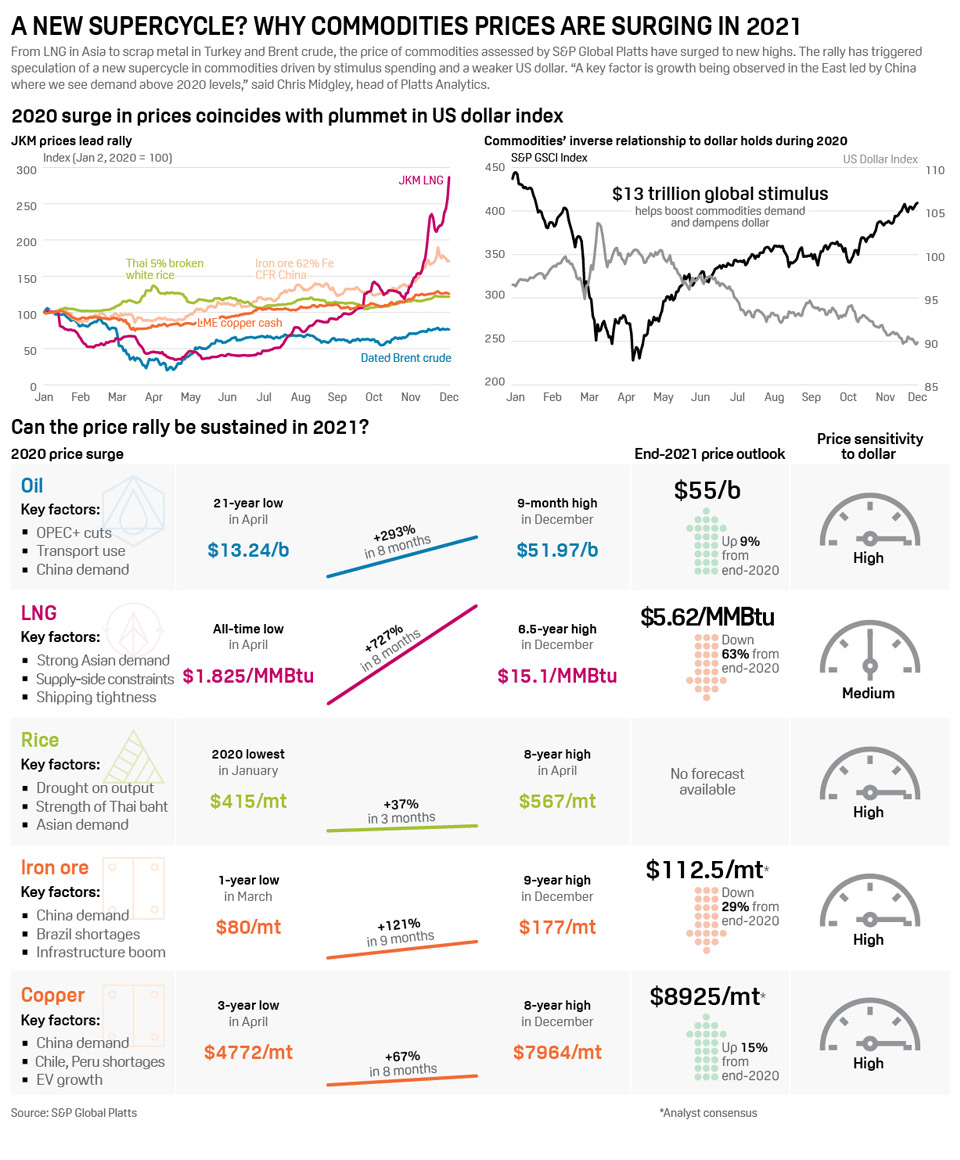

Commodity markets in 2021: a year in 6 infographics

|  |

| Sky's the limit? Global gas prices on stellar rally | Slow steel mill ramp-ups fuel Europe's steel price rally |

