen attracted a considerable amount of attention throughout the week as all manner of companies rush to fit the clean fuel into decarbonization strategies. Many attendees, however, remain concerned that green hydrogen may still be overhyped.

In Europe, big oil's chickens are coming home to roost. Shell admitted in its annual report last week that climate change, as well as an accelerating energy transition, could have an adverse impact on its profits, assets and operations, even warning of the risk of stranded assets, should carbon prices continue to rise. The company's carbon costs are set to treble in the coming decade, it said. The news followed a sober assessment by Egypt's chief climate negotiator of the failure of COP27 to deliver on emissions mitigation. Egypt's negotiator told a press briefing the lack of progress on financing for poorer countries blocked the way for agreement in Sharm el-Sheikh. Elsewhere, Mauritania is emerging as a green hydrogen center, with yet another megaproject announcement. Egypt's Infinity and UAE's Masdar have partnered with German project developer Conjuncta on a 10-GW plant, with a first 400-MW phase due to start in 2028.

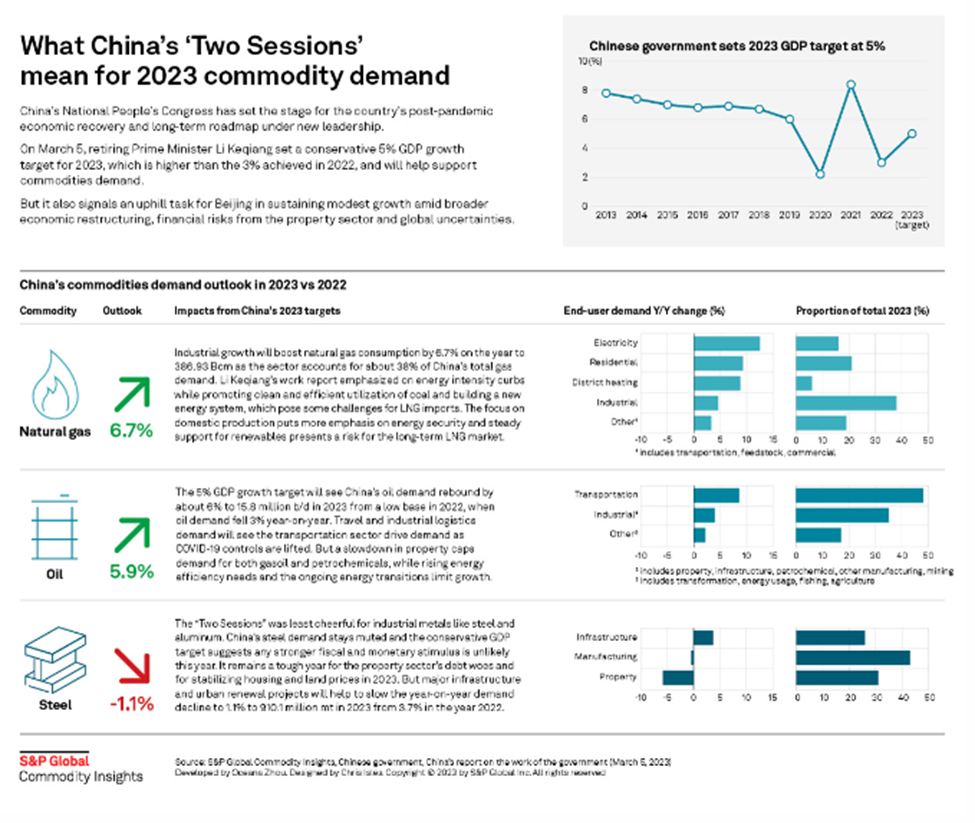

In Asia Pacific, Japan has committed $1.58 billion to the Hydrogen Energy Supply Chain project in Australia's southeastern state of Victoria, progressing the project to commercial demonstration phase. Last year the project delivered the world's first liquified hydrogen cargo to Japan from Australia. Meanwhile China's "Two Sessions" annual plenary set the stage for the country's post-pandemic economic recovery and long-term roadmap. The consistent push toward decarbonization is likely to limit growth in oil and natural gas demand this year. Finally, Indonesia's state-owned oil and gas company PT Pertamina is working with Chevron to study carbon capture, use and storage in East Kalimantan while South Korea is to commission 36,900 mt/year of hydrogen liquefaction capacity across three plants by year-end – Rocco Canonica

