INDIA CEO SERIES: Cairn says imperative to tap foreign, private firms to realize upstream dream

The S&P Global Commodity Insights India CEO Series is a compilation of exclusive interviews by Asia Energy Editor Sambit Mohanty with top government and industry leaders in India's oil and gas sector. Get insights on how those companies are planning to strike a balance between traditional and new businesses at a time when energy transition is changing the industry's landscape, while geopolitical turbulence is throwing up new challenges.

India's promising growth outlook for oil and gas demand in coming years is increasingly opening up opportunities for private and foreign players in the upstream sector, but they will need support through a more investor-friendly policy framework, Cairn Oil & Gas CEO Nick Walker told S&P Global Commodity Insights in an exclusive interview.

He said that India, which imports 85% of its oil requirements, had rich hydrocarbon potential, and oil and gas would continue to play a critical role in meeting the country's energy needs and supporting economic growth despite the increased talk of energy transition altering the energy landscape.

"In the near term, India's oil and gas demand will get a boost due to population growth as well as urbanization and economic development. To cater to this demand, investment in exploration and production of new resources, as well as in the infrastructure required to support transportation and distribution, will be necessary," Walker said.

"But in the longer term, while India is likely to see a shift towards a more diversified energy mix, oil and gas will continue to play an important role in meeting the country's energy self-dependency push," he added.

Cairn, part of Vedanta Resources, currently contributes about 25% to India's domestic oil and gas production. It has set a target to raise its share to 50% as the upstream investment climate has improved, with many procedural complexities having been sorted in the upstream oil & gas sector by the government. But more on the policy front still needs to be done if New Delhi wants to achieve its ambitions to reduce energy imports to 50% of its energy basket by 2030.

"For this journey to be successful, attracting correct investments and foreign players will be important. And for that, the ease of doing business in the oil and gas sector will be crucial," Walker said.

He added that in addition to exploration, even production processes need further simplification, while levies and taxes on the upstream sectors need to come down.

"It ultimately boils down to creating a more conducive policy environment that prioritizes hydrocarbon expansion. The government has done well to reduce tax burdens, introduce production-linked incentive schemes and more. I strongly believe similar initiatives for the oil and gas sector could play a vital role in attracting large-scale foreign investments," Walker said.

Walker said that India had huge untapped oil and gas resource potential; in existing basins yet-to-find resources are estimated at 30 billion barrels of oil equivalent and including frontier un-explored areas, this figure could be significantly greater.

"In moving towards actualizing this, a crucial component will be to incentivize current producing blocks for ramping up production through the deployment of enhanced recovery techniques," Walker said.

Cairn has interest in a total of 62 blocks in India. In 2004, Cairn made the largest onshore discovery in more than two decades in Mangala, Rajasthan. In its 20 years of operations, Cairn has opened four frontier basins with numerous discoveries and 38 in Rajasthan alone, which is its largest producing onshore oil block.

The company's current total production capacity stands at 147,000 boe/d, with the Rajasthan block contributing 120,000 boe/d, or nearly 82% of total production. Cumulatively, the block has produced over 700 million boe in the last decade.

Cairn said in October 2022 that it signed a 10-year production sharing contract for its oil and gas block exploration works in the western state of Rajasthan with the Indian petroleum and natural gas ministry. The contract extension would be applicable from May 2020.

According to S&P Global, the Rajasthan assets are the company's main cash cow and positions the company to remain highly liquids-weighted as compared to a general E&P-wide push toward gas-weighted assets. Cairn's portfolio is an attractive dollar hedge for the government.

"Although the Rajasthan block has been producing for 14 years, we have until now produced 12% of hydrocarbons in place. And that's because a lot of the untapped resources are in more difficult reservoirs and unconventional shale targets," Walker said, adding that new technologies would help to unlock the opportunities in a profitable way.

Walker said that there was a need to fully support the transition to lower carbon sources of energy and produce fossil fuels in a more responsible manner, but the country must be realistic about the pace at which this can unfold.