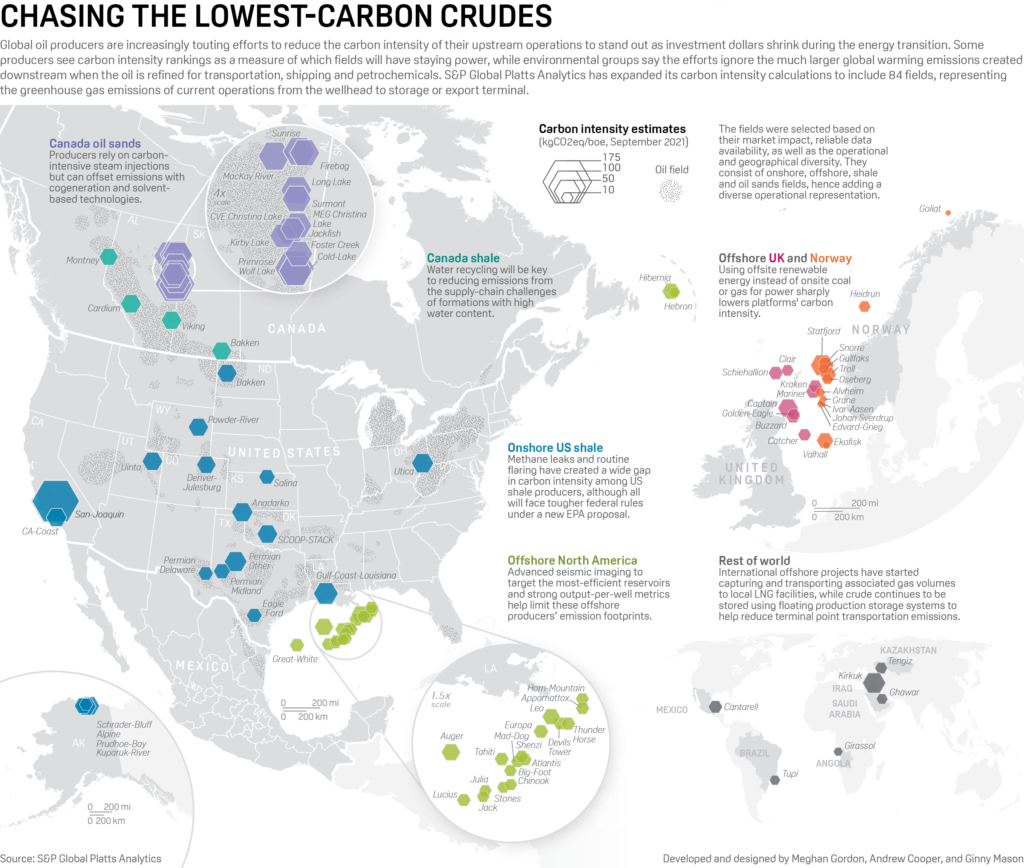

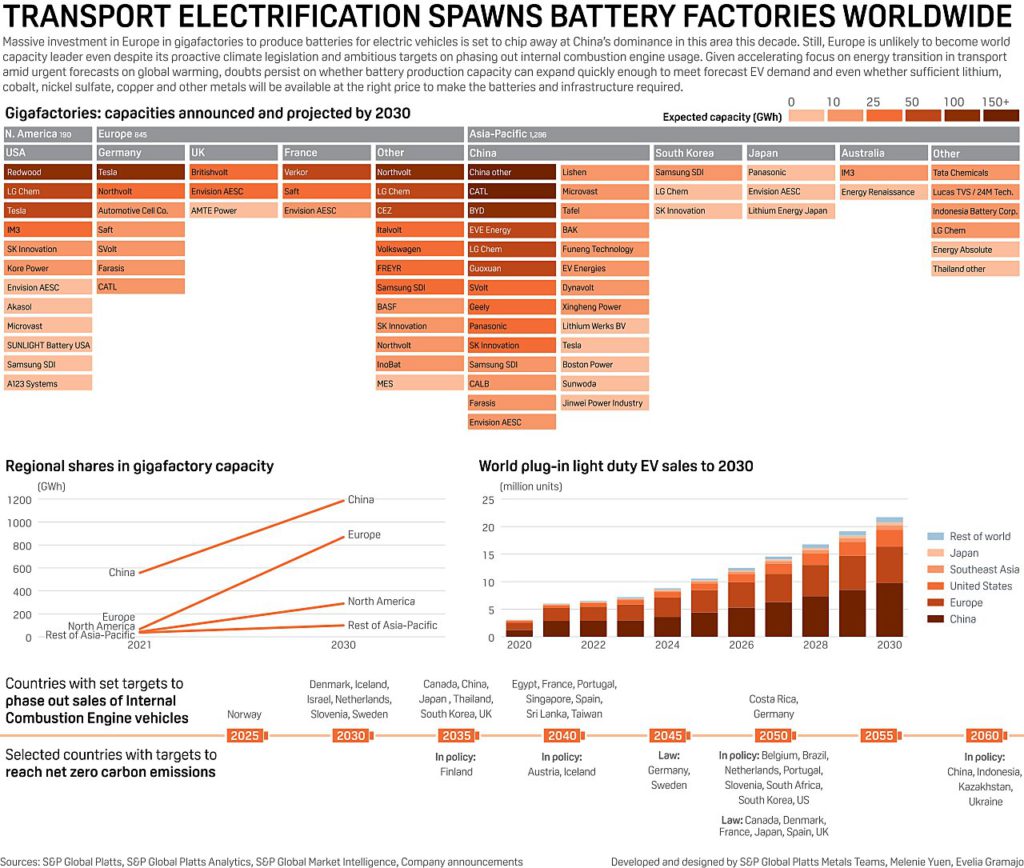

S&P Global Platts Analytics launched Nov. 15 an expanded set of carbon-intensity calculations for 84 fields around the world, with values expressed in kilograms of carbon dioxide equivalent per barrel of oil equivalent.More infographics on energy transition

S&P Global Platts Analytics launched Nov. 15 an expanded set of carbon-intensity calculations for 84 fields around the world, with values expressed in kilograms of carbon dioxide equivalent per barrel of oil equivalent.More infographics on energy transition |  |

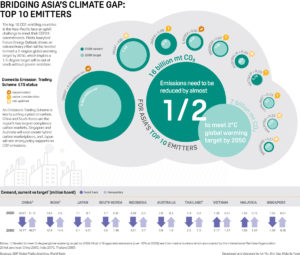

| Surging cost of energy transition casts shadow over COP26 climate talks | Bridging Asia's climate gap: Top 10 emitters |

More infographics on Russia

More infographics on Russia |  |

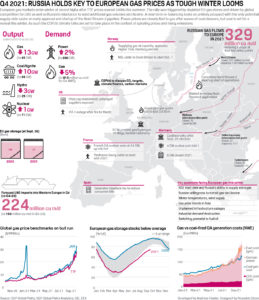

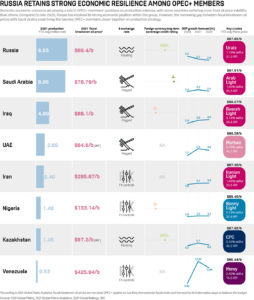

| Russia holds key to European gas prices as tough winter looms | Russia retains strong economic resilience among OPEC+ members |

