Ukraine increasingly stretched for fuel after infrastructure assault

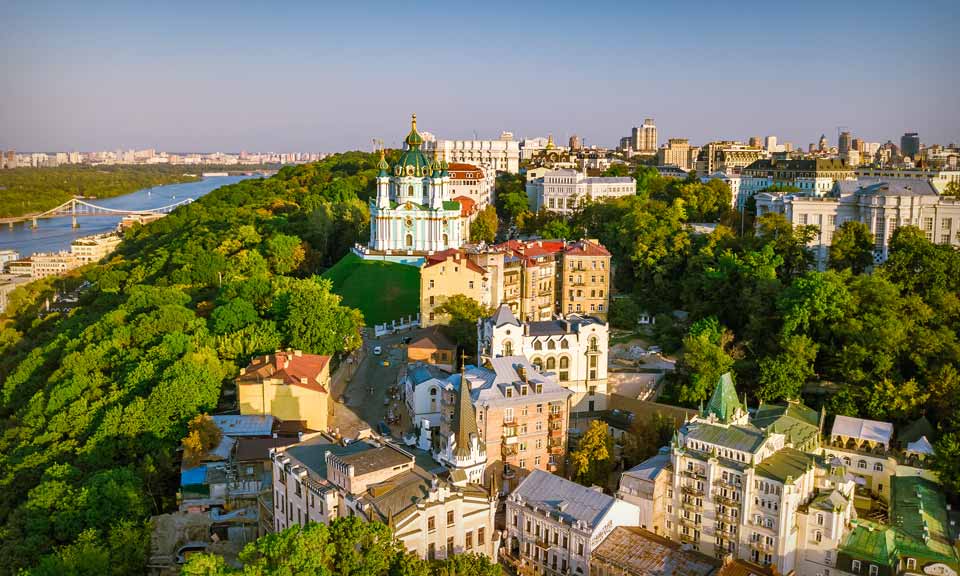

War-torn Ukraine is increasingly reliant on fuel supplies via truck from Poland following the destruction of up to 20 major fuel depots, damage to its main refinery, and the cutting of Black Sea shipping routes, Ukrainian experts say.

Russia's military assault on northern Ukraine has abated in recent days, but as the focus of military activity shifts to the east, the country faces increasingly stretched fuel supply, Serhiy Kuyun, head of the A-95 fuel consultancy, told S&P Global Commodity Insights.

Ukraine has long been shifting away from Russian energy and previously took Azeri crude by sea for the Kremenchuk refinery and diesel from northern neighbor Belarus. It also hosts the Odesa-Brody pipeline from the Black Sea into Central Europe.

But the Russian invasion meant cutting supplies from Belarus, which has supported Moscow, and Black Sea security risks and a Russian blockade have stopped shipments from Azerbaijan and Romania, the latter previously a source of fuel supply by sea.

With crucial infrastructure now damaged and the geography of the Carpathian Mountains preventing supply from other neighbors, Ukraine is now largely dependent on Poland; the latter is in the process of merging its two main refineries under PKN Orlen, which also operates Lithuania's Mazeikiai.

"The market has not stopped, but it has been forced to adapt," Kuyun commented in a statement. "There are no stocks of fuel anymore. We're selling as soon as fuel tanker truck arrives."

In the course of March, Russia's navy targeted fuel depots across the country, including in Lviv, Lutsk, Ternopil, Rivne, Zhytomyr, Odesa, Poltava, Kyiv, Chernihiv, Kharkiv and Dnipro.

Then on April 2 the 240,000 b/d Kremenchuk refinery was badly damaged in a Russian missile attack, putting it out of action, according to regional and company officials.

Ukraine's second refinery, the Shebelinka Gas Processing Plant in the east of the country, was taken offline Feb. 26 due to the threat of shelling.

Kuyun added that the stricken fuel depots were mostly full early in March, with later attacks coming when stores were already depleted.

The country now faces not only a shortage of fuel, but a squeeze on trucks available for bringing in fuel, he said.

"More fuel trucks are needed that can bring fuel directly from abroad," Kuyun said. "It is necessary that every owner of a fuel tanker truck has the opportunity to go and buy fuel."

Ukraine's government is also liaising with state railroad company Ukrzaliznytsia to make sure supplies can also come by rail.

Kuyun advised the government should cancel price controls and lift restrictions on maximum gasoline and diesel retail prices to encourage private traders to import more.

"I know of three regional fuel chains that have already stopped selling fuel in the last two days because the cost is higher than the set prices," he said. "Even large players are forced to limit sales, because new batches of fuel arrive at the pump, but its cost is already beyond the established price corridor."

The Ukrainian parliament on March 15 cancelled excise tax on all kinds of fuel and lowered VAT to 7% from 20% on imports of gasoline and diesel fuel. The lower taxes create an incentive for private fuel suppliers to arrange more supplies and help to reduce prices at retail stations.

The government also ordered the state customs service to remove bureaucracy from customs clearing of fuel imports.

While the turmoil of war and a flow of refugees out of the country will have impacted demand, the lack of refining capacity also poses a challenge for the vital grain sowing season — Ukraine being an important source for global grain markets.

Ukraine is likely to reduce the area planted with grain crops by up to 30% because of fighting in eastern and southern regions, in turn reducing the demand for fuel, according to the government.

In 2021, Ukraine imported 8.79 million mt of petroleum products, up 9.6% from 8.02 million mt in 2020, according to the state customs service.

