Deepwater drillers see bright outlook in next few years, citing high rig demand, scarce supply

Deepwater drillers Transocean and Valaris see a bright outlook for rig assets in global markets over the next few years, with increasing demand from recent discoveries and development projects as supply continues to tighten, the companies' CEOs said in separate first quarter earnings calls May 2.

As one of many measures of the buoyant market for deepwater oil and gas, Transocean said its contract backlog was $900 million in Q1, countering the lull seen during the period in years past.

"This is more than double the backlog we added in first quarter 2022 and more than seven times the backlog we added in first quarter 2021," Transocean CEO Jeremy Thigpen said. "We believe this is another clear indication of the sustainability of this constructive market environment."

Valaris CEO Anton Dibowitz said upstream spending is expected to increase 15% in 2023, and further increments are predicted in 2024-25 as a favorable macro environment and higher E&P capex have led to expanded floater and jackup activity.

"The number of contracted benign-environment floaters has increased from lows in late 2020 and early 2021 and recently has returned to pre-COVID levels," Dibowitz said.

A March presentation by S&P Global Commodity Insights said combined global demand for both shallow-water jackups and deepwater floater rigs was 532 units, the same as in October 2019, while floater demand was 140 units, similar to levels in October 2018.

A predicted tightness in the supply of high-specification, harsh-environment semisubmersible rigs— traditionally a rig suited to and mostly used offshore Norway — has begun to materialize as demand for the class is increasing in other global markets, including Australia, the Mediterranean and Libya, Thigpen said.

"We see multiple upcoming long-term developments on the horizon in Norway, [so any] departure of these assets from that region is meaningful," he said. "If demand continues to materialize as we expect, by the end of 2024 we anticipate future projects in Norway will require several of these rigs to return. And to lure them back, significant mobilization fees and higher day rates will be required."

Thigpen sees "strong" competition among operators, especially in Australia, to secure the best and most capable rigs, along with an increased willingness from customers to pay higher contract preparation costs.

While the harsh-environment market is pricier, benign-environment rigs, notably ultra-deepwater drillships, are also fetching higher day rates, with top-tier sixth- and seventh-generation units commanding $400,000-$450,000/d and utilization at nearly 100%, Thigpen said. By year's end, Thigpen expects leading-edge rates to exceed $500,000/d.

Across the Golden Triangle, East Africa and Mediterranean, Dibowitz currently sees 20-25 opportunities in next couple of years for ultra-deepwater floaters with expected durations greater than a year.

"While demand is increasing, the pool of available rigs is shrinking," he said. "We believe there to be no more than 10 competitive rigs remaining amongst the stacked drillship fleet."

The behavior of E&P customers has changed accordingly, as they seek to secure rigs for longer terms; in some cases, more than three years. This trend is expected to continue as access to available and desirable rigs becomes more difficult, Thigpen said.

Demand in Brazil, a large consumer of available rigs, is strong, Thigpen said. In West Africa and the Mediterranean, demand for floaters should be up over the next 18 months, as multiyear programs take shape in Angola, Egypt and Cyprus. In Namibia, rig demand is materializing after recent discoveries by Shell and TotalEnergies in the Orange Basin.

In the US Gulf of Mexico, a 30% uptick in number of deepwater blocks in the region's March lease sale compared to the November 2021 sale is encouraging, Thigpen said, noting he sees "strong activity for the foreseeable future."

Dibowitz noted "very few" ultra-deepwater floaters have exited the US Gulf, indicating "demand there will remain strong."

Valaris has seen the number of shallow-water jackup rigs contracted increase 15% from lows in early 2021 to the highest level since mid-2015. Dibowitz said active jackup utilization is about at 90% and day rates are in the low- to mid-$100,000s/d, with leading-edge rates continuing to trend upward.

"We believe many of the jackups that are currently idle are not competitive, either due to their age or length of time stacked," Dibowitz said. "One-third of the current jackup fleet is more than 30 years old, with limited useful life remaining."

"Out of about 100 jackups currently idle, we count only 17 that are less than 30 years old, have been stacked for less than three years, and are in the top half of the global fleet rankings," he added. "As a result, we believe that many of the stacked rigs will never return to the active fleet."

News

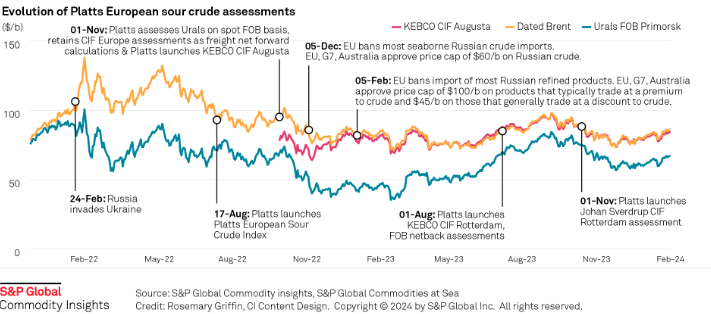

Russia's invasion of Ukraine has had a profound impact on sour crude export destinations, and increased the appetite for sweet crudes among European refiners. Platts methodology has evolved to reflect this changing landscape. Click here to see the full-size infographic.

