China's latest energy transition push to support nonferrous metals demand

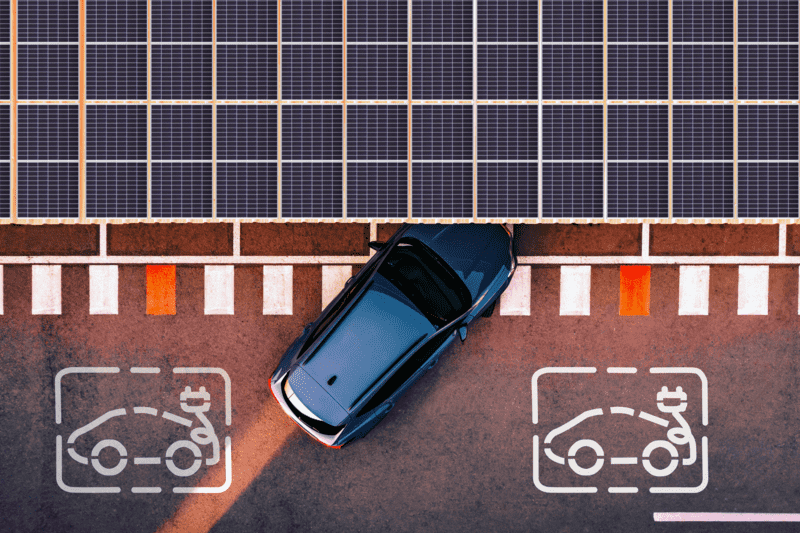

China's plans to offer stimulus measures to boost energy transition efforts are expected to favor sectors such as electric vehicles and photovoltaic panels in 2024, a trend that would support consumption of nonferrous metals such as aluminum, copper and lithium, industry sources said March 6.

China's Premier Li Qiang, in his work report released during the country's key annual political gathering on March 5, emphasized the important role EVs will play in the country's economy.

Li proposed several supportive measures, including development of new energy systems and storage, and boosting large-scale wind power photovoltaic bases.

Battery metals

EVs and energy storage sectors, which are the major consumers of battery metals, are expected to grow steadily this year driven by the expected stimulus measures from the government, sources said.

China's three state-backed vehicle producers First Auto Work, Dongfeng and Changan were called on to increase their EV outreach. As a result, EV production from these vehicle producers is expected to see an increase this year, some sources said.

However, the proposed measures aimed at EVs and energy storage sectors did not really alleviate concerns around battery and lithium chemicals oversupply in China, according to sources.

Due to weak downstream demand, most medium-to-small sized battery makers are running below 40% of their capacity currently, which could explain why the demand for cathode material and battery metals remained sluggish, said a Chinese battery maker source.

The weak outlook for lithium markets is also reflected in the falling EV sales in China. China's EV sales declined in January, falling below 30% of total vehicles sales reported in China during the month, according to latest data from the China Association of Automobile Manufacturers.

Lithium markets are expected to remain oversupplied in 2024, keeping spot prices subdued, sources said.

Platts assessed battery-grade lithium carbonate at Yuan 109,000/mt ($15,141/mt) on a DDP China basis March 5, down Yuan 1,000/mt on the day, , S&P Global Commodity Insights data showed. This came after a short-lived rebound driven by talks of environment-related checks on lithium salt producers and output cuts of Australian miners.

Aluminum and copper

China's proposed measures and expected higher consumption from energy transition-related sectors could offset the weak growth seen from the country's construction sector, which traditionally has been a strong consumer of aluminum and copper, according to sources.

Rising demand from the EV, photovoltaic and lithium battery sectors would be the three mainstays of aluminum and copper demand in China in 2024, state-run research agency Antaike said.

China's aluminum consumption from these three sectors is expected to reach 7.34 million mt in 2024, up 26% from the previous year, according to Antaike.

The government work report released March 5 also mentioned that China will continue to push forward with timely deliveries of presold homes in 2024.

However, China's construction sector is still expected to see tepid demand in 2024, pressured by the decline in housing starts over the past two-three years, Antaike said. The sector's aluminum demand is set to fall 2.5% on the year to 15.2 million mt in 2024, it added.

The growth of floor space completed usually lags two-to-three years behind the growth in housing starts.

Copper demand from construction and home appliance sectors typically makes up more than 20% of the country's total demand, market sources said.

