- Australia sets up Net Zero Authority to support industries, investors

- Renewables flood into US power grids

- TotalEnergies takes environmental groups to court

Asia Pacific saw varied developments to take energy transition forward starting with the big policy move in Australia to set up a Net Zero Authority for supporting industries and investments in clean energy technology, backed by a A$400 million ($271 million) fund. India's large hydrogen developer ACME Group announced it would combine forces with Indraprastha Gas to use its 21,000 km pipelines for exploring opportunities in blending renewable hydrogen in India. Japan's second-largest refiner Idemitsu Kosan and synthetic fuels producer HIF Global aims to develop e-fuel supply chains and biofuel bunkers are set to get more popular according to marine inspection company Veritas Petroleum Services.

Power grids across the US continue reporting surges of renewable generation additions of all stripes. While wind power continues climbing further ahead of all other generation sources in the Southwest Power Pool with another 5.4% increase this year over 2022, solar is having a bumper crop year in Texas, where developers plan to add up to 9.7 GW in 2023. Meanwhile, the biggest issue facing the PJM Interconnection in the Northeast is its backlog of renewable projects clogging up its interconnection queue. Developers in the region are wanting to add more than 11 GW of capacity this year.

In Europe, TotalEnergies is taking environmental group Greenpeace France and climate consultancy Factor-X to court after they filed a report accusing the French energy major of grossly underreporting its greenhouse gas emissions for 2019. "We accept criticism, and we accept that our strategy will be criticized," a TotalEnergies spokesperson said. "Greenpeace and Factor X had the right to criticize our greenhouse gas reporting, but not to use methodologies that they knew to be flawed", the spokesperson added. Meanwhile the Voluntary Carbon Markets Integrity Initiative is to launch a Claims Code of Practice on June 28 as it looks to give buyers of carbon credits confidence and clarity in their use and associated claims. The voluntary carbon market is facing increased scrutiny over the efficacy of some carbon offsets and projects, leading to a steady fall in liquidity and confidence. -- Eric Yep

Asia Pacific

SPGlobal.com

VPS-inspected marine biofuel samples surge amid push towards sustainable shipping

South Korea's SK E&S, US Plug Power commit $746 million to hydrogen project

Premium content (available exclusively on Platts Dimensions Pro)