News

Coal production to hit all-time low of 489 mil st Coal to cede generation share to renewables Nominal average delivered coal prices at $2.49/MMbtu The US Energy Information Administration Jan. 9 revised downward its 2024 coal export projection to 91 million st, which if realized would be 9% lower than 2023 exports of 100 million st. The EIA's January Short-Term Energy Outlook marked a 2.7% downward revision on the month for 2024 projected coal exports. Coal exports in 2025 are projected to recover 4.8% on the year to 95.4 million st. Lower coal demand was reflected in the EIA's 2024 US coal production estimate representing an all-time low. The EIA projected that coal production will fall 15.9% on the year to 489.3 million st in 2024 before declining another 12.4% year on year to 428.8 million st in 2025. Total coal consumption was projected at 391.3 million st in 2024, up 1.6% from the prior month's projection. The EIA estimated 2025 total coal consumption at 361.7 million st. For the electric power sector, coal consumption was estimated at 351.9 million st in 2024, down 8.4% from the prior year. For 2025, electric power sector coal consumption was projected at 322.2 million st, which would be an all-time low if realized, according to EIA data going back to 1997. Nominal average delivered coal prices were estimated at $2.49/MMbtu in 2024, down from $2.52/MMBtu in 2023. The EIA projected that 2025 nominal average delivered coal prices would shrink further to $2.44/MMBtu. Platts assessed US over-the-counter Central Appalachia 12,500 Btu/lb CSX rail coal for February delivery unchanged on the session at $72.40/st Jan. 8, showed data from S&P Global Commodity Insights. The assessment was based on broker indications of value at $72/st and $72.75/st, tested in the market through 4:30 pm ET. The Jan. 8 CAPP assessment at $72.40/st was equivalent to $2.896/MMBtu. The CAPP coal price averaged $81.12/st in 2023, the equivalent of $3.245/MMBtu. Powder River Basin 8,800 Btu/lb rail coal for prompt-month delivery closed at $13.95/st Jan. 8, unchanged on the session, based on broker indications of value at $13.85/st and $14/st. The assessment at $13.95/st was equivalent to $0.793/MMbtu. The coal averaged $14.46/MMbtu in 2023, the equivalent of $0.822/MMBtu. In line with falling coal consumption, coal's share of US power generation is expected to slip to 14.8% in 2024, down from 16.6% in 2023. The EIA projected coal generation at 13.3% in 2025 as renewables generation increases. Renewable energy sources totaled 21.8% of 2023 US generation share. Generation from renewables was projected to rise to 24% in 2024 and 25.9% in 2025. Nuclear generation's share was estimated to remain steady between 19.2% and 19.3% between 2024 and 2025. Natural gas generation, which constituted 41.9% of the US generation share in 2023, was projected to fall to 41.5% in 2024 and 41.1% in 2025. The EIA estimated that the Henry Hub spot price will average $2.76/MMbtu in 2024, down from the December 2024 estimate of $2.90/MMBtu. For 2024, the EIA projected Henry Hub prices at $3.06/MMBtu. The prompt-month NYMEX Henry Hub natural gas futures contract settled at $2.98/MMBtu Jan. 8, according to CME Group data. In 2023, the Henry Hub price averaged $2.665/MMBtu. Dry natural gas production was estimated at 105.04 Bcf/day in 2024, up from 103.54 Bcf/d in 2023. The EIA estimated that dry natural gas production would increase to 106.38 Bcf/d in 2025. LNG exports are expected to rise 4.4% on the year to 12.36 Bcf/d in 2024 before jumping 16.7% year on year to 14.42 Bcf/d in 2025. Total natural gas consumption for 2024 was projected at 89.91 Bcf/d, up 1.1% on the year. Total consumption of natural gas was projected to fall 0.2% on the year to 89.71 Bcf/d in 2025. Natural gas consumption in the US power sector was projected to rise 1.1% on the year to 35.54 Bcf/d in 2024. The EIA estimated that 2025 natural gas consumption in the US power sector will decline 0.7% on the year to 35.29 Bcf/d.

