European sour traders look for Urals alternatives as embargo looms

The last remaining European buyers of sour baseload crude Urals are now searching for alternatives to the Russian grade in order to fulfill contracts and ensure refinery throughput, after its Dec. 5 ban by the EU, marking a seismic shift in the European refinery slates.

Kazakh crude CPC Blend has seen increasing demand as a light grade that can be easily blended with alternative sour crudes to produce a medium sour Urals alternative. One sour trader said they had purchased CPC Blend and Iraq's Basrah Medium in order to run them together to produce Urals for a term contract buyer. Kurdish Blend Test crude and CPC Blend were also being run together as Urals replacements, the trader said.

Basrah Medium was heard to be flowing to Europe more in the last month, a second sour trader said, adding: "It's a substitute for Urals."

Kpler shipping data supports this view with 77,000 b/d more Basrah Medium flowing to Europe in October compared with September. Some 377,000 b/d was bound for Europe in October compared with 129,000 b/d in December 2021, the last full month of voyage data before the war in Ukraine.

Shipping data for KBT reveals a steadily increasingly flow of the medium sour grade toward Mediterranean refineries. In October, KBT exports to Europe soared to 359,000 b/d, up 129,000 b/d on the month, according to Kpler.

"The KBT [price] is trending lower," a third sour trader said, adding that it was trying to attract Urals buyers with strong discounts.

This comes as Iraqi oil marketer SOMO lowered the official selling price for all its grades in November in a surprise move to claim greater market share in Europe.

"[SOMO and Saudi Aramco] have to make the prices palatable to compete with other regions like Latin American and other sour producers," another sour trader said.

Turning to the North Sea, traders said there was growing expectation that Forties would be run with Johan Sverdrup as an alternative to the Urals baseload.

"There's more interest in Forties as it [Urals] will be illegal in Europe in 30 days," said a North Sea trader, with a second saying it was "expected" there would be more interest in Forties in the December trading cycle.

Another alternative for sour traders has come from the sweeter Libyan grade Es Sider that has caught the attention of buyers as production spikes and OSPs remain competitive. Es Sider is a sweeter grade than medium sour Urals but is often deemed too sulfurous for sweet buyers in the Mediterranean basin.

"Libyan is competitive as usual and the OSP is cheap," said a Mediterranean trader, highlighting that it is attractive to buyers n the region as they looked for a cheap baseload grade.

Platts, part of S&P Global Commodity Insights, last assessed Es Sider Nov.3 at a 1 cent/b discount to Dated Brent.

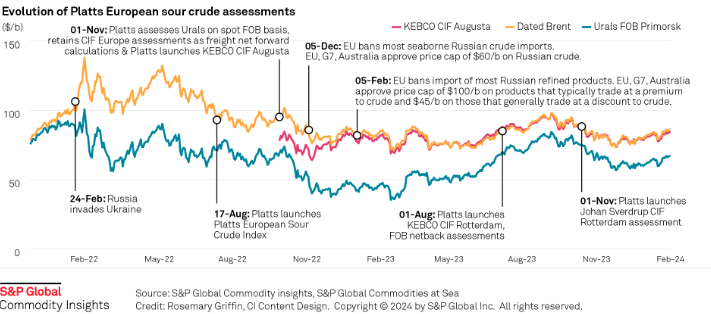

As European Urals purchases fade ahead of the Dec. 5 embargo, Kazakh-origin Urals (KEBCO) has risen in prominence as a Mediterranean sour marker. Platts last assessed KEBCO at a $16/b discount to Dated Brent on a CIF Augusta basis, $7.94/b higher than Russian Urals Nov. 3.

"90% of Mediterranean refineries can now take KEBCO," the second sour trader said, highlighting the rise in importance of the medium sour grade. They added that it was now pricing independently of Urals as a standalone marketed grade.

However, the third sour trader said some end-users were still wary of the grade as it transports through the Russian pipeline system leading to the molecules comingling. "With the Dec. 5 Embargo coming in, more and more people definitely realize they have to be cautious on these purchases," they added.

Kpler shipping data reveals more buyers in the KEBCO market. In the first month of data in August, 75% of cargoes of Kazakh-origin crude went to a KMG-owned refinery in Romania, but in the most recent month of data in October that number has declined to 33% with buyers from Spain, Italy, Rotterdam and Poland joining the list of new KEBCO buyers.