Australia to set up Net Zero Authority to support energy transition

India's ACME, Indraprastha team up on hydrogen production, blending

Idemitsu to develop e-fuels supply chains in Japan by late 2020s

Americas

SPGlobal.com

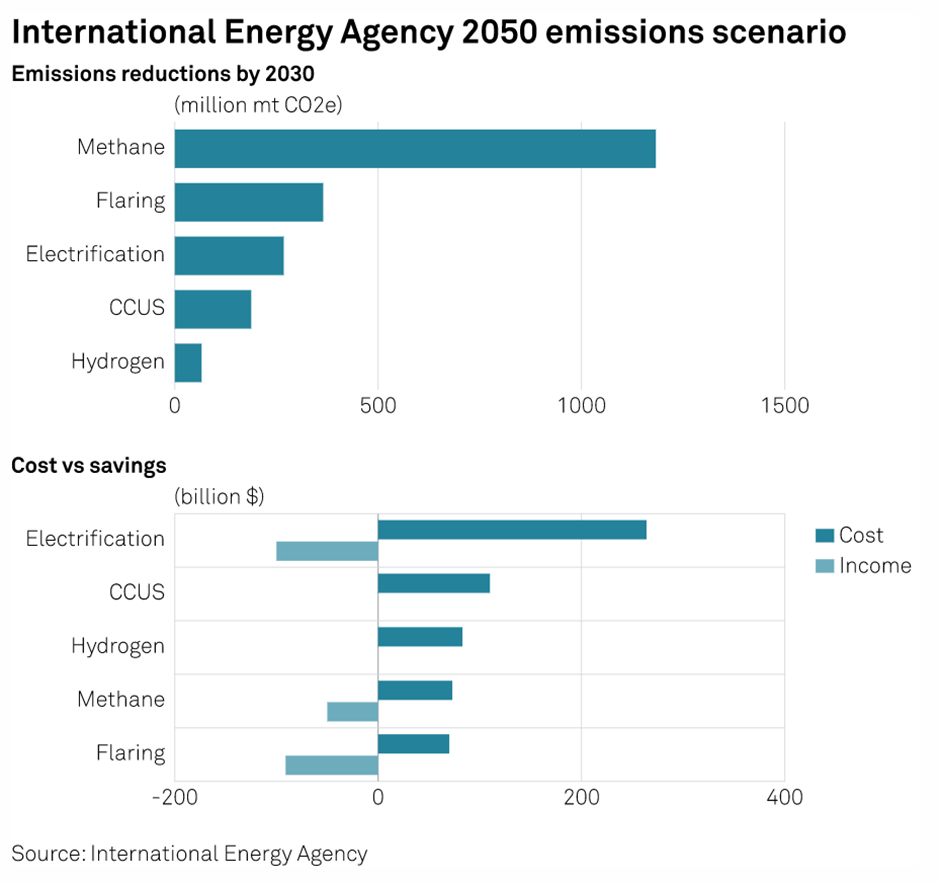

Oil and gas upstream, midstream operations primed for affordable decarbonization: IEA

PJM seeing a surge in solar this year, less new natural gas generation

Platts Dimensions Pro

Renewables dominate ERCOT's 2023 generation capacity additions

Nel selects Michigan for its largest US electrolyzer plant

US Southwest Power Pool looks for reliability, transmission solutions

EMEA

SPGlobal.com

Bearishness extends in carbon markets, EU ETS prices remain below Eur90/mt

Shell to deliver first SAF from Rotterdam plant from 2025

Seeing demand for small nuclear units grow, Westinghouse to market 300-MW reactor

Premium content (available exclusively on Platts Dimensions Pro)

Neste drops blue hydrogen option in favor of electrolysis at Porvoo

Voluntary carbon markets to see launch of Claims Code of Practice end-June: VCMI

TotalEnergies intensifies spat with Greenpeace on GHG emissions reporting

Quotes of the week:

"As interest in VCMs has grown, so has the demand for clear guidance. Corporates need to know that their activity in the market is making valuable contributions towards their own and wider climate and sustainability goals," Mark Kenber, Executive Director, Voluntary Carbon Markets Integrity Initiative

"Forward leaning [oil and gas] companies need to recognize the need to move faster than the global average reduction in emissions and build a broader coalition of companies willing to play their part." –International Energy Agency in a May 3 report

"Future bunker tankers arriving in Singapore will have to have the chemical tanker notation because now we are getting ready to supply biofuel blends that can be higher than 24%."- Rahul Choudhuri, Managing Director, Asia, Middle East & Africa, Veritas Petroleum Services.

Price of the week:

$360.66/mt -

The price of blue ammonia (CFR Far East Asia) has fallen 60% this year as the commodity tracks natural gas prices, S&P Global Commodity Insights data show

Charts of the week:

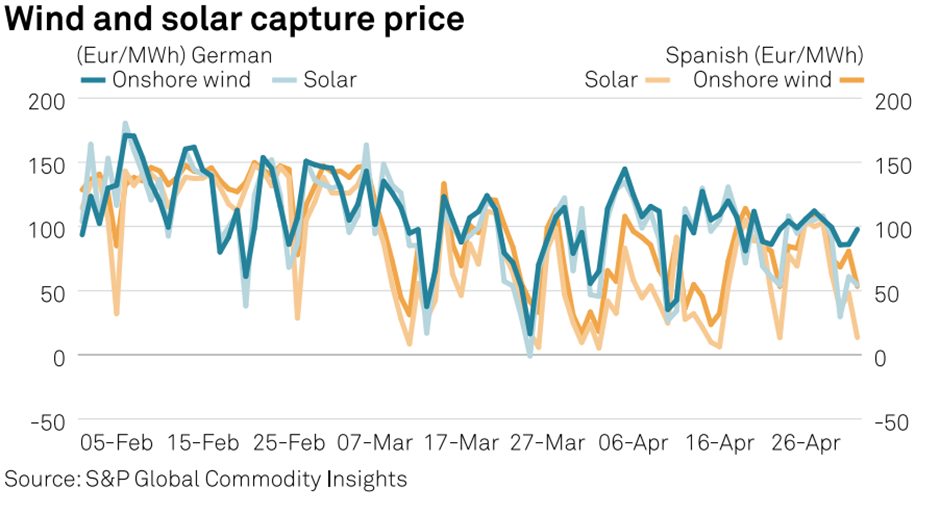

Spanish solar capture prices fell 26% in April in a month on month comparison as early summer output ramped up.

The IEA estimates 15% of energy-related emissions, or 5.1 billion mt of CO2e, stem from upstream and midstream oil and gas activities