"For India especially, fossil fuels will remain important. Cairn's skill and focus is as an oil and gas explorer and producer and that is what we will continue to focus on to meet India's energy needs, but it is important that we do that in a responsible way," Walker said.

He added that Carin had set a target to become net carbon zero by 2050 in the production of its barrels. "We are taking real action to achieve this -- for example, meeting our energy needs though investment in renewables. It is our aim to accelerate these initiatives as much as possible."

Cairn not only operates the world's longest continuously heated and insulated pipeline and the biggest enhanced oil recovery polymer flood project, it is also working on the longest horizontal well in India, as well as some of the biggest jet-pump operations, Walker said.

"We are constantly on the lookout for innovative technologies, great ideas that will help us find and develop new resources as well as state-of-the-art innovations that will improve efficiency and make our operations more cost-effective," Walker said.

Essar says for upstream investments to flow, it's now or never

Oil India sees time ripe for upstream sector to bask in glow of high oil prices

IOC's refining expansion landscape will reflect a shade of green

India's crude strategy a cushion for both global, domestic prices, says Puri

News

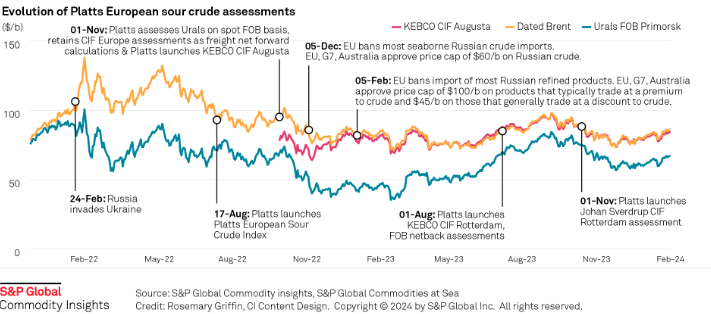

Russia's invasion of Ukraine has had a profound impact on sour crude export destinations, and increased the appetite for sweet crudes among European refiners. Platts methodology has evolved to reflect this changing landscape. Click here to see the full-size infographic.

