- US hydrogen economy begins to come into focus after new EPA rules, hub competition

- German partners launch hourly renewable energy certificate trial

- China's compliance emissions trading expected to accelerate coverage of CBAM-eligible sectors

The US's future hydrogen economy came into slightly clearer focus in multiple ways last week. The Environmental Protection Agency announced highly anticipated greenhouse gas regulations for fossil fuel-fired power plants, which have implications for plants interested in blending 30% hydrogen in their natural gas streams. A group in Mississippi announced that it was pitching itself as a "Strategic National Hydrogen Reserve" in its bid to become one of the Department of Energy's six to 10 clean hydrogen hubs. Plug Power said that it was considering multiple hydrogen production projects in California's neighboring states – even as far away as West Texas – to supply California's growing fuel cell electric vehicle market.

German supplier LichtBlick, transmission system operator 50Hertz and renewable energy software company Granular Energy have launched a pilot project allowing companies buy green power from specific plants on an hourly basis. The scheme will allow participants to receive time-stamped certificates for power generation, which in future could be traded or stored and reissued – notably when integrated with battery storage asset operation. Meanwhile global ammonia prices assessed by Platts have fallen by 60% to 70% since the start of the year, reflecting weaker natural gas feedstocks and slack demand. Platts' new Ammonia Price Chart illustrates monthly averages of daily assessments for gray, blue and green ammonia across a range of geographies and delivery options.

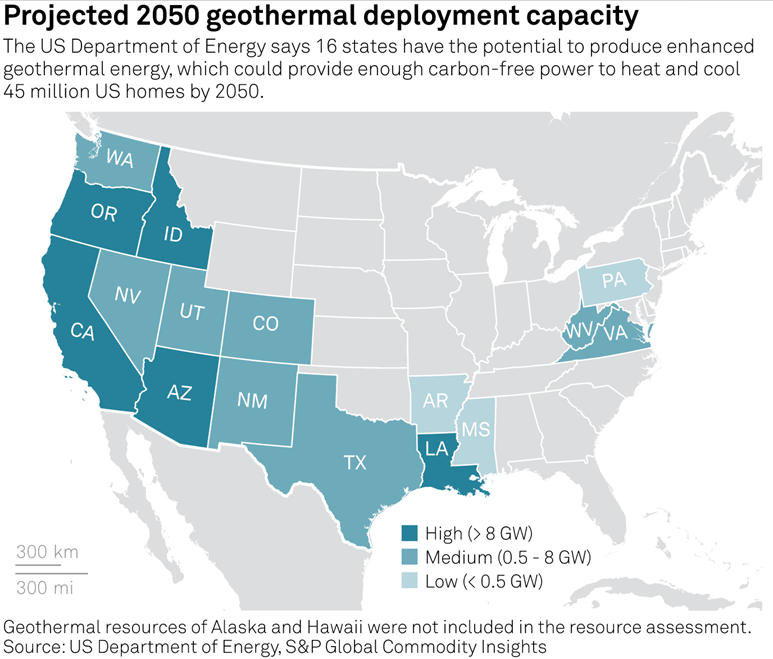

In Asia Pacific, China is likely to accelerate expanding its national compliance emission trading scheme in the next 2-3 years to cover sectors eligible under the EU's cross-border adjustment mechanism or CBAM, mainly cement, aluminum and iron and steel. In Australia, the federal government has responded to the US' Inflation Reduction Act with a $1.35 billion package for renewable hydrogen, aimed at accelerating commercialization. Australian government also increased funding for the country's carbon programs for advancing an international scheme and strengthening integrity. Japanese energy giant ENEOS Holdings earmarked a record strategic capital expenditure of $7.95 billion for the next three years to accelerate energy transition. Meanwhile, some stakeholders from both project development and demand sides said the voluntary carbon market faces difficulties to be utilized for Article 6 purposes. – Rocco Canonica

Americas

SPGlobal.com

Mississippi hub pitches itself as a 'Strategic National Hydrogen Reserve'

Carbon markets still in search of ways to quantify 'beyond-carbon' benefits

Floating offshore wind can be a key to US decarbonization goals: DOE expert

Premium content (available exclusively onPlatts Dimensions Pro)

