- Carbon-negative biohydrogen still in need of policy support

- Build-in-Europe clean tech act proposed in response to IRA

- China relaxes compliance carbon market rules for coal plants

Clean hydrogen is gaining momentum in the US market thanks to generous policy support from the Inflation Reduction Act and infrastructure bill. But while green and blue varieties of hydrogen are rewarded by tax credits according to their lifecycle carbon intensity levels, there is no mechanism to reward hydrogen produced with negative carbon intensity levels. This hydrogen is known as biohydrogen, an emerging variety in which organic waste material is turned into "greener-than-green" hydrogen. But without extra incentives to support this carbon-negative pathway, it will be hard for such projects find commercial viability, researchers said last week. Meanwhile, several power turbine manufacturers said will begin commercializing their turbines capable of combusting a pure hydrogen stream in 2025 as US power companies look to future-proof their plants.

The European Commission has set an ambitious target to meet at least 40% of EU clean tech needs from domestic manufacturing by 2030, according to a draft Net-Zero Industry Act laid out March 16. The target, a direct response to the US' Inflation Reduction Act, translates into annual production of at least 36 GW for wind turbines, 30 GW for solar panels and 31 GW of heat pumps. The EC is also aiming to have to almost 90% of its annual battery demand manufactured domestically. Meanwhile EU carbon prices fell 15% mid-March as weak demand and tepid auction results coupled with bank sector concerns. "The combination of weaker investor interest and fuel switching is expected to add bearish fundamental pressure on EUA prices into next month," said S&P Global carbon analyst Michael Evans.

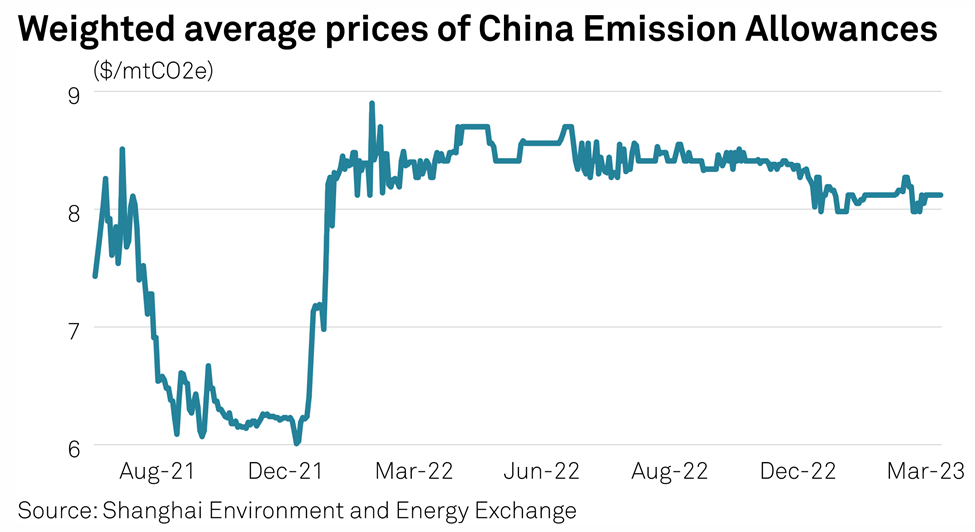

In Asia Pacific, China has relaxed rules under its national carbon market to reduce the financial burden on coal-fired power generators after a year of record fuel prices. The key measures include setting a limit on penalties under the mechanism, and allowing power plants to borrow emissions allowances from future years to offset current obligations. Meanwhile India is on course to announce details for its national carbon market scheme in June, consulting on market elements with a view to trade in 2025. In Australia and New Zealand, institutional investors are starting to participate in local carbon markets, attracted by rising carbon prices and improved policy certainty. Finally Japan and Germany have agreed to cooperate on clean energy, hydrogen and battery supply, while Singapore has approved 1 GW of renewable electricity imports from Cambodia. -- Henry Edwardes-Evans

