INDIA CEO SERIES: IOC's refining expansion landscape will reflect a shade of green

The S&P Global Commodity Insights India CEO Series is a compilation of exclusive interviews by Asia Energy Editor Sambit Mohanty with top government and industry leaders in India's oil and gas sector. Get insights on how those companies are planning to strike a balance between traditional and new businesses at a time when energy transition is changing the industry's landscape, while geopolitical turbulence is throwing up new challenges.

State-run Indian Oil Corp will pursue an ambitious refining expansion strategy in coming years amid a strong belief that oil demand is nowhere near its peak, while diversifying into cleaner forms of energy to meet part of the incremental demand growth, its chairman Shrikant Madhav Vaidya told S&P Global Commodity Insights in an exclusive interview.

While most of the refining expansion will proceed at a relatively lower carbon footprint, the company has drawn up a growth roadmap that will witness large inroads into petrochemicals, hydrogen and electric mobility.

"It is my primary requirement to ensure that energy security, energy access and energy availability are never compromised. For that, we are strengthening the core business since we formally believe that demand for petroleum products will continue to be there in very large volumes in the country for at least a couple of decades," Vaidya said.

He added that IOC aimed to lift refining capacity from the current 80 million mt, or 1.6 million b/d, -- nearly one-third of India's total refining capacity of 5.1 million b/d -- to 107 million mt by 2025-26.

"All these are approved projects. We are already working at the ground level to make sure that the core is strengthened," Vaidya said.

The total current capacity of 1.6 million b/d included the capacity of IOC's wholly-owned subsidiary Chennai Petroleum Corp.

Vaidya added that IOC aims to increase the use of electricity generated by renewable energy sources as it expanded its core refining capacity.

"For all refinery expansions, we will not be investing in captive power plants, which is the current model for our refineries. We'll be taking green grid power. So that will be one big step for us in ensuring that we achieve net zero operationally by 2046," Vaidya said.

One of the biggest projects on the drawing board is a mega refinery-cum-petrochemicals complex in the western coast of India, the planned Ratnagiri Refinery, which would have an annual capacity of 60 million mt. It is jointly built by three state-run refiners -- Indian Oil Corp, Hindustan Petroleum Corp and Bharat Petroleum Corp -- while Saudi Aramco and ADNOC have signed initial agreements to take a joint stake in the project.

However, the project was facing delays as the land acquisition process has yet to complete.

"The Ratnagiri Refinery is very much required. The capacity, what we have thought of, is extremely important for the country to bridge the energy gap," Vaidya said. "But at this point we have taken a conscious call that we will not try and put up the entire 60 million mt capacity at one go. Now, the considered opinion is we will be going in batches of 20 million mt."

Currently, he said the ongoing land study was focused on soil and other things associated with the site proposed by the Maharashtra state government. Once the report from Engineers India Ltd is available, IOC and other stakeholders will engage with the state government to finalize details.

Highlighting IOC's petrochemical push, Vaidya said the IOC board recently approved setting up the Paradip Petrochemical Complex in the eastern state of Odisha. The mega project was estimated to cost around Indian Rupees 611 billion ($7.39 billion) and will be IOC's biggest investment in a single location.

"Today, we are about 5 million mt of petrochemical capacity and we are trying to take that to nearly 15 million mt by 2030. That way our petrochemical intensity index rises from the current 4.6 to 15," Vaidya said. "India is a big importer of petrochemicals but if I make those products myself, it will be a natural hedge against the volatility of crude prices."

With India's economic growth outlook expected to remain robust over the coming years, India would need all forms of energy -- fossil fuels as well as renewables, Vaidya said.

Gas and LNG would continue to be a key component of IOC's portfolio and therefore IOC was undertaking capacity expansions at terminals, such as Ennore. In addition, IOC aimed to boost the use of gas in its own refineries.

"All my refineries are switching over to gas. Three refineries will be switching over in the next few months, that is Paradip, Barauni and Haldia. They will be taking gas from the Dhamra terminal," Vaidya said.

He added that IOC's current renewables footprint was only about 250 MW, but it planned to raise this to 5 GW by 2030, and to 12 GW by 2046. For that, IOC signed strategic partnerships with state-run National Thermal Power Corp and SJVN.

For electric mobility, IOC was not taking the lithium-ion battery route since India is a net importer, Vaidya said, adding that IOC had tied up with Israeli company Phinergy for aluminum air batteries.

"Field trials are going on for four-wheelers. And once these trials are done, we'll have definitive agreements with four-wheeled vehicle manufacturers and we'll be putting a factory in India for the aluminum air battery," Vaidya said. "We already have a tie-up with Hindalco for the supply of aluminum."

The battery-swapping segment was gaining popularity in India and IOC intended to make inroads into the sector in a big way, especially for two-wheelers and three-wheelers, he added.

"Green hydrogen is one area where we are going to really push ourselves. I'm a big consumer of hydrogen as it is today because of the hydro desulfurization processes," Vaidya said.

"And my intent of entering the green hydrogen phase is, once I give the volumes, I'm sure the prices will come down," he said. IOC has finalized joint ventures with ReNew and L&T to push ahead in that segment.