Plug Power eyes 'multiple projects' in various states to supply California market

US EPA releases long-awaited GHG regulations for fossil fuel-fired power plants

EMEA

SPGlobal.com

EU carbon permits inch closer to Eur90/mt despite mixed signals

Interactive: Ammonia price chart

Renewable gas 'tradability' pivotal as substantial EU targets loom: EBA

Premium content (available exclusively onPlatts Dimensions Pro)

Neste drops blue hydrogen option in favor of electrolysis at Porvoo

Hourly renewable energy certificate trial launched in Germany

APAC

SPGlobal.com

China's compliance emission trading system to accelerate coverage of CBAM-eligible sectors

Voluntary carbon market faces headwinds as Article 6 mechanism gains traction

INTERVIEW: Shipping needs strict deadlines to boost decarbonization, says PSL MD

Premium content (available exclusively onPlatts Dimensions Pro)

Australia responds to IRA measures with A$2 billion green hydrogen fund

Australia increases funding for carbon schemes, signals market reforms

Japan's ENEOS Holdings plans record strategic capex to accelerate energy transition

Charts of the week:

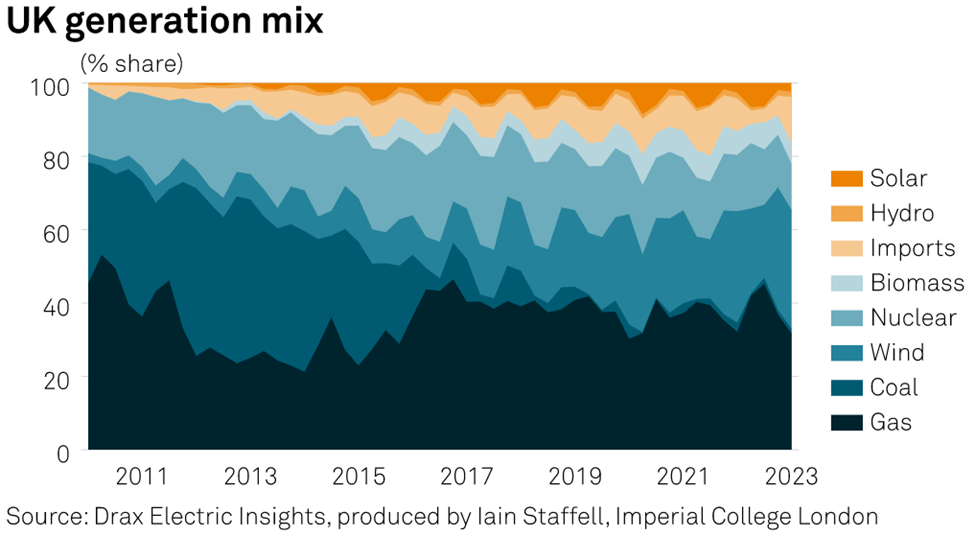

Wind generated more electricity than natural gas in the UK during Q1 2023, which was the first time that has happened during any quarter in the history of the country's electricity grid.

Quotes of the week:

"We actually are looking at multiple projects – and I mean multiple – in the neighboring states to be able to support California's [mobility market]. We're even looking at some opportunities that might even end up in the West Texas area." – Plug Power Chief Strategy Officer Sanjay Shrestha

"The current voluntary markets are not Paris compliant and that's something we have to realize," said Kevin Conrad, executive director of intergovernmental organization Coalition for Rainforest Nations, and former Special Climate Envoy of Papua New Guinea. "Avoidance is not permitted under the Paris Agreement, and it will never be," he said. "Over 90% of the voluntary market is about avoidance. And ICVCM [Integrity Council for the Voluntary Carbon Market] still haven't got avoidance out of their system."

Prices of the week:

$6.15/mtCO2

Platts nature-based avoidance carbon credit assessment has fallen 47% since the start of 2023

Yuan 56.00/mtCO2e

On May 12, one emission allowance was priced at around $8.06/mtCO2e in China's ETS and at $96.19/mtCO2e in EU ETS. The huge gap implies a heavy future carbon tariff even after the CBAM-eligible sectors enrolled into China's ETS.