Marathon Petroleum ramps up Q2 rates to meet strong ULSD, gasoline demand

Marathon Petroleum, the largest US refiner, is ramping up rates at its refineries, with expectations of reaching 95% capacity in the second quarter to meet the rising demand for both diesel and gasoline as the summer driving season looms.

The company is deferring some planned work to capture the strong current spot market environment, "backloading" the company's 2022 turnaround work, according to Ray Brooks, Marathon's head of refining, on the May 3 results call.

"With current demands, we are really seeking to maximize our refining system as indicated by the second-quarter guidance," Brooks said, adding, "what this really means...is that we've looked at some fixed bed catalyst changes that we had planned for [Q2]. We've determined we have a little bit as far as catalyst activity. So we've deferred that out later in the year.

"We're working right now to maximize distillate production across our system. Just to give you a little more color on that, that's something that we look at daily, make sure that we're maximizing the total recoverable distillate, the endpoint, and maximizing the front end of the distillate," he said.

Marathon, like its peers, has been running in maximum distillate mode to take advantage of global rising diesel cracks from tight supplies and backwardation in distillate markets.

The company's total exports averaged 200,000 b/d at the end of Q1 and have moved up to an average of 250,000 b/d and 300,000 b/d so far in Q2, with barrels moving primarily into Latin America, but with some barrels moving to Europe.

Brian Partee, Marathon's head of clean products, said that increased distillate exports have tightened the US Atlantic Coast market, which is seeing lower European imports as well as lower flows up the Colonial Pipeline, the main conduit of refined products from the USGC refiners to New York Harbor.

But this is a function of timing, and the "run-up in the prompt front end of the cycle," he said, allowing Marathon to capture current high diesel prices immediately through export rather than waiting for the time it takes diesel to move up the Colonial Pipeline.

However, that dynamic is beginning to ease as the spread between the price of US Atlantic Coast ULSD and USGC export diesel is widening, drawing imports into the USAC.

Platts assessments showed USAC ULSD diesel barges held a 91.4 cent/gal premium of USGC ULSD export price May 2, compared with the 33 cent/gal premium so far in 2022.

"I think you're reading the tea leaves right as you look forward and think about less Russian exports and European complex starting to find a way to rebalance the New York Harbor market," he told an analyst on the call, adding the Colonial Pipeline is a "forward opportunity, more structural and longer term," he said.

Restrictions on Russian petroleum exports following its incursion into Ukraine in February have had a particular impact on the global diesel supply. Russian middle distillate exports, which averaged 1.1 million b/d in February, fell to 943,000 b/d in March and 868,000 b/d in April, Kpler data showed.

The extreme volatility with distillate cracks and the backwardation of distillate markets is creating an unusual situation in oil markets at a time when refiners historically switch to maximum gasoline mode to build up inventories, which are lagging the five-year average. Total US gasoline inventories stood at 230.8 million barrels for the week ended April 29, according to the most recent Energy Information Administration data.

However, like its peers, Marathon is constantly looking at the economics of making diesel versus making gasoline as it prepares for the summer driving season looming at the end of May with the Memorial Day weekend, while looking to take advantage of the backwardation in the diesel market.

"Our plan right now is to run really, really full, and run really, really hard during gasoline season this year," Brooks said.

News

India's unwavering appetite for Russian crude has provided ample bandwidth to Middle Eastern sour crude suppliers to cater to the needs of South Korea, Japan, Thailand and other East Asian buyers. Even if OPEC+ decides to extend production cuts, East Asian refiners are confident they can secure adequate Middle East sour crude term supplies. View full-size infographic Also listen:

News

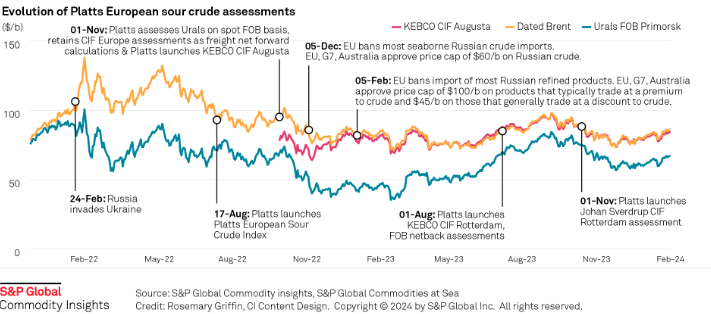

Russia's invasion of Ukraine has had a profound impact on sour crude export destinations, and increased the appetite for sweet crudes among European refiners. Platts methodology has evolved to reflect this changing landscape. Click here to see the full-size infographic.