News

Output at Brazilian lithium concentrate plant to reach 130,000 mt/year during Q4 Lithium hydroxide refinery in Germany to delivery first production batches during Q3 Q1 sales of lithium concentrate fell 24% due to shipping variations Miner and lithium supplier AMG Critical Materials has announced that the expansion of its mining operations in Brazil and the ramp-up of its conversion plant Germany remains on schedule despite ongoing volatility in global lithium markets. In a statement marking the release of the company’s first quarter 2024 results on May 7, AMG said that its lithium expansion strategy remains on-track with the company able to access approximately $600 million in capital following a $100 million term loan expansion secured at the end of April. In Brazil, AMG said that the expansion of its lithium concentrate is progressing as planned with the plant expected to reach a full nameplate capacity of 130,000mt/year during Q4 2024, up from a previous capacity 90,000 mt/year. In Germany, the company said that the ramp-up of its lithium hydroxide refinery in Bitterfeld remains on track with the first production batches expected to be shipped out to clients during Q3 2024. AMG plans to produce 20,000 mt/year of battery-grade lithium hydroxide at the plant in the first module, with four additional modules planned to achieve a total production capacity of 100,000 mt/year. In its Q1 results AMG reported quarterly sales of lithium concentrate at 15,652 dmt, some 24% lower than the 20,509 dmt sold during Q1 2023 with the company citing shipping variances in 2023. “Volumes were negatively impacted by shipments that arrived in the fourth quarter of 2023 to the detriment of our first quarter 2024 volumes,” it said. The average realized sales price was $1,163/dmt CIF China for the quarter at an average cost of $616/dmt CIF China. EBITDA during the quarter fell 71% on the year to 31 million which the company attributed to the decline in lithium and vanadium prices. “The average quarterly prices of lithium carbonate and ferrovanadium, the material prices that most significantly impact our financial results, decreased 76% and 33%, respectively, versus the average pricing in the first quarter of 2023,” the company said. With the ramp-up of the lithium concentrate plant, AMG said that the cost per ton will rise relative to historical costs during Q2 2024 due to unabsorbed costs during the ramp-up and lower tantalum sales volumes offsetting higher spodumene production. “Long-term demand trends are encouraging, and additional supply prospects are confronting challenging constraints throughout the industry,” said CEO Heinz Schimmelbusch. “Our low-cost position allows us to endure the current market conditions and prosper considerably at more normalized price levels.” Platts, part of S&P Global Commodity Insights, assessed lithium hydroxide CIF Europe at $14,800/mt May 7, down from $15,900/mt on Jan. 2. Platts Connect: News & Insights (spglobal.com)

News

Exports also 25.5% higher than March Year-to-date exports up at 89,203 mt Chile’s lithium exports rose sharply in April as producers Albemarle and SQM continued to ramp up production, customs data showed May 7, jumping 82.6% on the year to reach a record 28,764 mt April exports were also up 25.5% from those for the preceding month of March. Exports during the first four months totaled 89,203 mt, up 26% from the same period of 2023. However, the value of Chile’s lithium exports has continued to plummet in line with falling prices. Exports in April fell 38% to $316 million, while exports during the year to date dropped 47.6% to $1.27 billion. Calculated from export volumes and values, Chilean lithium fetched an average price of $11/kg in April, down from $32/kg a year earlier. Platts, part of S&P Global Commodity Insights, assessed lithium carbonate at $15,500/mt on a DDP US basis May 7. Meanwhile, exports of copper concentrates rose 24.7% in April to 1.19 million mt (total weight), while exports during the first four months of the year increased 27.4% to 4.359 million mt. The rise was driven by shipments to China which climbed 12.9% to 2.876 million mt. Chilean copper production is expected to rise 5% this year to around 5.51 million mt, driven by the ramp-up of Teck’s newly expanded Quebrada Blanca mine. The rise helped offset the sharp fall in cathode shipments this year. These fell 8.2% in the year to April to 746,940 mt, including a 17.5% drop in April to 181,336 mt. Platts Connect: News & Insights (spglobal.com)

