Russian, Belarus refiners cut runs on mounting stocks, sanctions

Refineries in Russia and Belarus are reducing throughput, with some halting production, as they have been unable to place their output due to the reluctance of international buyers to take Russian-origin cargoes following Moscow's invasion of Ukraine.

According to estimates by market participants, around 4 million mt of capacity has been shut since Feb. 24, the day Russia invaded Ukraine. Russian refiners typically process around 25 million mt/month (around 5.9 million b/d).

Russian Deputy Prime Minister Alexander Novak said April 7 that Russia's oil output in April could fall 4%-5% month on month due to financial and logistical difficulties. Novak, who was speaking to Russia 24 TV channel, also said there would also be "adjustments to refining, there will also be a decrease in refining volumes," adding that he did not expect this to affect domestic supplies, and exports would continue.

Some of the lower throughput is due to planned spring turnarounds, though in addition to those, a host of plants appear to have brought forward their works and extended them through June.

The maintenance schedule is encompassing a growing number of plants, including those in the key Samara and Ufa refinery hubs in central Russia and the Far East, and will involve both primary and secondary units.

Small and medium-sized refineries, which produce feedstock predominantly for export, are expected to run at around 50% of capacity in April.

Others have fully halted their output. At the beginning of March the Tuapse and Novoshakhtinsky plants in southern Russia reduced or fully stopped crude intake, as they were unable to ship production.

Tuapse previously exported more than 100,000 mt/month of VGO, but its exports have dropped to zero in April.

Despite their previous dependence on Russian vacuum gasoil, many European refineries have taken the decision to self-sanction Russian-origin products in response to the invasion of Ukraine. "There is just no demand for Russian VGO in Northwest Europe," a trader said.

Russian fuel oil has faced a similar response from international buyers, with mounting stocks putting pressure on domestic prices and refinery runs.

Earlier this week, local media reported that Russian oil major Lukoil was expecting potential refinery closures due to a lack of outlets for fuel oil and spare storage. Later, the company denied the information and said all its refineries were operating normally and finding homes for fuel oil.

However, problems placing Russian feedstock products have worsened.

Another widely exported Russian feedstock, naphtha, is facing avoidance not only internationally, but from domestic petrochemical buyers, themselves subject to sanctions pressure.

The Taif refinery is expected to halt processing this week, as an adjacent petrochemical company has decided to stop taking its naphtha. Petrochemical maker Nizhnekamskneftekhim told local media that its exports to European markets, its main outlet, have dropped since the end of February and individual contracts have been suspended.

The two refineries in Belarus have nearly halved their runs due to sanctions, local media uoted Prime Minister Roman Golovchenko as saying. Naftan currently processes 11,700 mt/day crude oil and Mozyr about 13,700 mt/day. They each have capacity of around 12 million mt/year, although have been processing less than that.

While the US and its partners have not imposed additional sanctions on Belarus' oil sector since the invasion, Belarus had already become reliant on Russian ports for its exports, and the ports are now being shunned by much of European industry.

Naftan also brought forward its planned maintenance to March after losing some export markets, with Ukraine the main one.

Belarus was the biggest source of Ukraine's oil product imports before the war, accounting for 41.9%, but Ukraine halted these after Russia invaded. In 2021, Belarus supplied 3.87 million mt of petroleum products to Ukraine.

Currently refineries in Belarus produce enough to supply the domestic market. In the past they had exported oil products, in particular gasoline, to Russia, but Russian refiners themselves are struggling to place their products.

With buyers in the West avoiding Russian products, Moscow is turning to buyers in the East.

In addition, exports have been ramped up to neighboring Central Asian countries.

Data emerged during the week that Russia increased significantly its oil product exports to China and Kazakhstan in March.

Fuel oil represented the bulk of its exports to China, with 394,200 mt supplied, 43.6% higher month on month, while gasoline exports to Kazakhstan increased 32-fold to 7,600 mt.

However, gasoline exports to Kazakhstan will not come close to offsetting the potential loss of more than 300,000 mt that Russia previously exported monthly.

While Russia traditionally has been short gasoline, the situation appears to be reversing amid an abundance of output countered by diminishing demand.

Russian domestic gasoline supply has been rising, as more naphtha is heading into the gasoline pool due to reduced exports and use by petrochemical plants.

Meanwhile, market participants are concerned that domestic demand is weak on poor prospects for domestic tourism to southern regions, due to the war in nearby Ukraine.

Diesel for the moment appears to be somewhat bucking the pressure of sanctions so far, with fairly typical exports in March, while the April export program from its Baltic port of Primorsk appears to be fairly normal, and domestic demand is drawing support from buying from the agricultural sector and the military.

However, there is growing doubt that these diesel flows will find homes in Europe. In March Russia exported around 2.513 million mt of diesel to Europe, but this is currently set to fall to around 452,000 mt in April so far, according to Kpler data.