More from the series: India's crude strategy a cushion for both global, domestic prices, says Puri

News

India's unwavering appetite for Russian crude has provided ample bandwidth to Middle Eastern sour crude suppliers to cater to the needs of South Korea, Japan, Thailand and other East Asian buyers. Even if OPEC+ decides to extend production cuts, East Asian refiners are confident they can secure adequate Middle East sour crude term supplies. View full-size infographic Also listen:

News

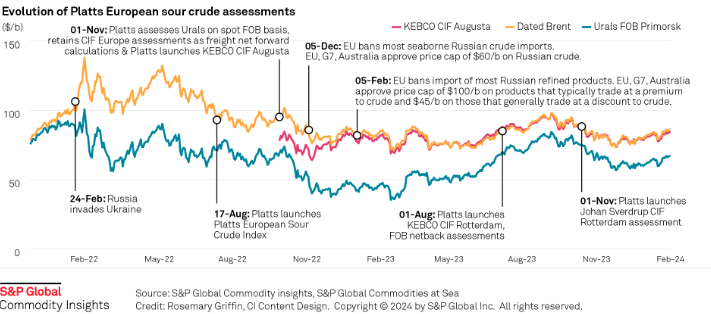

Russia's invasion of Ukraine has had a profound impact on sour crude export destinations, and increased the appetite for sweet crudes among European refiners. Platts methodology has evolved to reflect this changing landscape. Click here to see the full-size infographic.

News

Latest update: Jan. 30, 2024 A key OPEC+ advisory committee, co-chaired by Saudi Arabia and Russia, is set to meet online Feb. 1, with crude prices still stuck below the level that many of the alliance’s major producers need to balance their budgets. Traders will be seeking signals from the Joint Ministerial Monitoring Committee meeting on how long the bloc will keep the reins on its production and how it sees supply-demand fundamentals shaping up in the months ahead. Related story: OPEC+ monitoring committee prepares to meet as group battles sticky oil prices (Subscriber content) Click here to view the full-size infographic Compare hundreds of different crude grades and varieties produced around the world with Platts interactive Periodic Table of Oil .

News

Sumas spot gas down 90.6% year on year CAISO solar generation up 6 points in Dec US West power forwards are trending roughly 50% lower than year-ago packages on weaker gas forwards and above-normal temperatures forecast with El Nino weather conditions to linger into spring. El Nino conditions, which typically occur January through March, tend to bring more rain to the US Southwest and warmer-than-normal temperatures. The three-month outlook indicates a greater probability for above-normal temperatures across most of the Western US, with the exception of the Desert Southwest, according to the US National Weather Service's Climate Prediction Center. SP15 on-peak January rolled off the curve at $55.75/MWh, 79.4% lower than where the 2023 package ended, according to data from Platts, part of S&P Global Commodity Insights. The February package is currently in the low 50s/MWh, 70% below where its 2023 counterpart was a year earlier, while the March package is in the mid-$30s/MWh, 55.4% lower. In gas forwards, SoCal January rolled off the curve at $3.779/MMBtu, 97.9% below where the 2023 contract ended a year earlier, according to S&P Global data. The February contract is currently around $4.063/MMBtu, 78.9% lower than its 2023 counterpart at the same time last year, while the March contract is about $2.816/MMBtu, 63.2% lower. Gas plants burned an average of 1.815 Bcf/d in December to generate an average of 267.167 GWh/d, an analysis of S&P Global data showed. That's down 0.66% from November and a drop of 11.2 % from 2023. S&P Global forecast CAISO's gas fleet to generate around 220 GWh/d in February. In comparison, burning fuel at the same rate as February 2023 would consume 1.758 Bcf/d, a 6% decrease year on year. Spot markets In spot markets, power prices were down significantly from a year ago, when cold weather hit the region and drove up prices. SP15 on-peak day-ahead locational marginal prices averaged $43.49/MWh in December, 83% lower year over year and 11.2% below November prices, according to California Independent System Operator data. Helping pull down power prices, spot gas at SoCal city-gate was down 88.4% year on year and 40% lower month on month at an average of $3.554/MMBtu in December, according to S&P Global data. In the Northwest, Sumas spot gas was down 90.6% year on year at an average of $2.669/MMBtu. The decline in spot gas prices likely accounts for the lower average spot power prices month on month in December, said Morris Greenberg, senior manager with the low-carbon electricity team at S&P Global. Compared to a year earlier, CAISO population-weighted temperatures averaged 8% higher in December, resulting in 38.4% fewer heating-degree days, according to CustomWeather data. Fuel mix Thermal generation remained the lead fuel source at 46.1% of the total fuel mix in December, little changed year on year, while solar generation was up nearly 6 percentage points to average 14.7% of the mix, according to CAISO data. Hydropower remained strong, averaging 8% of the December fuel mix, 2 points higher than a year earlier. Total generation was down nearly 8% from a year earlier at an average of roughly 23.4 GWh/day, as peakload slipped 2% year on year to average 27.254 GW in December, according to CAISO data. In the Northwest, peakload dropped nearly 11% year on year to average 7.89 GW in December, according to Bonneville Power Administration data. Hydropower remained the lead fuel source at nearly 74% of the mix, followed by nuclear at 12.3%, thermal at 9.6% and wind at 4.3%. Following El Nino expectations of the Northwest for warmer temperatures and drier precipitation, BPA population-weighted temperatures in December were 10% above normal and 21.5% higher than a year earlier, leading to 27% fewer heating-degrees days year on year, according to CustomWeather data.