News

Sales prices higher than stabilized seaborne levels Company attributes prices to product quality, customer relationships Total capacity could reach 170,000 mt/year by end of 2026 Arcadium Lithium achieved average realized pricing of over $20,000/mt for its global lithium carbonate and hydroxide sales in the first quarter, coming in higher than seaborne lithium prices for the period, CEO Paul Graves said May 7 in the company's Q1 earnings statement. “Our multi-year customer relationships and wide range of high-quality lithium products allow us to reduce the overall volatility of our earnings while maximizing the value per unit of lithium sold,” Graves said. The first quarter represented Arcadium’s first full quarter as a newly created company via the merger of lithium producers Livent and Allkem . The merger was completed in January. The combined lithium company is now dual listed in the US and Australia with operations in multiple continents. Asian seaborne lithium prices, one of the leading indicators for global lithium prices, have stabilized so far in 2024 after rising to record highs in 2022 and subsequently plunging in 2023. Platts, part of S&P Global Commodity Insights, assessed lithium carbonate CIF North Asia at $14,600/mt May 7, its highest level since Jan. 11. The assessment has hovered between $13,500/mt and $14,500/mt for most of the year. The trend has been similar for lithium hydroxide since 2022, with the Platts assessment at $14,800/mt May 7 on a CIF North Asia basis. “We see encouraging signs in the lithium market and underlying demand fundamentals remain very strong,” Graves said. “Prices have increased from the cycle bottom and appear to have stabilized at levels that are notably higher than what we saw in the last downturn.” Arcadium said its total Q1 sales volumes, including both finished lithium products and mined lithium spodumene, dipped from the prior sequential quarter due to a decline in spodumene sales resulting from its production cuts at Mt. Cattlin in Australia. However, it did not disclose its sales volumes. The lithium producer reported a net income of $19.9 million on sales of $261.2 million in Q1, compared with an income of $114.8 million on sales of $253.5 million in Q1 2023. Expansions in 2025-26 to add 95,000 mt/year of capacity Arcadium said it remains on track to complete a slate of new capacity constructions and existing capacity expansions in 2025 and 2026, adding about 95,000 mt/year of nameplate production capability to reach a total 170,000 mt/year across its global footprint by the end of 2026, on a lithium carbonate equivalent basis. “This pathway to significant near-term volume growth puts our company in a unique position within our industry,” Graves said. “There is no doubt that post-merger, we are stronger and more resilient, and we remain confident investing in our highly attractive assets throughout market cycles.” The new capacity planned through 2025 and 2026 will add 25,000 mt in Argentina across the Fénix and Sal de Vida projects and an additional 70,000 mt in Canada across the Nemaska and James Bay projects. In 2024, Arcadium is currently commissioning, qualifying or ramping a 10,000 mt carbonate expansion at its Fénix site in Argentina, a 25,000 mt carbonate expansion at its Olaroz site in Argentina, a 5,000 mt hydroxide expansion at its Bessemer City plant in the US and new hydroxide capacity totaling 15,000 mt at its Zhejiang plant in China. Platts Connect: News & Insights (spglobal.com)

News

Announces 105,454 jobs in 40 states, Puerto Rico Republican districts land most of the investment, jobs A $1.4 billion investment by Toyota to build a new SUV at its Indiana plant and a $294 million solar technology investment for North Carolina in April added to the growing tally of large clean energy projects and jobs that the Inflation Reduction Act has spurred since 2022, according to business group E2. The investment by Boviet Solar Technology, a Vietnamese manufacturer of monocrystalline photovoltaic cells, is expected to bring 908 jobs to eastern North Carolina, E2 reported. Also new for April was a $400 million hydrogen manufacturing plant announced for Virginia and a $10 million planned investment in Alabama by a company making steel structures for solar panels. But the pace of new investments has been slowing significantly this year compared with 2023, when there were three or four times as many clean energy announcements every month, E2's data shows. The market cannot continuously absorb the volume of deals that followed the passage of the law, Bob Keefe, executive director of E2, said in an interview. He also noted that the November elections and anti-IRA rhetoric in Congress could be taking a toll. "We've had more than 30 attempts in the [US House of Representatives] to roll back the IRA, or to reduce it," Keefe said. "And the uncertainty over the election is casting a cloud over the future of these policies." The CEO of a company that is building a $2 billion battery factory in Georgia recently told Keefe that the overall political uncertainty has made it more difficult to raise money and hire people for the project. 'Not a partisan issue' E2 keeps a running tally of large-scale projects made possible by tax credits under the landmark 2022 legislation passed to stimulate clean energy manufacturing in the US. The group of business leaders advocates for policies that are "good for the economy … and the environment," with its members representing more than 2,500 companies nationwide. So far, North Carolina, Georgia, and South Carolina top all other states in terms of IRA investment volumes, E2 said. In all, more than $123 billion in investment and at least 105,454 jobs have been announced in 40 states and Puerto Rico since the IRA was enacted in August 2022, the group reported. Of those investments, 85% have gone to Republican congressional districts, as have 70% of the jobs. The reason behind the partisan discrepancy is that nearly all new electric vehicle manufacturing was placed in the South, where carmakers already had operations, Keefe said. EV manufacturing has captured the single largest share of IRA-related investments -- 142 projects and $81.2 billion in investments, E2's data shows. "What this shows is that this should not be a partisan issue," Keefe said. "There's nothing partisan about creating jobs, driving economic growth, attracting investments and making America more competitive, in my opinion." Platts Connect: News & Insights (spglobal.com)