Petroecuador tender shows divergence in Latam gasoline, diesel markets

Petroecuador unveiled bids April 14 for a six-cargo 80 RON tender discounted to its gasoline formula in contrast to the diesel market where recent Latin American tenders have seen much higher premiums than the past.

Ecuador's state-owned oil company received three offers for the 1.77 million barrels tender, with Trafigura offering to sell at a $1.51/b discount to the Platts US Gulf Coast unleaded 87 pipeline assessment from S&P Global Commodity Insights, while Novum had a $0.58/b discount and Glencore a $0.11/b premium, sources said. No official award was immediately announced, although sources said it would likely be awarded to Trafigura. Petroecuador's previous RON 80 tender for 590,000 barrels in October was awarded at a $0.66/b premium, also to Trafigura.

The gasoline tender came after Petroperú and Petroecuador, starting late March, broke a month-long lull in large Latin American tenders, although the companies paid up to do so. Petroecuador paid a $7.45/b premium to the Platts benchmark USGC ULSD pipeline for seven cargoes of 50 ppm premium diesel, compared with slight discounts for previous tenders this year, sources said, while Petroperú paid a premium of $8.80/b, nearly double the premiums paid for January and February tenders for four ultra low sulfur diesel cargoes.

Latin America is a flat price buyer and outright prices remain well above historical norms and have reached record levels for diesel. But outright prices and differentials for gasoline are relatively much lower than tenders for ULSD in the region.

"Diesel is very short in Latin America at the moment," said Felipe Perez, Latin America downstream strategist for S&P Global. "Days of supply are quite low in almost all the major markets. Gasoline in Latin America will enter a lower demand seasonality, although demand has been quite robust."

Winter slows driving demand for gasoline but creates more distillate demand for heating and power generation. The loss of Russian diesel supply into the global market that already experienced low inventories has already caused record global ULSD prices. Perez said that Petroperú is restarting its 95,000 b/d Talara oil refinery after a lengthy renovation that could reduce the need to import large volumes of refined products. The refinery began trial runs April 12 and expects to be operating fully in six months.

But diesel demand was also strong because of spring harvest, especially in Argentina, where an industry group said diesel rationing has begun at service stations because price controls keep local prices 30% less than import prices, discouraging imports.

The Platts assessments for gasoline and ULSD in Latin America have mirrored movements in the benchmark USGC markets, where finished gasoline settled at $3.3064/gal April 14, well below ULSD pipeline at $3.8948/gal. Comparatively, year-ago prices recorded USGC finished gasoline at $1.9880/gal, while ULSD trailed at $1.8425/gal.

In Eastern Mexico, Platts assessed delivered CIF cargoes for ULSD up $4.73 at $162.84/b and for gasoline up $3.39 at $134.92/b April 14. Ecuador RON 93 CIF jumped $2.57 to $141.79/b and ULSD CIF rose $4.24 to $168.17/b.

For import parity prices, ULSD prices in Peru rose $7.69 to $170.3/b and gasoline rose $4.94 to $1.4034/b. IPP prices for Santos, Brazil, rose $7.15 to $174.59/b for ULSD and $5.12 to $129.88/b for gasoline.

"If prices stay as high as they are now, we might see a slightly demand destruction, but most of the governments in the region are doing some tax break or subsidy to alleviate the pain at the pump for consumers," Perez said.

News

India's unwavering appetite for Russian crude has provided ample bandwidth to Middle Eastern sour crude suppliers to cater to the needs of South Korea, Japan, Thailand and other East Asian buyers. Even if OPEC+ decides to extend production cuts, East Asian refiners are confident they can secure adequate Middle East sour crude term supplies. View full-size infographic Also listen:

News

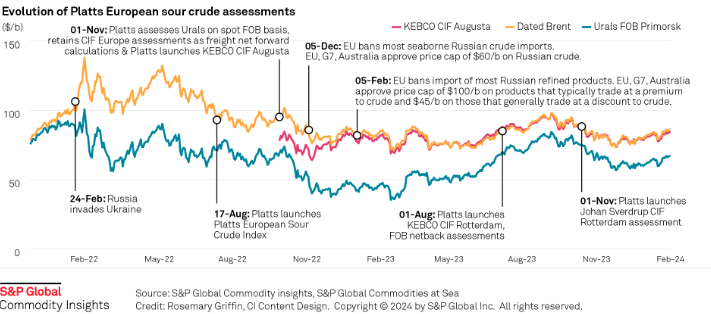

Russia's invasion of Ukraine has had a profound impact on sour crude export destinations, and increased the appetite for sweet crudes among European refiners. Platts methodology has evolved to reflect this changing landscape. Click here to see the full-size infographic.

