Poland buys Saudi diesel in record import spree fueled by Ukraine war: sources

Poland is looking further afield and building ties with Saudi Arabia as it diversifies its sourcing of ultra low sulfur diesel following Russia's invasion of Ukraine and an upsurge in Ukrainian reliance on fuel from Poland, according to market and shipping sources.

Polish ULSD imports spiked to a new record of around 701,000 mt in March, according to Kpler shipping data, far outpacing the three-month moving average of around 384,000 mt/month of diesel imports and the March 2021 level of 363,000 mt.

In a never-before seen move, long-range tanker Minerva Pisces recently carried around 95,000 mt of Saudi ULSD from Yanbu to Gdansk, while around 35,000 mt arrived from BP's Rotterdam refinery in the Netherlands, split over two parcels.

It comes as EU member Poland, a strong supporter of Ukraine, steps up efforts to limit reliance on Russia -- before the war Poland had taken crude from as far afield as Iraqi Kurdistan -- and as Poland's PKN Orlen is in the process of selling Saudi Aramco a stake in the country's Number 2 refinery, Gdansk.

In addition, Poland is becoming the main source of fuel for war-torn Ukraine following the destruction of Ukrainian fuel infrastructure, including parts of its largest refinery, Kremenchuk, and as Ukraine has cut imports from northern neighbor Belarus, an ally of Moscow.

However, the vast majority of Poland's March imports were still of Russian origin: around 525,000 mt -- almost 75% -- came from Russia's Baltic port of Primorsk, while 46,000 mt originated nearby in Lithuania, where PKN Orlen owns the Orlen Lietuva refinery at Mazeikiai.

Normally Poland relies on Russia for up to 100% of its diesel imports, while East of Suez arrivals in Europe rarely get further north than the Amsterdam-Rotterdam-Antwerp hub.

The dominance of Russian diesel generally precludes alternatives being shipped from ARA to the Baltic, although steep discounts for Middle East diesel may have been a factor in March, with FOB Arab Gulf 10 ppm ULSD averaging a near $10/b discount to CIF NWE cargoes, according to S&P Global Commodity Insights data.

In April, Poland continues to expect arrivals from further afield. By the end of April, around 172,000 mt of Russian diesel is set to have arrived -- around 50% of total imports, according to Kpler data. However, a second long-range tanker, Polaris Bay, already delivered around 88,000 mt of ULSD from Yanbu to Gdansk on April 5.

A cargo of around 30,000 mt of ULSD from West Coast India also arrived on the tanker Seasprat, having loaded from a larger vessel via ship-to-ship transfer.

A second cargo of around 35,000 mt from BP's Rotterdam refinery also made its way to Poland in early April, Kpler data showed.

Poland is almost the sole conduit for meeting Ukraine's fuel needs, including military and agricultural demand, due to lack of supply from Belarus and Russia, and the closure of Black Sea imports from countries such as Azerbaijan as a result of war risk. The geography of the Carpathian Mountains limits shipments from neighbors such as Hungary or Romania.

Ukraine's largest refinery, Kremenchuk, was badly damaged in a missile attack on April 2 and put out of action, while the Shebelinka Gas Processing Plant in eastern Ukraine was taken offline on Feb. 26 due to the threat of shelling. In addition, the Odesa and Lysychansk refineries were hit by air strikes in April, though both had been out of action for more than 10 years.

Imports via tanker truck are an increasingly important means of supply as Russia's navy has targeted fuel depots across the country, according to Ukrainian analysts and industry sources.

In 2021, Ukraine imported 8.79 million mt of petroleum products, up 9.6% from 2020, according to the state customs service.

News

India's unwavering appetite for Russian crude has provided ample bandwidth to Middle Eastern sour crude suppliers to cater to the needs of South Korea, Japan, Thailand and other East Asian buyers. Even if OPEC+ decides to extend production cuts, East Asian refiners are confident they can secure adequate Middle East sour crude term supplies. View full-size infographic Also listen:

News

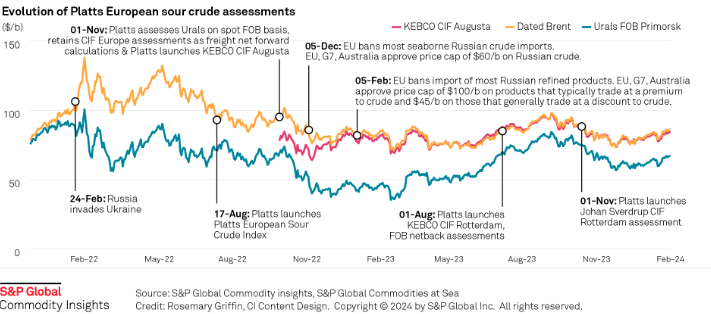

Russia's invasion of Ukraine has had a profound impact on sour crude export destinations, and increased the appetite for sweet crudes among European refiners. Platts methodology has evolved to reflect this changing landscape. Click here to see the full-size infographic.

