South Korea refiners look to gain on strong 2022 products cracks, but cautious on 2023 margins

South Korean refiners are expected to report stellar 2022 earnings when they release financial results in February, helped by strong oil products cracks and export margins last year. However, the global economic slowdown and a possible increase in Chinese supply would likely compel the industry to err on the side of caution in 2023.

Limited Chinese exports and trade hurdles for Russian barrels worked heavily in favor of the South Korean refining industry, which has the biggest exporting capacity in Asia. This was despite feedstock costs surging for Asia refiners, with the global physical crude benchmark Platts Dated Brent averaging above $107/b during the second and third quarters of 2022, refinery officials, product marketers and plant operation managers based in Seoul, Ulsan and Incheon said.

"Asia-wide refiners broadly should be reporting strong 2022 calendar year earnings. South Korean refiners probably took the maximum advantage of robust margins as they reaped full benefits of both domestic and international sales," according to a middle distillate marketing manager at a South Korean refiner.

Major South Korean refiners are due to report their full-year 2022 earnings progressively from mid-February.

Hyundai Oilbank had posted a third-quarter 2022 operating profit of Won 2.8 trillion, or around $2.2 billion, more than double from a year earlier. It has handed out 1,000% of base salaries to staff as bonuses, according to local media reports and a middle distillate trading source at the company, who declined to be identified.

SK Innovation's refining arm SK Energy reported Q3 operating profit of around $2.66 billion, up more than 400% from a year earlier, while S-Oil Corp. saw Q3 operating profit jump 104% year on year to $2.87 billion and GS Caltex's Q3 profit surged 186% from a year earlier to $3.47 billion.

"The country's smallest refiner [Hyundai Oilbank] has set a very positive and high standard for the rest," said a feedstock management source at another South Korean refiner, who declined to be identified due to the sensitive nature of corporate earnings.

Refining margins still appear attractive although middle distillate crack spreads have come off from June 2022 peak levels, product marketing managers at two major South Korean refiners said.

Platts assessed the second-month gasoil crack spread against Dubai crude swap at $29.34/b Jan. 10, down from the record $67.41/b reached June 24, 2022, but well above the five-year average of $16.60/b, S&P Global data showed.

China easing COVID-19 movement controls and restrictions on Russian oil products trades should provide adequate support for crack spreads, middle distillate marketers based in Seoul and Ulsan said.

However, South Korean refiners would maintain a cautious stance as rising interest rates could put pressure on consumer and business demand. A slowdown in Asia's property sector, as well as potential increases in China's oil products exports this year, pose a big risk to refining and export margins, the middle distillate marketers said.

Industry sources said they expect more competition in the regional export market in the early part of 2023 as Beijing issued 18.99 million mt export quotas for clean oil products in its first batch for 2023.

The quotas for China exporting gasoline, gasoil and jet fuel are 46% higher from 13 million mt issued in the same batch for 2022.

In addition, the region's commercial flight traffic and jet fuel demand remains far behind prepandemic levels. The global economic slowdown is a real concern since no matter how good the cracks are, margins must be backed up by solid consumer and industrial demand, according to the product marketers and a senior official at a third South Korean refiner.

News

India's unwavering appetite for Russian crude has provided ample bandwidth to Middle Eastern sour crude suppliers to cater to the needs of South Korea, Japan, Thailand and other East Asian buyers. Even if OPEC+ decides to extend production cuts, East Asian refiners are confident they can secure adequate Middle East sour crude term supplies. View full-size infographic Also listen:

News

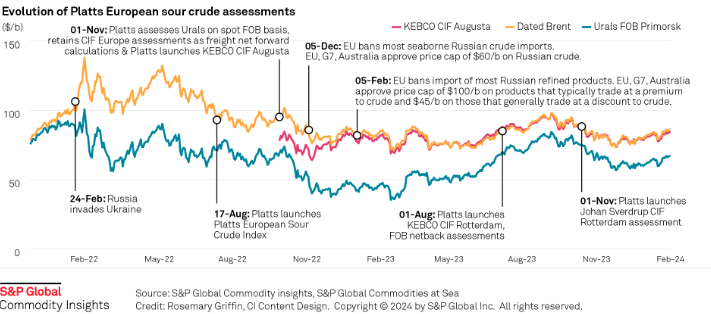

Russia's invasion of Ukraine has had a profound impact on sour crude export destinations, and increased the appetite for sweet crudes among European refiners. Platts methodology has evolved to reflect this changing landscape. Click here to see the full-size infographic.