News

India's unwavering appetite for Russian crude has provided ample bandwidth to Middle Eastern sour crude suppliers to cater to the needs of South Korea, Japan, Thailand and other East Asian buyers. Even if OPEC+ decides to extend production cuts, East Asian refiners are confident they can secure adequate Middle East sour crude term supplies. View full-size infographic Also listen:

News

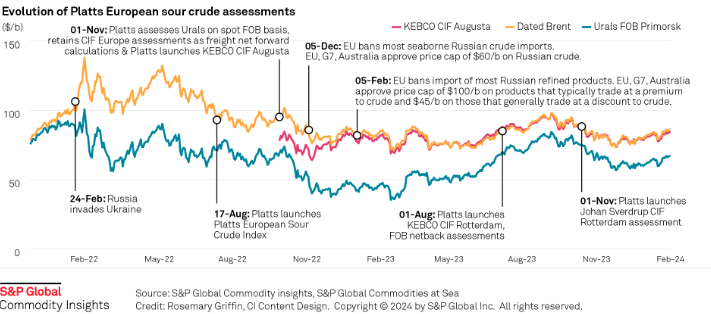

Russia's invasion of Ukraine has had a profound impact on sour crude export destinations, and increased the appetite for sweet crudes among European refiners. Platts methodology has evolved to reflect this changing landscape. Click here to see the full-size infographic.

News

Latest update: Jan. 30, 2024 A key OPEC+ advisory committee, co-chaired by Saudi Arabia and Russia, is set to meet online Feb. 1, with crude prices still stuck below the level that many of the alliance’s major producers need to balance their budgets. Traders will be seeking signals from the Joint Ministerial Monitoring Committee meeting on how long the bloc will keep the reins on its production and how it sees supply-demand fundamentals shaping up in the months ahead. Related story: OPEC+ monitoring committee prepares to meet as group battles sticky oil prices (Subscriber content) Click here to view the full-size infographic Compare hundreds of different crude grades and varieties produced around the world with Platts interactive Periodic Table of Oil .

News

Sumas spot gas down 90.6% year on year CAISO solar generation up 6 points in Dec US West power forwards are trending roughly 50% lower than year-ago packages on weaker gas forwards and above-normal temperatures forecast with El Nino weather conditions to linger into spring. El Nino conditions, which typically occur January through March, tend to bring more rain to the US Southwest and warmer-than-normal temperatures. The three-month outlook indicates a greater probability for above-normal temperatures across most of the Western US, with the exception of the Desert Southwest, according to the US National Weather Service's Climate Prediction Center. SP15 on-peak January rolled off the curve at $55.75/MWh, 79.4% lower than where the 2023 package ended, according to data from Platts, part of S&P Global Commodity Insights. The February package is currently in the low 50s/MWh, 70% below where its 2023 counterpart was a year earlier, while the March package is in the mid-$30s/MWh, 55.4% lower. In gas forwards, SoCal January rolled off the curve at $3.779/MMBtu, 97.9% below where the 2023 contract ended a year earlier, according to S&P Global data. The February contract is currently around $4.063/MMBtu, 78.9% lower than its 2023 counterpart at the same time last year, while the March contract is about $2.816/MMBtu, 63.2% lower. Gas plants burned an average of 1.815 Bcf/d in December to generate an average of 267.167 GWh/d, an analysis of S&P Global data showed. That's down 0.66% from November and a drop of 11.2 % from 2023. S&P Global forecast CAISO's gas fleet to generate around 220 GWh/d in February. In comparison, burning fuel at the same rate as February 2023 would consume 1.758 Bcf/d, a 6% decrease year on year. Spot markets In spot markets, power prices were down significantly from a year ago, when cold weather hit the region and drove up prices. SP15 on-peak day-ahead locational marginal prices averaged $43.49/MWh in December, 83% lower year over year and 11.2% below November prices, according to California Independent System Operator data. Helping pull down power prices, spot gas at SoCal city-gate was down 88.4% year on year and 40% lower month on month at an average of $3.554/MMBtu in December, according to S&P Global data. In the Northwest, Sumas spot gas was down 90.6% year on year at an average of $2.669/MMBtu. The decline in spot gas prices likely accounts for the lower average spot power prices month on month in December, said Morris Greenberg, senior manager with the low-carbon electricity team at S&P Global. Compared to a year earlier, CAISO population-weighted temperatures averaged 8% higher in December, resulting in 38.4% fewer heating-degree days, according to CustomWeather data. Fuel mix Thermal generation remained the lead fuel source at 46.1% of the total fuel mix in December, little changed year on year, while solar generation was up nearly 6 percentage points to average 14.7% of the mix, according to CAISO data. Hydropower remained strong, averaging 8% of the December fuel mix, 2 points higher than a year earlier. Total generation was down nearly 8% from a year earlier at an average of roughly 23.4 GWh/day, as peakload slipped 2% year on year to average 27.254 GW in December, according to CAISO data. In the Northwest, peakload dropped nearly 11% year on year to average 7.89 GW in December, according to Bonneville Power Administration data. Hydropower remained the lead fuel source at nearly 74% of the mix, followed by nuclear at 12.3%, thermal at 9.6% and wind at 4.3%. Following El Nino expectations of the Northwest for warmer temperatures and drier precipitation, BPA population-weighted temperatures in December were 10% above normal and 21.5% higher than a year earlier, leading to 27% fewer heating-degrees days year on year, according to CustomWeather data.