News

Coal production to hit all-time low of 489 mil st Coal to cede generation share to renewables Nominal average delivered coal prices at $2.49/MMbtu The US Energy Information Administration Jan. 9 revised downward its 2024 coal export projection to 91 million st, which if realized would be 9% lower than 2023 exports of 100 million st. The EIA's January Short-Term Energy Outlook marked a 2.7% downward revision on the month for 2024 projected coal exports. Coal exports in 2025 are projected to recover 4.8% on the year to 95.4 million st. Lower coal demand was reflected in the EIA's 2024 US coal production estimate representing an all-time low. The EIA projected that coal production will fall 15.9% on the year to 489.3 million st in 2024 before declining another 12.4% year on year to 428.8 million st in 2025. Total coal consumption was projected at 391.3 million st in 2024, up 1.6% from the prior month's projection. The EIA estimated 2025 total coal consumption at 361.7 million st. For the electric power sector, coal consumption was estimated at 351.9 million st in 2024, down 8.4% from the prior year. For 2025, electric power sector coal consumption was projected at 322.2 million st, which would be an all-time low if realized, according to EIA data going back to 1997. Nominal average delivered coal prices were estimated at $2.49/MMbtu in 2024, down from $2.52/MMBtu in 2023. The EIA projected that 2025 nominal average delivered coal prices would shrink further to $2.44/MMBtu. Platts assessed US over-the-counter Central Appalachia 12,500 Btu/lb CSX rail coal for February delivery unchanged on the session at $72.40/st Jan. 8, showed data from S&P Global Commodity Insights. The assessment was based on broker indications of value at $72/st and $72.75/st, tested in the market through 4:30 pm ET. The Jan. 8 CAPP assessment at $72.40/st was equivalent to $2.896/MMBtu. The CAPP coal price averaged $81.12/st in 2023, the equivalent of $3.245/MMBtu. Powder River Basin 8,800 Btu/lb rail coal for prompt-month delivery closed at $13.95/st Jan. 8, unchanged on the session, based on broker indications of value at $13.85/st and $14/st. The assessment at $13.95/st was equivalent to $0.793/MMbtu. The coal averaged $14.46/MMbtu in 2023, the equivalent of $0.822/MMBtu. In line with falling coal consumption, coal's share of US power generation is expected to slip to 14.8% in 2024, down from 16.6% in 2023. The EIA projected coal generation at 13.3% in 2025 as renewables generation increases. Renewable energy sources totaled 21.8% of 2023 US generation share. Generation from renewables was projected to rise to 24% in 2024 and 25.9% in 2025. Nuclear generation's share was estimated to remain steady between 19.2% and 19.3% between 2024 and 2025. Natural gas generation, which constituted 41.9% of the US generation share in 2023, was projected to fall to 41.5% in 2024 and 41.1% in 2025. The EIA estimated that the Henry Hub spot price will average $2.76/MMbtu in 2024, down from the December 2024 estimate of $2.90/MMBtu. For 2024, the EIA projected Henry Hub prices at $3.06/MMBtu. The prompt-month NYMEX Henry Hub natural gas futures contract settled at $2.98/MMBtu Jan. 8, according to CME Group data. In 2023, the Henry Hub price averaged $2.665/MMBtu. Dry natural gas production was estimated at 105.04 Bcf/day in 2024, up from 103.54 Bcf/d in 2023. The EIA estimated that dry natural gas production would increase to 106.38 Bcf/d in 2025. LNG exports are expected to rise 4.4% on the year to 12.36 Bcf/d in 2024 before jumping 16.7% year on year to 14.42 Bcf/d in 2025. Total natural gas consumption for 2024 was projected at 89.91 Bcf/d, up 1.1% on the year. Total consumption of natural gas was projected to fall 0.2% on the year to 89.71 Bcf/d in 2025. Natural gas consumption in the US power sector was projected to rise 1.1% on the year to 35.54 Bcf/d in 2024. The EIA estimated that 2025 natural gas consumption in the US power sector will decline 0.7% on the year to 35.29 Bcf/d.

News

Sees $2.5 bil-$4.5 bil impairment amid weak margins Throughput impacted by North America maintenance Upstream output set to steady in Q4 Shell on Jan. 8 highlighted a weak fourth quarter for its refining and chemicals unit due to lower margins and a maintenance impact on throughput, as it warned investors of an expected financial impairment of $2.5 billion-$4.5 billion, primarily in the downstream. Shell said in December it plans to offload its 500,000 b/d Singapore refining and chemicals operations due to a lack of advantage in feedstock, energy and utility costs, starkly contrasting with the company's earlier enthusiasm for opportunities in Asia in the previous decade. Shell's global indicative refining margin dropped from $15.72/b in Q3 2023 to $10/b in Q4, and it said it expected significantly lower results from chemicals and products trading compared with Q3, with the chemicals and products unit set for an adjusted earnings loss. Results were also affected by a slump in refinery throughput to a range of 78%-82%, a level reminiscent of the pandemic, but due to planned maintenance at its North American refining operations. Shell's North American downstream business is spread across two sites in Canada and one in the US: the 100,000 b/d Scotford refinery in Alberta, which processes synthetic crude derived from oil sands, and the 85,000 b/d Sarnia refinery near Ontario, as well as the 250,000 b/d Norco refinery in Louisiana. Scotford was expected to operate at reduced levels during maintenance in October, while Norco was expected to be under maintenance for most of that month, S&P Global Commodity Insights reported earlier. Steadier upstream Elsewhere in its business, there were some signs of more stable upstream production, with the midpoint of Shell's guidance for the upstream unit higher than output in Q4 2022. It forecast production in a range of 1.83 million-1.93 million b/d of oil equivalent, offset by a potential fall in production in the LNG-focused Integrated Gas unit, to 880,000-920,000 boe/d. Shell's oil output declined significantly between 2019 and 2022, and particularly during 2022. Shell confirmed its earlier guidance that LNG liquefaction volumes for Q4 2023 were higher than a year earlier, in a range of 6.9 million-7.3 million mt, although that is also significantly below pre-2022 levels. It added that financial results from LNG trading were expected to be "significantly higher" than in Q3 2023 due to "seasonality and increased optimization opportunities." The Platts Dated Brent benchmark was assessed $4.53/b lower on average in Q4 2023 compared with a year earlier at $84.34/b. Platts is part of S&P Global Commodity Insights.