Americas

SPGlobal.com

CERAWEEK: Chevron expands Gulf Coast CCS project's storage capacity to 1 bil mt of CO2

CERAWEEK: Federal laws boost energy transition opportunities, but challenges remain

Premium content (available exclusively on Platts Dimensions Pro)

CERAWEEK: Proponents defend nature-based carbon market as greenwashing charges intensify

CERAWEEK: Queue backlog could prevent US from reaching IRA potential, net-zero

CERAWEEK: Mitsubishi Power shifts focal point of hydrogen business from Japan to US

EMEA

SPGlobal.com

Shell warns of ballooning carbon costs, climate risks to its oil, gas business

Unlocking finance key to progress on climate change mitigation: COP27 Presidency

VoltH2 targets mid-sized green hydrogen projects to optimize offshore wind

Premium content (available exclusively on Platts Dimensions Pro)

Conjuncta, Infinity Power to develop 10-GW green hydrogen project in Mauritania

UK grid constraints put 2035 decarbonized power system goal at risk: CCC

APAC

SPGlobal.com

Japan commits $1.58 billion to HESC clean hydrogen project in Australia

What China's 'Two Sessions' mean for 2023 commodity demand

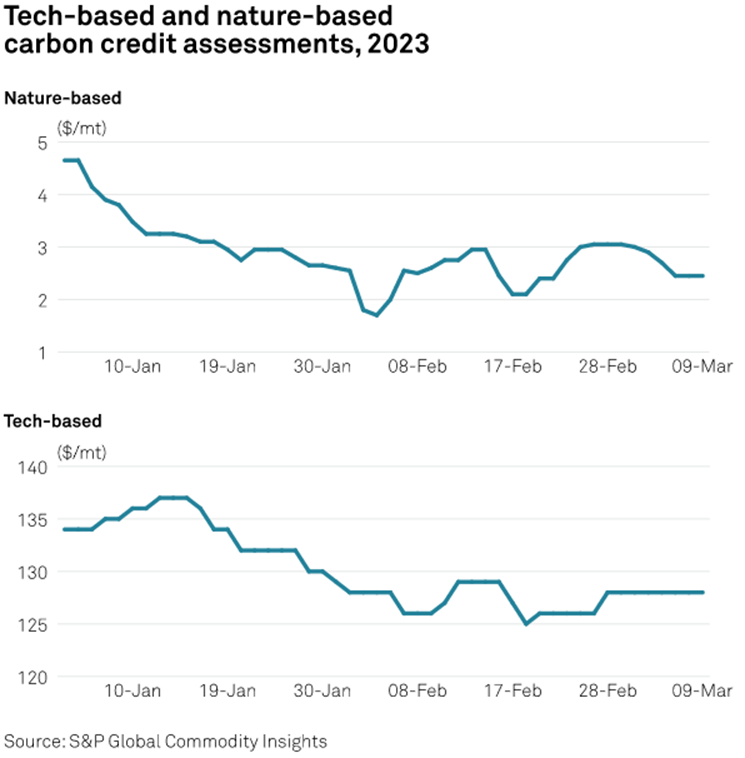

Carbon in early stages of development as asset class: Standard Chartered

Premium content (available exclusively on Platts Dimensions Pro)

Indonesia's Pertamina, Chevron to conduct feasibility study on CCUS in East Kalimantan

South Korea to start up 36,900 mt/year hydrogen liquefaction capacity across 3 plants by year end

Australian HIR-Generic carbon credit spread widens on focus on nature-based units

Charts of the week:

https://www.spglobal.com/platts/PlattsContent/_assets/_images/latest-news/20230307-infographic-china-two-sessions-2023-commodity-demand-gas-oil-steel.jpg

Quote of the week:

"My leaders in Japan have recognized that the energy transition is going to happen in the US first. As such, our center of excellence for the energy transition is going to be in the US. We've got team members coming over from Japan, and we are the tip of the spear for learning everything." -- Mitsubishi Power Americas CEO Bill Newsom.

Price of the week:

$493 million

How much Shell spent on EU ETS allowances and other carbon market schemes in 2022