Further reading on our data visualization: Platts infographics

Further reading on our data visualization: Platts infographics

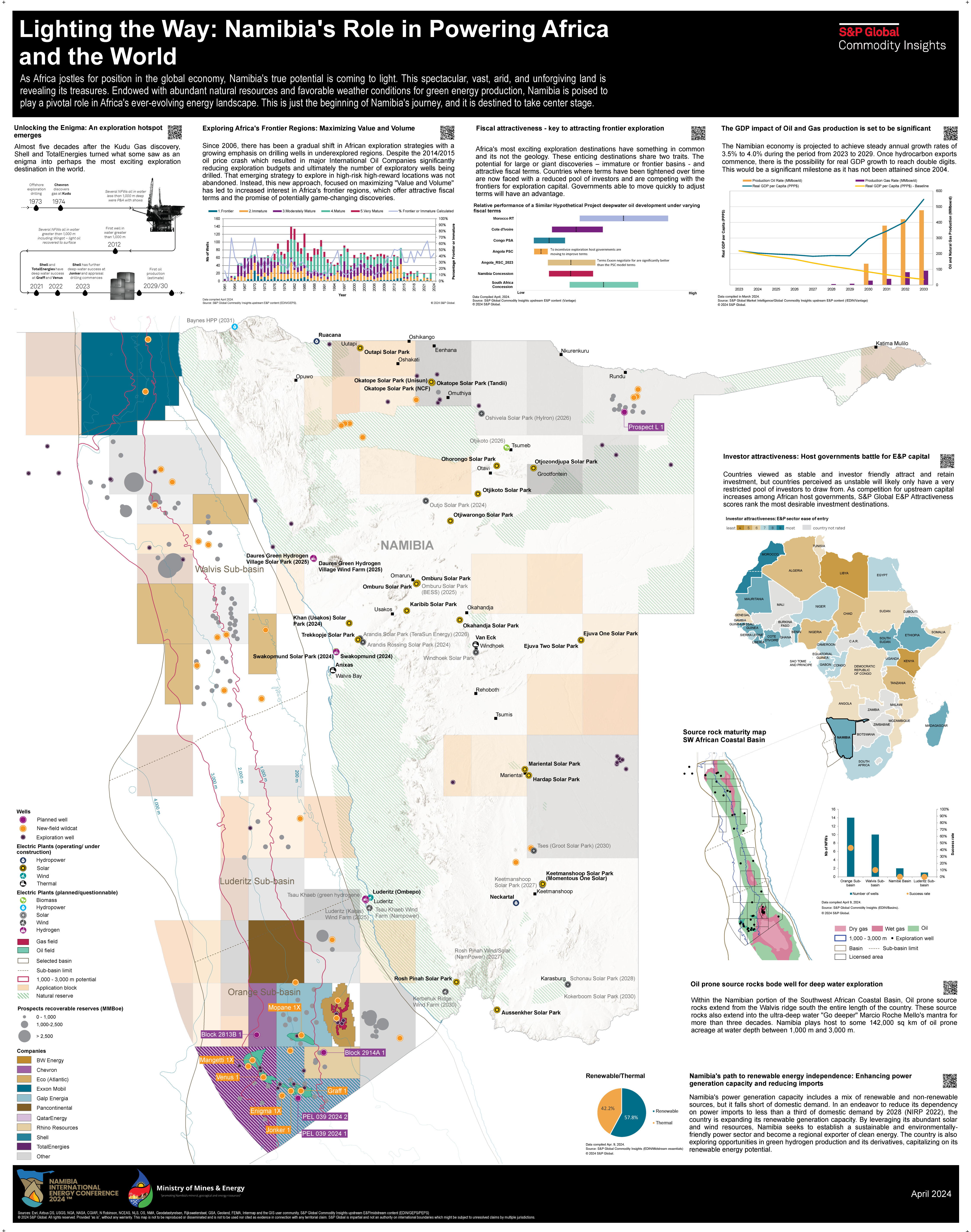

Thought Leadership

As Africa jostles for position in the global economy, Namibia's true potential is coming to light. This spectacular, vast, arid, and unforgiving land is revealing its treasures. Endowed with abundant natural resources and favorable weather conditions for green energy production, Namibia is poised to play a pivotal role in Africa's ever-evolving energy landscape. This is just the beginning of Namibia's journey, and it is destined to take center stage. The 6th edition of the Namibia International Energy Conference 2024 takes place from 23 – 25 April 2024 in Windhoek, Namibia . Themed ‘ Reimagine Resource-Rich Namibia: Turning Possibilities into Prosperity ,‘ this influential event brings together policymakers, energy stakeholders, investors, and international partners to foster industry growth and position Namibia as a prime investment destination. Convened by RichAfrica Consultancy, the three-day flagship event is held under the patronage of the Ministry of Mines & Energy and in strategic partnership with the African Energy Chamber. S&P Global Commodities Insights in partnership with RichAfrica and the African Energy Chamber will be present at the event delivering insights into Namibia's role in powering Africa and the world. DOWNLOAD INFOGRAPHIC