North America

SPGlobal.com

US industry groups urge EPA to hand over CO2 well permitting authority to states

Carbon 'negativeness' of biohydrogen not rewarded by US policy framework: researchers

Premium content (available exclusively on Platts Dimensions Pro)

Panelists pessimistic on quick transmission fix from US Congress, eye alternatives

Power drives cuts in energy sector CO2, but still falls short of US goals: EIA

Turbines capable of burning 100% hydrogen to hit US market beginning in 2025

EMEA

SPGlobal.com

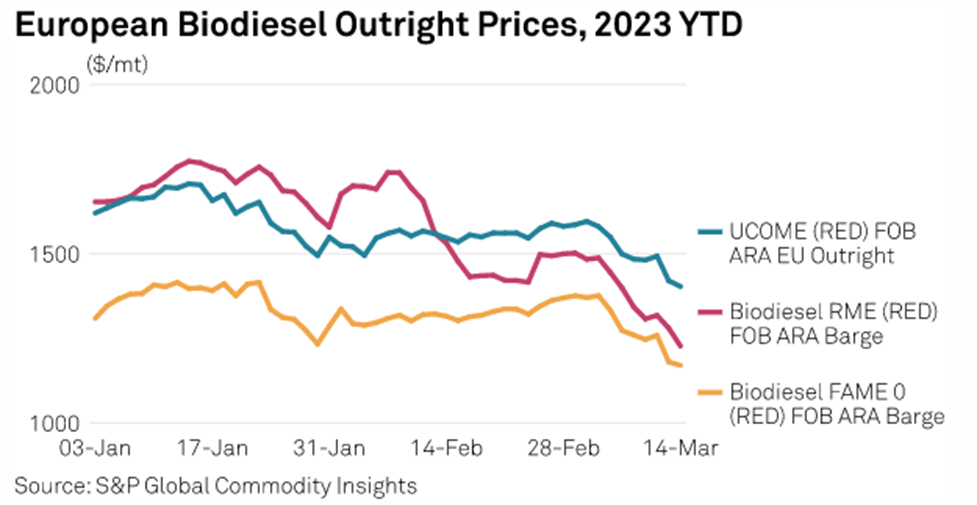

European biodiesel prices plummet amid weakening market factors

Barriers remain to commercial CCS rollout in Europe, despite high carbon prices

INTERVIEW: HFI close to $2/kg H2 production using proprietary wind technology

Premium content (available exclusively on Platts Dimensions Pro)

EU ETS price drops below Eur90/mt as bearish factors close in

EU unveils multi-gigawatt targets for 'made-in-Europe' clean technology

UK's Protium to supply Budweiser's Samlesbury site with green hydrogen

Asia Pacific

SPGlobal.com

China relaxes compliance carbon market rules for coal-fired power plants

India may announce details of national carbon market scheme in June: official

FEATURE: Rising prices attract institutional investors to carbon markets in New Zealand, Australia

Premium content (available exclusively on Platts Dimensions Pro)

Japan, Germany agree to cooperate for clean energy, hydrogen, battery supply

Singapore approves 1 GW of renewable electricity imports from Cambodia

Australia sees nearly 20% rise in power prices, to offer bill relief in May budget

Quotes of the week

"If projects like ours help save 50 basis points on a global financing, there is a huge benefit [to the buyer of green hydrogen]. Levelized cost of hydrogen is important, but it's a relatively small piece of the broader package" -- Chris Jackson, Protium CEO

"Since those incurring the biggest deficits are also the ones that will be buying up the CEAs [China Emission Allowances], capping their obligations will inevitably cast downside pressure on market liquidity and prices in the current compliance cycle" -- Feng Xiaonan, senior research analyst S&P Global Commodity Insights

Charts of the week

European biodiesel prices have been declining this year on the back of weaker diesel demand

China's compliance emission allowance price remained steady at around $8.1/mtCO2e in the week to March 17, implying that the newly launched policy resulted in limited buyers' interests

Price of the week

Eur87.29/mtCO2

Platts' assessed price of EU allowances (nearest December) is well down on February 27's all-time high of Eur100.23/mtCO2