- Asia focuses on decarbonization of shipping

- US Republicans challenge Inflation Reduction Act

- Europe's Salcos green steel project gets Eur1 billion grant

In Asia Pacific, energy transition discussions shifted from the G7 summit in Japan to the Singapore Maritime Week, where decarbonization of shipping took center stage. Shipping is estimated to account for 3% of global GHG emissions. New fuels expected to gain traction range from LNG to hydrogen, ammonia, ethanol and even electric propulsion. Member states are "actively engaged" in upgrading decarbonization strategies for shipping as the IMO works towards adoption of a Revised Greenhouse Gas Strategy, IMO Secretary-General Kitack Lim said. Meanwhile, Singapore is set to expand its range of multi-fuel offerings for the marine sector with a first methanol bunkering pilot scheduled in Q3 2023, the Maritime and Port Authority of Singapore said. The order book for methanol-powered vessels continues to grow globally across different segments, particularly container ships.

US Republicans have mounted a challenge to the Biden administration's Inflation Reduction Act in the form of the Limit, Save, Grow Act of 2023. The bill, which was passed by the Republican-controlled House April 26, would repeal or shorten a wave of IRA clean energy and manufacturing incentives while streamlining permit reviews for oil and gas pipelines, LNG terminals and other energy infrastructure. It is unlikely the bill will move much farther than the House. Democratic leaders in the Senate have said the bill is dead on arrival, and President Biden has vowed to veto the legislation were it to reach his desk. Biden has also pledged to veto another effort by House Republicans that would end a freeze on tariffs for some imported solar energy equipment, which has been in place for nearly a year.

In a hugely significant moment for Europe's hard-to-abate metals sector, German steel maker Salzgitter has received a Eur1 billion state grant for the first stage of its Salcos green steel project, due to start operation in 2025. The company plans to start building an electric arc furnace next year with capacity of 1.9 million mt/year crude steel production, reducing its demand for coal initially using natural gas and, longer-term, hydrogen. Meanwhile, in a highly critical report, UK MPs warned the government it was failing to decarbonize the power sector because of fractured policy making and a stubborn resistance to onshore wind. The most significant failure, however, was on network readiness, with low-carbon projects now facing delays of up to 15 years to connect. -- Henry Edwardes-Evans

Asia-Pacific

SPGlobal.com

INTERVIEW: Engine tech, fuel flexibility key for maritime decarbonization: Wartsila

FEATURE: G7 Sapporo was breather for energy security, but headwinds ahead for decarbonization

INTERVIEW: JERA sees Asia as potential LNG demand source as it tackles decarbonization

Premium content (available exclusively on Platts Dimensions Pro)

IMO member states 'actively' upgrading GHG strategy: Secretary General

Woodside's sees investment decision on US liquid hydrogen project in 2023

FEATURE: Methanol's appeal as bunker fuel anchoring among ports, shipping companies

Americas

SPGlobal.com

US House passes debt bill that would curtail Inflation Reduction Act credits

Air Products' green hydrogen import plans for California in flux as market evolves: VP

Premium content (available exclusively on Platts Dimensions Pro)

Portland General Electric adds 400 MW of battery storage, eyes 75 MW more

US hydrogen developers on tenterhooks over tax code definition of green

Effort to end pause on US solar tariffs builds steam but faces Biden veto

Europe

Weak compliance demand drags EU carbon prices to three-month low

IEA forecasts global EV sales to surge by 35% in 2023

EU, Norway to bolster clean energy ties, with focus on carbon and hydrogen

Premium content (available exclusively on Platts Dimensions Pro)

UK on course to miss 2035 power decarbonization goal: report

Dutch decarbonization auction delayed by EC antitrust scrutiny

Salzgitter hails Eur1 billion green steel state aid package

Price of the Week:

$36,000/mt

Platts' assessed price of lithium carbonate (CIF North Asia) fell 36% in April alone and has more than halved since Dec. 1, 2022

Quotes of the Week:

"The clear fact of the matter is that not every country can afford two energy transitions. The countries represented around the table here at the G7, the wealthiest developed countries in the world, can go from coal to gas, and then gas to other things, whether it's abatement in the fossil sector or renewables or nuclear or the fuels of the future like hydrogen. But not every country can do that. Most can't." -- Andrew Light, US assistant secretary of energy for international affairs

"The IRA tax incentives that would be repealed by the Limit, Save and Grow Act ... have spurred American companies to announce dozens of clean energy generation and manufacturing projects. Backtracking on these popular programs would harm our economy, weaken American competitiveness in the booming global clean energy marketplace, and undermine our climate goals." -- Gregory Wetstone, President and CEO of the American Council on Renewable Energy

"The UK must rapidly increase the generation of fossil fuel-free electricity. If we fail, there will be a physical limit to the volume of electric vehicles, electric heat pumps and other newly electrified processes that can be powered through low-carbon electricity." -- Cross-party parliamentary committee on Business, Energy and Industrial Strategy

Charts of the Week:

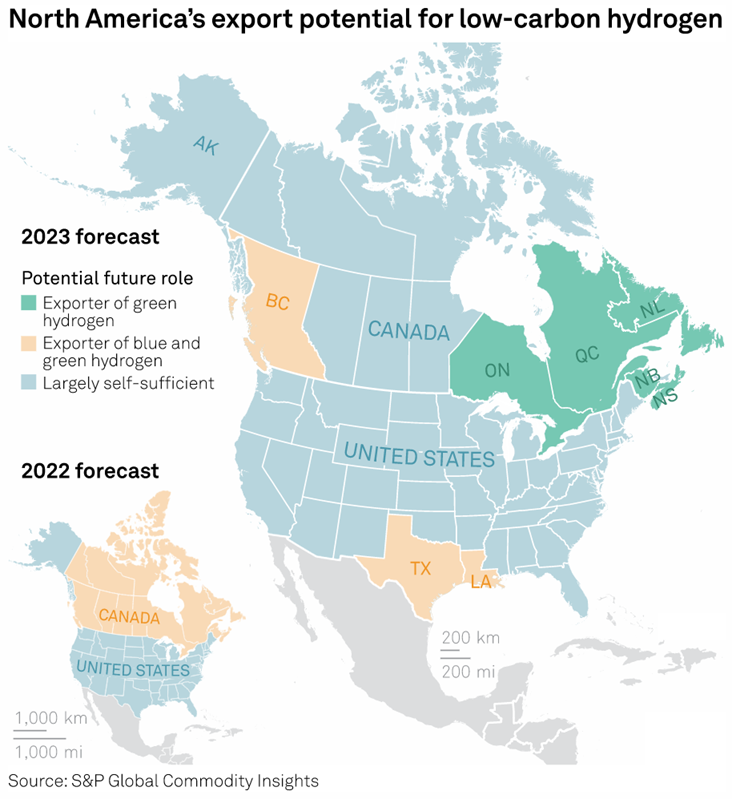

The US Gulf Coast and the Western Coast of Canada have been identified by S&P Global Commodity Insights as regions with great export potential of clean hydrogen

Wind and solar additions are set to dominate capacity additions in the Great British market