Thought Leadership

The price wall visualizes 258 of the most important price benchmarks assessed by Platts across various commodities from crude through to chemicals, LNG and carbon. The wall shows the price performance of these benchmarks over 2023 based on their indexed value from the first day of trading. Click on the commodity button to isolate different groups of resources to see which performed best in 2023, a year that saw dramatic changes in trade flows and demand because of sanctions and price caps on Russian commodities and a recovering post-COVID global economy. Isolate individual benchmarks by clicking on the tile to reveal a unique QR code to navigate to specific Platts methodology pages and average price data for 2022 and 2023. Click to start exploring

Thought Leadership

India must keep investing in the upstream sector to ensure higher oil and gas production to avoid possible supply problems or volatile energy prices, as it embraces technologies that are more environment friendly, Mannish Mahesshwari, CEO of Invenire Energy, told S&P Global Commodity Insights. "Flipping the lens to energy security, sustained under investment in upstream without substitutional capacity and substantial scale in clean and new energy could have far reaching consequences in the journey of just transition," Mahesshwari said on the sidelines of the India Energy Week in Goa. Most of assets of private equity backed Invenire are discovered fields in India that the company has acquired through secondary market purchases from other firms as well as through primary acquisitions directly from the government. The company also has assets in Indonesia and East Africa. The private upstream firm is looking to accelerate production of oil and gas from the discovered fields in its portfolio but has no plans to venture into exploration in the foreseeable future. "We are putting our money where our mind is. As a company, our ability to understand the rocks and the molecules is relatively better than the electrons. We are investing in today's energy system, which is mainly oil and helping in phasing out coal with the help of low-carbon gas," Mahesshwari said. He said that the transition to a world of net zero is more certain today than envisaged in 2015, the year of the Paris Agreement. However, it is the uncertainty around the energy transition pace that adds complexity and risk for upstream projects. The upstream industry has been avoiding spending on projects that would either lock in heavy emissions for years to come or quickly turn into stranded assets. Right focus Invenire currently holds stakes in nine blocks in India. Out of these, four are discovered small fields (DSF) blocks -- one in Assam and three in Mumbai offshore -- comprising a total of about 100 million barrels equivalent of oil and gas. Invenire holds a 100% stake in the four DSF acreages. The company has a small production portfolio of about 12,000 b/d but has plans to boost that volume to 35,000 b/d by 2025. According to S&P Global, Invenire Energy's upstream plans show ambition and promise, considering the wider competitive landscape in India. The company's experience of operating in a tough post-2014 upstream period that saw oil prices slump will certainly influence its post-2023 growth ambitions. For assets outside India, the company might have plans to become a non-operator joint venture partner to take stakes in small-to-medium sized producing assets. The company's focus has been on monetizing discovered resources, having both operator and non-operator portfolios, S&P Global said. Besides India, Invenire has producing fields with 45.55% participating interest in a material acreage located in South Sumatra Basin in Indonesia. "The upstream industry's main focus now is to deliver the supply required to meet demand. Most of the industry's oil and gas investment for the rest of this decade will target advantaged resources -- those with the lowest cost, least risk, and possibly lowest Scope 1 emissions. Beyond this decade, to meet demand, the industry will depend increasingly on late-life reserves growth from legacy supply sources." Mahesshwari said. Similar views Mahesshwari's views echoed comments made by state-run upstream producers ONGC Ltd. and Oil India Ltd. at the IEW conference. ONGC Ltd., which contributes about 74% of India's crude oil and around 63% of its natural gas production, has been actively looking to widen its upstream portfolio as it believes that oil and gas will be a major component of the country's energy mix for the next three decades, while pursuing new crude-to-chemicals projects to prepare for the changing energy landscape, its Chairperson Arun Kumar Singh told the conference. Oil India Ltd. is aiming to double its exploration acreage in the coming years and seeking partnerships to realize the hydrocarbon potential of offshore regions in Indian sedimentary basins, its Chairman and Managing Director Ranjit Rath said. Mahesshwari said that there is a need to take a balanced view of energy transition, adding that any shortfall in upstream investments can add to supply issues and volatile energy prices, as seen in recent years. While it's important to keep looking for opportunities to invest in low-carbon businesses, continuing to responsibly invest in the core upstream business will remain the priority for the company in the foreseeable future. "The potential in carbon capture utilization and storage is enormous, and the oil and gas sector has unique skills that make it ideally placed to lead in reducing CO2 and methane emissions and decarbonize hard-to-abate sectors through carbon upcycling," Mahesshwari said.