News

Sumas spot gas down 90.6% year on year CAISO solar generation up 6 points in Dec US West power forwards are trending roughly 50% lower than year-ago packages on weaker gas forwards and above-normal temperatures forecast with El Nino weather conditions to linger into spring. El Nino conditions, which typically occur January through March, tend to bring more rain to the US Southwest and warmer-than-normal temperatures. The three-month outlook indicates a greater probability for above-normal temperatures across most of the Western US, with the exception of the Desert Southwest, according to the US National Weather Service's Climate Prediction Center. SP15 on-peak January rolled off the curve at $55.75/MWh, 79.4% lower than where the 2023 package ended, according to data from Platts, part of S&P Global Commodity Insights. The February package is currently in the low 50s/MWh, 70% below where its 2023 counterpart was a year earlier, while the March package is in the mid-$30s/MWh, 55.4% lower. In gas forwards, SoCal January rolled off the curve at $3.779/MMBtu, 97.9% below where the 2023 contract ended a year earlier, according to S&P Global data. The February contract is currently around $4.063/MMBtu, 78.9% lower than its 2023 counterpart at the same time last year, while the March contract is about $2.816/MMBtu, 63.2% lower. Gas plants burned an average of 1.815 Bcf/d in December to generate an average of 267.167 GWh/d, an analysis of S&P Global data showed. That's down 0.66% from November and a drop of 11.2 % from 2023. S&P Global forecast CAISO's gas fleet to generate around 220 GWh/d in February. In comparison, burning fuel at the same rate as February 2023 would consume 1.758 Bcf/d, a 6% decrease year on year. Spot markets In spot markets, power prices were down significantly from a year ago, when cold weather hit the region and drove up prices. SP15 on-peak day-ahead locational marginal prices averaged $43.49/MWh in December, 83% lower year over year and 11.2% below November prices, according to California Independent System Operator data. Helping pull down power prices, spot gas at SoCal city-gate was down 88.4% year on year and 40% lower month on month at an average of $3.554/MMBtu in December, according to S&P Global data. In the Northwest, Sumas spot gas was down 90.6% year on year at an average of $2.669/MMBtu. The decline in spot gas prices likely accounts for the lower average spot power prices month on month in December, said Morris Greenberg, senior manager with the low-carbon electricity team at S&P Global. Compared to a year earlier, CAISO population-weighted temperatures averaged 8% higher in December, resulting in 38.4% fewer heating-degree days, according to CustomWeather data. Fuel mix Thermal generation remained the lead fuel source at 46.1% of the total fuel mix in December, little changed year on year, while solar generation was up nearly 6 percentage points to average 14.7% of the mix, according to CAISO data. Hydropower remained strong, averaging 8% of the December fuel mix, 2 points higher than a year earlier. Total generation was down nearly 8% from a year earlier at an average of roughly 23.4 GWh/day, as peakload slipped 2% year on year to average 27.254 GW in December, according to CAISO data. In the Northwest, peakload dropped nearly 11% year on year to average 7.89 GW in December, according to Bonneville Power Administration data. Hydropower remained the lead fuel source at nearly 74% of the mix, followed by nuclear at 12.3%, thermal at 9.6% and wind at 4.3%. Following El Nino expectations of the Northwest for warmer temperatures and drier precipitation, BPA population-weighted temperatures in December were 10% above normal and 21.5% higher than a year earlier, leading to 27% fewer heating-degrees days year on year, according to CustomWeather data.