News

India's unwavering appetite for Russian crude has provided ample bandwidth to Middle Eastern sour crude suppliers to cater to the needs of South Korea, Japan, Thailand and other East Asian buyers. Even if OPEC+ decides to extend production cuts, East Asian refiners are confident they can secure adequate Middle East sour crude term supplies. View full-size infographic Also listen:

News

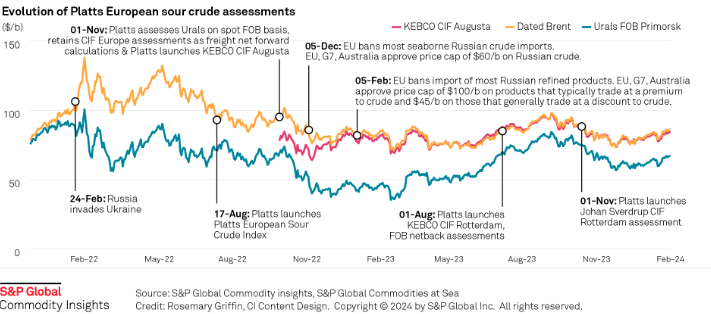

Russia's invasion of Ukraine has had a profound impact on sour crude export destinations, and increased the appetite for sweet crudes among European refiners. Platts methodology has evolved to reflect this changing landscape. Click here to see the full-size infographic.

News

Latest update: Jan. 30, 2024 A key OPEC+ advisory committee, co-chaired by Saudi Arabia and Russia, is set to meet online Feb. 1, with crude prices still stuck below the level that many of the alliance’s major producers need to balance their budgets. Traders will be seeking signals from the Joint Ministerial Monitoring Committee meeting on how long the bloc will keep the reins on its production and how it sees supply-demand fundamentals shaping up in the months ahead. Related story: OPEC+ monitoring committee prepares to meet as group battles sticky oil prices (Subscriber content) Click here to view the full-size infographic Compare hundreds of different crude grades and varieties produced around the world with Platts interactive Periodic Table of Oil .

News

Sumas spot gas down 90.6% year on year CAISO solar generation up 6 points in Dec US West power forwards are trending roughly 50% lower than year-ago packages on weaker gas forwards and above-normal temperatures forecast with El Nino weather conditions to linger into spring. El Nino conditions, which typically occur January through March, tend to bring more rain to the US Southwest and warmer-than-normal temperatures. The three-month outlook indicates a greater probability for above-normal temperatures across most of the Western US, with the exception of the Desert Southwest, according to the US National Weather Service's Climate Prediction Center. SP15 on-peak January rolled off the curve at $55.75/MWh, 79.4% lower than where the 2023 package ended, according to data from Platts, part of S&P Global Commodity Insights. The February package is currently in the low 50s/MWh, 70% below where its 2023 counterpart was a year earlier, while the March package is in the mid-$30s/MWh, 55.4% lower. In gas forwards, SoCal January rolled off the curve at $3.779/MMBtu, 97.9% below where the 2023 contract ended a year earlier, according to S&P Global data. The February contract is currently around $4.063/MMBtu, 78.9% lower than its 2023 counterpart at the same time last year, while the March contract is about $2.816/MMBtu, 63.2% lower. Gas plants burned an average of 1.815 Bcf/d in December to generate an average of 267.167 GWh/d, an analysis of S&P Global data showed. That's down 0.66% from November and a drop of 11.2 % from 2023. S&P Global forecast CAISO's gas fleet to generate around 220 GWh/d in February. In comparison, burning fuel at the same rate as February 2023 would consume 1.758 Bcf/d, a 6% decrease year on year. Spot markets In spot markets, power prices were down significantly from a year ago, when cold weather hit the region and drove up prices. SP15 on-peak day-ahead locational marginal prices averaged $43.49/MWh in December, 83% lower year over year and 11.2% below November prices, according to California Independent System Operator data. Helping pull down power prices, spot gas at SoCal city-gate was down 88.4% year on year and 40% lower month on month at an average of $3.554/MMBtu in December, according to S&P Global data. In the Northwest, Sumas spot gas was down 90.6% year on year at an average of $2.669/MMBtu. The decline in spot gas prices likely accounts for the lower average spot power prices month on month in December, said Morris Greenberg, senior manager with the low-carbon electricity team at S&P Global. Compared to a year earlier, CAISO population-weighted temperatures averaged 8% higher in December, resulting in 38.4% fewer heating-degree days, according to CustomWeather data. Fuel mix Thermal generation remained the lead fuel source at 46.1% of the total fuel mix in December, little changed year on year, while solar generation was up nearly 6 percentage points to average 14.7% of the mix, according to CAISO data. Hydropower remained strong, averaging 8% of the December fuel mix, 2 points higher than a year earlier. Total generation was down nearly 8% from a year earlier at an average of roughly 23.4 GWh/day, as peakload slipped 2% year on year to average 27.254 GW in December, according to CAISO data. In the Northwest, peakload dropped nearly 11% year on year to average 7.89 GW in December, according to Bonneville Power Administration data. Hydropower remained the lead fuel source at nearly 74% of the mix, followed by nuclear at 12.3%, thermal at 9.6% and wind at 4.3%. Following El Nino expectations of the Northwest for warmer temperatures and drier precipitation, BPA population-weighted temperatures in December were 10% above normal and 21.5% higher than a year earlier, leading to 27% fewer heating-degrees days year on year, according to CustomWeather data.