Thought Leadership

In a highly unusual move, Arizona utility regulators ordered their staff to draft new rules that would repeal the state's existing mandates for renewable energy and energy efficiency. The Feb. 6 order by the Arizona Corporation Commission, approved by a 4-1 vote at an open meeting, sets the Republican-led state apart from most other jurisdictions across the country, which are pushing utilities to source electricity from emissions-free sources. According to the Energy Information Administration, as of November 2022, 36 states and the District of Columbia had established renewable portfolio standards. In Arizona's case, the ACC first established the state's renewable energy standard and tariff in 2006. That standard requires regulated utilities to obtain 15% of their power from renewables no later than 2025. But the mandates have become unpopular with some Republicans, who claim the rules are raising prices for utility ratepayers since the costs utilities incur to comply with the rules are passed on to customers. In a joint press release Feb. 8, ACC Chairman Jim O'Connor and Commissioner Kevin Thompson claimed that the REST mandate has cost ratepayers about $2.3 billion since it was implemented in 2006. O'Connor said that at the time the REST rules were approved, then-Chairman Jeff Hatch-Miller promised that the commission would review the rules every year to ensure they remained in ratepayers' best interest. "Those reviews never occurred, and costs were never considered," O'Connor claimed. O'Connor also said that utilities often ended up acquiring power above market prices to comply with the renewables mandate. "Mandates distort market signals and are not protective of ratepayers," he claimed. The repeal of the REST rule has concerned some renewable developers, who say the action is part of a broader campaign in Arizona against renewable development by industry opponents. Speaking remotely to the Feb. 6 ACC meeting, Autumn Johnson, executive director of the Arizona Solar Energy Industries Association, claimed that "a half-dozen" bills have been proposed in the state legislature, "all intended to make it harder or more expensive to build utility-scale renewables." She also said that three local jurisdictions in the state have imposed moratoria or limits on new renewable projects. "I worry that, on top of all of this, the only state in the country to repeal what is already an extremely modest RPS sends the wrong signal to the industry," Johnson said. "It says, 'Take your business and your jobs and your dollars elsewhere.'" In addition to the REST mandate, the ACC's order also calls for revoking efficiency rules for both electric and gas utilities. Those rules, which went into effect in 2010, have cost ratepayers just under $1.1 billion to date, according to O'Connor and Thompson. "Living in Arizona, we all should be mindful to practice energy efficiency," Thompson said. "But too much focus has been placed on societal metrics and costly feel-good programs that don't prioritize ratepayer affordability and grid reliability." He added: "Once the mandates are removed, it will be incumbent upon Arizona's utilities to propose programs that actually work to benefit ratepayers and protect the integrity of our grid." In their statement, the two commissioners said the process of revoking the rules could take over a year due to a requirement for public comment and the need to submit the action for review by other state agencies.