- California sees 25 GW of offshore wind by 2045

- European battery recycling capacity builds

- Shenghong Petchems receives blue ammonia cargo

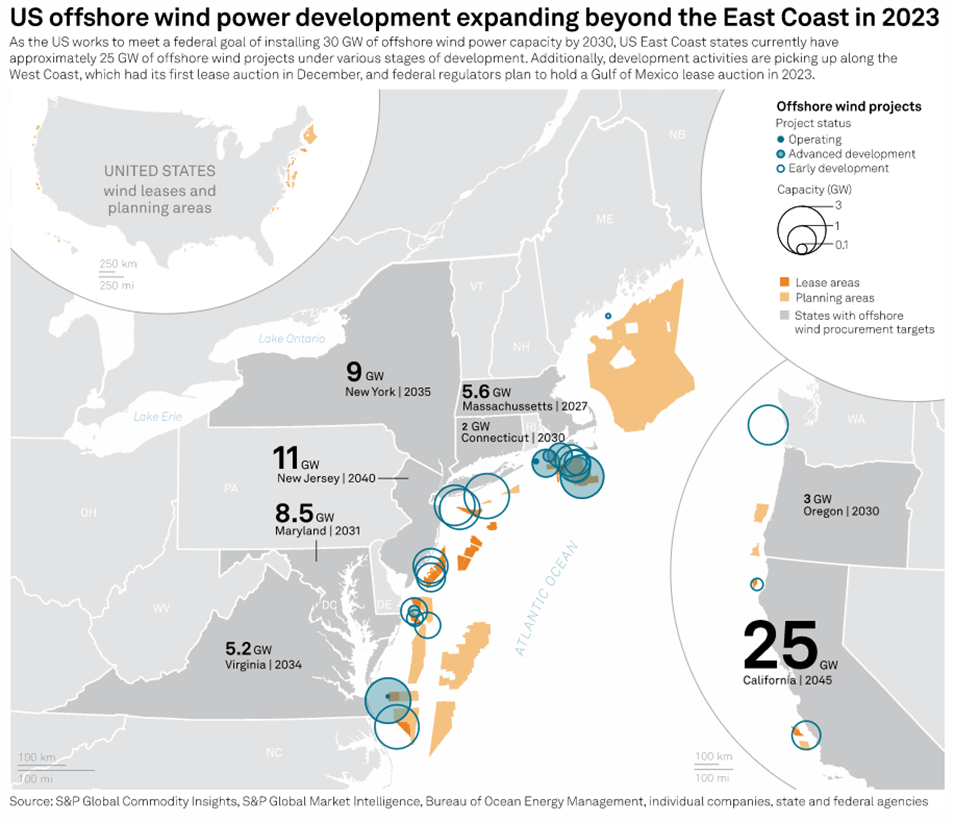

The California coast is the next frontier for offshore wind development in the US. The West Coast is expected to add at least 25 GW of offshore wind power to the national grid by 2045, according to the Bureau of Ocean Energy Management. However, because the subsurface topography of the Pacific Ocean is considerably deeper than the Atlantic, most West Coast wind will require floating turbine technology. In the meantime, California grid emissions are expected to grow this summer – an unexpected consequence of Washington state's new cap-and-trade program. Carbon traders say that the Washington program will incentivize the state's homegrown clean hydropower to stay in the state rather than be exported to the California grid. A shortfall of clean hydropower imports could prompt California to fill that gap with dirtier sources.

Europe is experiencing a wave of investment in battery recycling capacity, S&P Global Commodity Insights reports. With around 50 new battery production plants set to enter production by 2030, automakers and battery manufacturers are seeking to offset an anticipated global shortfall in critical metals such as lithium, nickel, cobalt and copper, with "black mass" recycling seen as a key route to sustainability. Meanwhile the International Emissions Trading Association reports that carbon emissions reductions could double if countries enhance their cooperation under Article 6 of the Paris Agreement. The trade could surpass $100 billion a year by 2030 if countries choose to effectively cooperate in trading their Nationally Determined Contributions (NDCs), adopting cross-border exchanges of credits known as Internationally Transferable Mitigation Outcomes under Article 6.2, IETA said.