News

Latest update: Jan. 30, 2024 A key OPEC+ advisory committee, co-chaired by Saudi Arabia and Russia, is set to meet online Feb. 1, with crude prices still stuck below the level that many of the alliance’s major producers need to balance their budgets. Traders will be seeking signals from the Joint Ministerial Monitoring Committee meeting on how long the bloc will keep the reins on its production and how it sees supply-demand fundamentals shaping up in the months ahead. Related story: OPEC+ monitoring committee prepares to meet as group battles sticky oil prices (Subscriber content) Click here to view the full-size infographic Compare hundreds of different crude grades and varieties produced around the world with Platts interactive Periodic Table of Oil .

News

Sumas spot gas down 90.6% year on year CAISO solar generation up 6 points in Dec US West power forwards are trending roughly 50% lower than year-ago packages on weaker gas forwards and above-normal temperatures forecast with El Nino weather conditions to linger into spring. El Nino conditions, which typically occur January through March, tend to bring more rain to the US Southwest and warmer-than-normal temperatures. The three-month outlook indicates a greater probability for above-normal temperatures across most of the Western US, with the exception of the Desert Southwest, according to the US National Weather Service's Climate Prediction Center. SP15 on-peak January rolled off the curve at $55.75/MWh, 79.4% lower than where the 2023 package ended, according to data from Platts, part of S&P Global Commodity Insights. The February package is currently in the low 50s/MWh, 70% below where its 2023 counterpart was a year earlier, while the March package is in the mid-$30s/MWh, 55.4% lower. In gas forwards, SoCal January rolled off the curve at $3.779/MMBtu, 97.9% below where the 2023 contract ended a year earlier, according to S&P Global data. The February contract is currently around $4.063/MMBtu, 78.9% lower than its 2023 counterpart at the same time last year, while the March contract is about $2.816/MMBtu, 63.2% lower. Gas plants burned an average of 1.815 Bcf/d in December to generate an average of 267.167 GWh/d, an analysis of S&P Global data showed. That's down 0.66% from November and a drop of 11.2 % from 2023. S&P Global forecast CAISO's gas fleet to generate around 220 GWh/d in February. In comparison, burning fuel at the same rate as February 2023 would consume 1.758 Bcf/d, a 6% decrease year on year. Spot markets In spot markets, power prices were down significantly from a year ago, when cold weather hit the region and drove up prices. SP15 on-peak day-ahead locational marginal prices averaged $43.49/MWh in December, 83% lower year over year and 11.2% below November prices, according to California Independent System Operator data. Helping pull down power prices, spot gas at SoCal city-gate was down 88.4% year on year and 40% lower month on month at an average of $3.554/MMBtu in December, according to S&P Global data. In the Northwest, Sumas spot gas was down 90.6% year on year at an average of $2.669/MMBtu. The decline in spot gas prices likely accounts for the lower average spot power prices month on month in December, said Morris Greenberg, senior manager with the low-carbon electricity team at S&P Global. Compared to a year earlier, CAISO population-weighted temperatures averaged 8% higher in December, resulting in 38.4% fewer heating-degree days, according to CustomWeather data. Fuel mix Thermal generation remained the lead fuel source at 46.1% of the total fuel mix in December, little changed year on year, while solar generation was up nearly 6 percentage points to average 14.7% of the mix, according to CAISO data. Hydropower remained strong, averaging 8% of the December fuel mix, 2 points higher than a year earlier. Total generation was down nearly 8% from a year earlier at an average of roughly 23.4 GWh/day, as peakload slipped 2% year on year to average 27.254 GW in December, according to CAISO data. In the Northwest, peakload dropped nearly 11% year on year to average 7.89 GW in December, according to Bonneville Power Administration data. Hydropower remained the lead fuel source at nearly 74% of the mix, followed by nuclear at 12.3%, thermal at 9.6% and wind at 4.3%. Following El Nino expectations of the Northwest for warmer temperatures and drier precipitation, BPA population-weighted temperatures in December were 10% above normal and 21.5% higher than a year earlier, leading to 27% fewer heating-degrees days year on year, according to CustomWeather data.