News

India's unwavering appetite for Russian crude has provided ample bandwidth to Middle Eastern sour crude suppliers to cater to the needs of South Korea, Japan, Thailand and other East Asian buyers. Even if OPEC+ decides to extend production cuts, East Asian refiners are confident they can secure adequate Middle East sour crude term supplies. View full-size infographic Also listen:

News

Russia's invasion of Ukraine has had a profound impact on sour crude export destinations, and increased the appetite for sweet crudes among European refiners. Platts methodology has evolved to reflect this changing landscape. Click here to see the full-size infographic.

News

Latest update: Jan. 30, 2024 A key OPEC+ advisory committee, co-chaired by Saudi Arabia and Russia, is set to meet online Feb. 1, with crude prices still stuck below the level that many of the alliance’s major producers need to balance their budgets. Traders will be seeking signals from the Joint Ministerial Monitoring Committee meeting on how long the bloc will keep the reins on its production and how it sees supply-demand fundamentals shaping up in the months ahead. Related story: OPEC+ monitoring committee prepares to meet as group battles sticky oil prices (Subscriber content) Click here to view the full-size infographic Compare hundreds of different crude grades and varieties produced around the world with Platts interactive Periodic Table of Oil .

News

Sumas spot gas down 90.6% year on year CAISO solar generation up 6 points in Dec US West power forwards are trending roughly 50% lower than year-ago packages on weaker gas forwards and above-normal temperatures forecast with El Nino weather conditions to linger into spring. El Nino conditions, which typically occur January through March, tend to bring more rain to the US Southwest and warmer-than-normal temperatures. The three-month outlook indicates a greater probability for above-normal temperatures across most of the Western US, with the exception of the Desert Southwest, according to the US National Weather Service's Climate Prediction Center. SP15 on-peak January rolled off the curve at $55.75/MWh, 79.4% lower than where the 2023 package ended, according to data from Platts, part of S&P Global Commodity Insights. The February package is currently in the low 50s/MWh, 70% below where its 2023 counterpart was a year earlier, while the March package is in the mid-$30s/MWh, 55.4% lower. In gas forwards, SoCal January rolled off the curve at $3.779/MMBtu, 97.9% below where the 2023 contract ended a year earlier, according to S&P Global data. The February contract is currently around $4.063/MMBtu, 78.9% lower than its 2023 counterpart at the same time last year, while the March contract is about $2.816/MMBtu, 63.2% lower. Gas plants burned an average of 1.815 Bcf/d in December to generate an average of 267.167 GWh/d, an analysis of S&P Global data showed. That's down 0.66% from November and a drop of 11.2 % from 2023. S&P Global forecast CAISO's gas fleet to generate around 220 GWh/d in February. In comparison, burning fuel at the same rate as February 2023 would consume 1.758 Bcf/d, a 6% decrease year on year. Spot markets In spot markets, power prices were down significantly from a year ago, when cold weather hit the region and drove up prices. SP15 on-peak day-ahead locational marginal prices averaged $43.49/MWh in December, 83% lower year over year and 11.2% below November prices, according to California Independent System Operator data. Helping pull down power prices, spot gas at SoCal city-gate was down 88.4% year on year and 40% lower month on month at an average of $3.554/MMBtu in December, according to S&P Global data. In the Northwest, Sumas spot gas was down 90.6% year on year at an average of $2.669/MMBtu. The decline in spot gas prices likely accounts for the lower average spot power prices month on month in December, said Morris Greenberg, senior manager with the low-carbon electricity team at S&P Global. Compared to a year earlier, CAISO population-weighted temperatures averaged 8% higher in December, resulting in 38.4% fewer heating-degree days, according to CustomWeather data. Fuel mix Thermal generation remained the lead fuel source at 46.1% of the total fuel mix in December, little changed year on year, while solar generation was up nearly 6 percentage points to average 14.7% of the mix, according to CAISO data. Hydropower remained strong, averaging 8% of the December fuel mix, 2 points higher than a year earlier. Total generation was down nearly 8% from a year earlier at an average of roughly 23.4 GWh/day, as peakload slipped 2% year on year to average 27.254 GW in December, according to CAISO data. In the Northwest, peakload dropped nearly 11% year on year to average 7.89 GW in December, according to Bonneville Power Administration data. Hydropower remained the lead fuel source at nearly 74% of the mix, followed by nuclear at 12.3%, thermal at 9.6% and wind at 4.3%. Following El Nino expectations of the Northwest for warmer temperatures and drier precipitation, BPA population-weighted temperatures in December were 10% above normal and 21.5% higher than a year earlier, leading to 27% fewer heating-degrees days year on year, according to CustomWeather data.