In Asia Pacific, China's Shenghong Petrochemicals received a first blue ammonia cargo from Saudi Arabian Mining Co as part of an agreement to export 25,000 mt. Ma'aden is shipping more than 138,000 mt of blue ammonia to countries that include South Korea, China, Japan, India, Thailand and the European Union. In Australia, meanwhile, energy infrastructure company APA completed a feasibility study for the 100% use of hydrogen in a natural gas pipeline in Western Australia, with positive results opening the way to the next phase of development. Finally Chinese state-owned oil majors Sinopec and PetroChina have outlined plans to build supply chains for green hydrogen production, distribution and consumption akin to natural gas, with similar commercial strategies and infrastructural frameworks. – Henry Edwardes-Evans

North America

SPGlobal.com

Summit Ag Group to build 'world's largest' ethanol-based SAF plant in USGC

US offshore wind power development expanding beyond the East Coast in 2023

Much of North America risks summer power shortfalls in extreme conditions: NERC

Premium content (available exclusively on Platts Dimensions Pro)

Washington's cap-and-trade program to drive up California emissions: traders

US EPA sends RFS rule to White House for review as June 14 deadline nears

EMEA

SPGlobal.com

Black mass recycling emerges as critical component in Europe's battery supply chains

Zimbabwe looks to revamp carbon credit trade, boost revenue

Premium content (available exclusively on Platts Dimensions Pro)

Better collaboration on Article 6 can double reduction in carbon emissions: report

Phased deliverability key to UK hydrogen auction success: Carlton Power

Companies likely underreporting emissions from electricity use: FlexiDAO report

Asia-Pacific

SPGlobal.com

G7 leaders call to strengthen climate response, adopt gas investment for energy security

China oil majors plan to model green hydrogen supply chain on natural gas industry

Premium content (available exclusively on Platts Dimensions Pro)

Saudi Arabia's miner Ma'aden ships first blue ammonia cargo to China

APA to progress 100% hydrogen pipeline plan in Western Australia

Australia needs regulatory framework for hastening CCS opportunities: Santos CEO

Charts of the week:

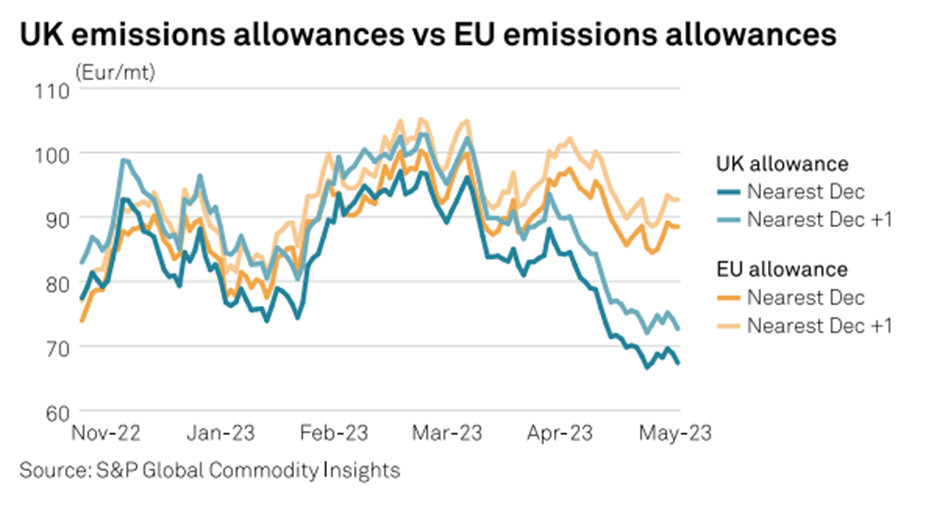

UK compliance carbon prices have fallen heavily, disengaging from their EU counterparts

Price of the week:

Yuan 13,500/mt

Chinese recycled battery (LFP black mass DDP China) prices are rising steadily on bullish lithium prices

Quotes of the week:

"We have entered the golden age of hydrogen. China will build an ecosystem for green hydrogen as comprehensive as today's natural gas industry. In future, the potential and the scale of China's green hydrogen industry is likely to go far beyond the natural gas industry." - Zou Caineng, Chief Specialist of New Energy with PetroChina

"What you're seeing is a lot of clean [power] resources that generally flowed south [to California] staying in the Pacific Northwest. We think that emissions are going to go up over summer and meaningfully over time just because [California] can no longer rely on the clean resources from the Pacific Northwest, just because the economic incentives to flow south are no longer there." -- Adam Raphaely, head of the carbon trading desk at Mercuria

"The metals used in battery production are finite, but by substituting raw materials mined from the Earth with recycled materials, we can not only cut the carbon footprint of batteries but enable the sustainable long-term use of li-ion battery technology." -- Northvolt Chief Environmental Officer Emma Nehrenheim