News

Sees $2.5 bil-$4.5 bil impairment amid weak margins Throughput impacted by North America maintenance Upstream output set to steady in Q4 Shell on Jan. 8 highlighted a weak fourth quarter for its refining and chemicals unit due to lower margins and a maintenance impact on throughput, as it warned investors of an expected financial impairment of $2.5 billion-$4.5 billion, primarily in the downstream. Shell said in December it plans to offload its 500,000 b/d Singapore refining and chemicals operations due to a lack of advantage in feedstock, energy and utility costs, starkly contrasting with the company's earlier enthusiasm for opportunities in Asia in the previous decade. Shell's global indicative refining margin dropped from $15.72/b in Q3 2023 to $10/b in Q4, and it said it expected significantly lower results from chemicals and products trading compared with Q3, with the chemicals and products unit set for an adjusted earnings loss. Results were also affected by a slump in refinery throughput to a range of 78%-82%, a level reminiscent of the pandemic, but due to planned maintenance at its North American refining operations. Shell's North American downstream business is spread across two sites in Canada and one in the US: the 100,000 b/d Scotford refinery in Alberta, which processes synthetic crude derived from oil sands, and the 85,000 b/d Sarnia refinery near Ontario, as well as the 250,000 b/d Norco refinery in Louisiana. Scotford was expected to operate at reduced levels during maintenance in October, while Norco was expected to be under maintenance for most of that month, S&P Global Commodity Insights reported earlier. Steadier upstream Elsewhere in its business, there were some signs of more stable upstream production, with the midpoint of Shell's guidance for the upstream unit higher than output in Q4 2022. It forecast production in a range of 1.83 million-1.93 million b/d of oil equivalent, offset by a potential fall in production in the LNG-focused Integrated Gas unit, to 880,000-920,000 boe/d. Shell's oil output declined significantly between 2019 and 2022, and particularly during 2022. Shell confirmed its earlier guidance that LNG liquefaction volumes for Q4 2023 were higher than a year earlier, in a range of 6.9 million-7.3 million mt, although that is also significantly below pre-2022 levels. It added that financial results from LNG trading were expected to be "significantly higher" than in Q3 2023 due to "seasonality and increased optimization opportunities." The Platts Dated Brent benchmark was assessed $4.53/b lower on average in Q4 2023 compared with a year earlier at $84.34/b. Platts is part of S&P Global Commodity Insights.

News

Sumas spot gas down 90.6% year on year CAISO solar generation up 6 points in Dec US West power forwards are trending roughly 50% lower than year-ago packages on weaker gas forwards and above-normal temperatures forecast with El Nino weather conditions to linger into spring. El Nino conditions, which typically occur January through March, tend to bring more rain to the US Southwest and warmer-than-normal temperatures. The three-month outlook indicates a greater probability for above-normal temperatures across most of the Western US, with the exception of the Desert Southwest, according to the US National Weather Service's Climate Prediction Center. SP15 on-peak January rolled off the curve at $55.75/MWh, 79.4% lower than where the 2023 package ended, according to data from Platts, part of S&P Global Commodity Insights. The February package is currently in the low 50s/MWh, 70% below where its 2023 counterpart was a year earlier, while the March package is in the mid-$30s/MWh, 55.4% lower. In gas forwards, SoCal January rolled off the curve at $3.779/MMBtu, 97.9% below where the 2023 contract ended a year earlier, according to S&P Global data. The February contract is currently around $4.063/MMBtu, 78.9% lower than its 2023 counterpart at the same time last year, while the March contract is about $2.816/MMBtu, 63.2% lower. Gas plants burned an average of 1.815 Bcf/d in December to generate an average of 267.167 GWh/d, an analysis of S&P Global data showed. That's down 0.66% from November and a drop of 11.2 % from 2023. S&P Global forecast CAISO's gas fleet to generate around 220 GWh/d in February. In comparison, burning fuel at the same rate as February 2023 would consume 1.758 Bcf/d, a 6% decrease year on year. Spot markets In spot markets, power prices were down significantly from a year ago, when cold weather hit the region and drove up prices. SP15 on-peak day-ahead locational marginal prices averaged $43.49/MWh in December, 83% lower year over year and 11.2% below November prices, according to California Independent System Operator data. Helping pull down power prices, spot gas at SoCal city-gate was down 88.4% year on year and 40% lower month on month at an average of $3.554/MMBtu in December, according to S&P Global data. In the Northwest, Sumas spot gas was down 90.6% year on year at an average of $2.669/MMBtu. The decline in spot gas prices likely accounts for the lower average spot power prices month on month in December, said Morris Greenberg, senior manager with the low-carbon electricity team at S&P Global. Compared to a year earlier, CAISO population-weighted temperatures averaged 8% higher in December, resulting in 38.4% fewer heating-degree days, according to CustomWeather data. Fuel mix Thermal generation remained the lead fuel source at 46.1% of the total fuel mix in December, little changed year on year, while solar generation was up nearly 6 percentage points to average 14.7% of the mix, according to CAISO data. Hydropower remained strong, averaging 8% of the December fuel mix, 2 points higher than a year earlier. Total generation was down nearly 8% from a year earlier at an average of roughly 23.4 GWh/day, as peakload slipped 2% year on year to average 27.254 GW in December, according to CAISO data. In the Northwest, peakload dropped nearly 11% year on year to average 7.89 GW in December, according to Bonneville Power Administration data. Hydropower remained the lead fuel source at nearly 74% of the mix, followed by nuclear at 12.3%, thermal at 9.6% and wind at 4.3%. Following El Nino expectations of the Northwest for warmer temperatures and drier precipitation, BPA population-weighted temperatures in December were 10% above normal and 21.5% higher than a year earlier, leading to 27% fewer heating-degrees days year on year, according to CustomWeather data.