News

Latest update: Jan. 30, 2024 A key OPEC+ advisory committee, co-chaired by Saudi Arabia and Russia, is set to meet online Feb. 1, with crude prices still stuck below the level that many of the alliance’s major producers need to balance their budgets. Traders will be seeking signals from the Joint Ministerial Monitoring Committee meeting on how long the bloc will keep the reins on its production and how it sees supply-demand fundamentals shaping up in the months ahead. Related story: OPEC+ monitoring committee prepares to meet as group battles sticky oil prices (Subscriber content) Click here to view the full-size infographic Compare hundreds of different crude grades and varieties produced around the world with Platts interactive Periodic Table of Oil .

News

Sumas spot gas down 90.6% year on year CAISO solar generation up 6 points in Dec US West power forwards are trending roughly 50% lower than year-ago packages on weaker gas forwards and above-normal temperatures forecast with El Nino weather conditions to linger into spring. El Nino conditions, which typically occur January through March, tend to bring more rain to the US Southwest and warmer-than-normal temperatures. The three-month outlook indicates a greater probability for above-normal temperatures across most of the Western US, with the exception of the Desert Southwest, according to the US National Weather Service's Climate Prediction Center. SP15 on-peak January rolled off the curve at $55.75/MWh, 79.4% lower than where the 2023 package ended, according to data from Platts, part of S&P Global Commodity Insights. The February package is currently in the low 50s/MWh, 70% below where its 2023 counterpart was a year earlier, while the March package is in the mid-$30s/MWh, 55.4% lower. In gas forwards, SoCal January rolled off the curve at $3.779/MMBtu, 97.9% below where the 2023 contract ended a year earlier, according to S&P Global data. The February contract is currently around $4.063/MMBtu, 78.9% lower than its 2023 counterpart at the same time last year, while the March contract is about $2.816/MMBtu, 63.2% lower. Gas plants burned an average of 1.815 Bcf/d in December to generate an average of 267.167 GWh/d, an analysis of S&P Global data showed. That's down 0.66% from November and a drop of 11.2 % from 2023. S&P Global forecast CAISO's gas fleet to generate around 220 GWh/d in February. In comparison, burning fuel at the same rate as February 2023 would consume 1.758 Bcf/d, a 6% decrease year on year. Spot markets In spot markets, power prices were down significantly from a year ago, when cold weather hit the region and drove up prices. SP15 on-peak day-ahead locational marginal prices averaged $43.49/MWh in December, 83% lower year over year and 11.2% below November prices, according to California Independent System Operator data. Helping pull down power prices, spot gas at SoCal city-gate was down 88.4% year on year and 40% lower month on month at an average of $3.554/MMBtu in December, according to S&P Global data. In the Northwest, Sumas spot gas was down 90.6% year on year at an average of $2.669/MMBtu. The decline in spot gas prices likely accounts for the lower average spot power prices month on month in December, said Morris Greenberg, senior manager with the low-carbon electricity team at S&P Global. Compared to a year earlier, CAISO population-weighted temperatures averaged 8% higher in December, resulting in 38.4% fewer heating-degree days, according to CustomWeather data. Fuel mix Thermal generation remained the lead fuel source at 46.1% of the total fuel mix in December, little changed year on year, while solar generation was up nearly 6 percentage points to average 14.7% of the mix, according to CAISO data. Hydropower remained strong, averaging 8% of the December fuel mix, 2 points higher than a year earlier. Total generation was down nearly 8% from a year earlier at an average of roughly 23.4 GWh/day, as peakload slipped 2% year on year to average 27.254 GW in December, according to CAISO data. In the Northwest, peakload dropped nearly 11% year on year to average 7.89 GW in December, according to Bonneville Power Administration data. Hydropower remained the lead fuel source at nearly 74% of the mix, followed by nuclear at 12.3%, thermal at 9.6% and wind at 4.3%. Following El Nino expectations of the Northwest for warmer temperatures and drier precipitation, BPA population-weighted temperatures in December were 10% above normal and 21.5% higher than a year earlier, leading to 27% fewer heating-degrees days year on year, according to CustomWeather data.