News

Latest update: Jan. 30, 2024 A key OPEC+ advisory committee, co-chaired by Saudi Arabia and Russia, is set to meet online Feb. 1, with crude prices still stuck below the level that many of the alliance’s major producers need to balance their budgets. Traders will be seeking signals from the Joint Ministerial Monitoring Committee meeting on how long the bloc will keep the reins on its production and how it sees supply-demand fundamentals shaping up in the months ahead. Related story: OPEC+ monitoring committee prepares to meet as group battles sticky oil prices (Subscriber content) Click here to view the full-size infographic Compare hundreds of different crude grades and varieties produced around the world with Platts interactive Periodic Table of Oil .

News

Sumas spot gas down 90.6% year on year CAISO solar generation up 6 points in Dec US West power forwards are trending roughly 50% lower than year-ago packages on weaker gas forwards and above-normal temperatures forecast with El Nino weather conditions to linger into spring. El Nino conditions, which typically occur January through March, tend to bring more rain to the US Southwest and warmer-than-normal temperatures. The three-month outlook indicates a greater probability for above-normal temperatures across most of the Western US, with the exception of the Desert Southwest, according to the US National Weather Service's Climate Prediction Center. SP15 on-peak January rolled off the curve at $55.75/MWh, 79.4% lower than where the 2023 package ended, according to data from Platts, part of S&P Global Commodity Insights. The February package is currently in the low 50s/MWh, 70% below where its 2023 counterpart was a year earlier, while the March package is in the mid-$30s/MWh, 55.4% lower. In gas forwards, SoCal January rolled off the curve at $3.779/MMBtu, 97.9% below where the 2023 contract ended a year earlier, according to S&P Global data. The February contract is currently around $4.063/MMBtu, 78.9% lower than its 2023 counterpart at the same time last year, while the March contract is about $2.816/MMBtu, 63.2% lower. Gas plants burned an average of 1.815 Bcf/d in December to generate an average of 267.167 GWh/d, an analysis of S&P Global data showed. That's down 0.66% from November and a drop of 11.2 % from 2023. S&P Global forecast CAISO's gas fleet to generate around 220 GWh/d in February. In comparison, burning fuel at the same rate as February 2023 would consume 1.758 Bcf/d, a 6% decrease year on year. Spot markets In spot markets, power prices were down significantly from a year ago, when cold weather hit the region and drove up prices. SP15 on-peak day-ahead locational marginal prices averaged $43.49/MWh in December, 83% lower year over year and 11.2% below November prices, according to California Independent System Operator data. Helping pull down power prices, spot gas at SoCal city-gate was down 88.4% year on year and 40% lower month on month at an average of $3.554/MMBtu in December, according to S&P Global data. In the Northwest, Sumas spot gas was down 90.6% year on year at an average of $2.669/MMBtu. The decline in spot gas prices likely accounts for the lower average spot power prices month on month in December, said Morris Greenberg, senior manager with the low-carbon electricity team at S&P Global. Compared to a year earlier, CAISO population-weighted temperatures averaged 8% higher in December, resulting in 38.4% fewer heating-degree days, according to CustomWeather data. Fuel mix Thermal generation remained the lead fuel source at 46.1% of the total fuel mix in December, little changed year on year, while solar generation was up nearly 6 percentage points to average 14.7% of the mix, according to CAISO data. Hydropower remained strong, averaging 8% of the December fuel mix, 2 points higher than a year earlier. Total generation was down nearly 8% from a year earlier at an average of roughly 23.4 GWh/day, as peakload slipped 2% year on year to average 27.254 GW in December, according to CAISO data. In the Northwest, peakload dropped nearly 11% year on year to average 7.89 GW in December, according to Bonneville Power Administration data. Hydropower remained the lead fuel source at nearly 74% of the mix, followed by nuclear at 12.3%, thermal at 9.6% and wind at 4.3%. Following El Nino expectations of the Northwest for warmer temperatures and drier precipitation, BPA population-weighted temperatures in December were 10% above normal and 21.5% higher than a year earlier, leading to 27% fewer heating-degrees days year on year, according to CustomWeather data.