News

Latest update: Jan. 30, 2024 A key OPEC+ advisory committee, co-chaired by Saudi Arabia and Russia, is set to meet online Feb. 1, with crude prices still stuck below the level that many of the alliance’s major producers need to balance their budgets. Traders will be seeking signals from the Joint Ministerial Monitoring Committee meeting on how long the bloc will keep the reins on its production and how it sees supply-demand fundamentals shaping up in the months ahead. Related story: OPEC+ monitoring committee prepares to meet as group battles sticky oil prices (Subscriber content) Click here to view the full-size infographic Compare hundreds of different crude grades and varieties produced around the world with Platts interactive Periodic Table of Oil .

News

Sumas spot gas down 90.6% year on year CAISO solar generation up 6 points in Dec US West power forwards are trending roughly 50% lower than year-ago packages on weaker gas forwards and above-normal temperatures forecast with El Nino weather conditions to linger into spring. El Nino conditions, which typically occur January through March, tend to bring more rain to the US Southwest and warmer-than-normal temperatures. The three-month outlook indicates a greater probability for above-normal temperatures across most of the Western US, with the exception of the Desert Southwest, according to the US National Weather Service's Climate Prediction Center. SP15 on-peak January rolled off the curve at $55.75/MWh, 79.4% lower than where the 2023 package ended, according to data from Platts, part of S&P Global Commodity Insights. The February package is currently in the low 50s/MWh, 70% below where its 2023 counterpart was a year earlier, while the March package is in the mid-$30s/MWh, 55.4% lower. In gas forwards, SoCal January rolled off the curve at $3.779/MMBtu, 97.9% below where the 2023 contract ended a year earlier, according to S&P Global data. The February contract is currently around $4.063/MMBtu, 78.9% lower than its 2023 counterpart at the same time last year, while the March contract is about $2.816/MMBtu, 63.2% lower. Gas plants burned an average of 1.815 Bcf/d in December to generate an average of 267.167 GWh/d, an analysis of S&P Global data showed. That's down 0.66% from November and a drop of 11.2 % from 2023. S&P Global forecast CAISO's gas fleet to generate around 220 GWh/d in February. In comparison, burning fuel at the same rate as February 2023 would consume 1.758 Bcf/d, a 6% decrease year on year. Spot markets In spot markets, power prices were down significantly from a year ago, when cold weather hit the region and drove up prices. SP15 on-peak day-ahead locational marginal prices averaged $43.49/MWh in December, 83% lower year over year and 11.2% below November prices, according to California Independent System Operator data. Helping pull down power prices, spot gas at SoCal city-gate was down 88.4% year on year and 40% lower month on month at an average of $3.554/MMBtu in December, according to S&P Global data. In the Northwest, Sumas spot gas was down 90.6% year on year at an average of $2.669/MMBtu. The decline in spot gas prices likely accounts for the lower average spot power prices month on month in December, said Morris Greenberg, senior manager with the low-carbon electricity team at S&P Global. Compared to a year earlier, CAISO population-weighted temperatures averaged 8% higher in December, resulting in 38.4% fewer heating-degree days, according to CustomWeather data. Fuel mix Thermal generation remained the lead fuel source at 46.1% of the total fuel mix in December, little changed year on year, while solar generation was up nearly 6 percentage points to average 14.7% of the mix, according to CAISO data. Hydropower remained strong, averaging 8% of the December fuel mix, 2 points higher than a year earlier. Total generation was down nearly 8% from a year earlier at an average of roughly 23.4 GWh/day, as peakload slipped 2% year on year to average 27.254 GW in December, according to CAISO data. In the Northwest, peakload dropped nearly 11% year on year to average 7.89 GW in December, according to Bonneville Power Administration data. Hydropower remained the lead fuel source at nearly 74% of the mix, followed by nuclear at 12.3%, thermal at 9.6% and wind at 4.3%. Following El Nino expectations of the Northwest for warmer temperatures and drier precipitation, BPA population-weighted temperatures in December were 10% above normal and 21.5% higher than a year earlier, leading to 27% fewer heating-degrees days year on year, according to CustomWeather data.