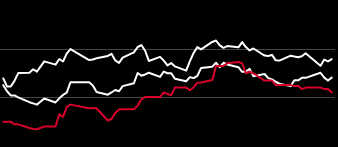

ERCOT Emissions Adjusted REC Prices

Energy Transition

Login

What are ERCOT Emissions Adjusted REC Prices?

ERCOT Emissions Adjusted non-Solar Compliance REC Current Year Vintage Platts ERCOT Emissions Adjusted non-Solar Compliance REC Current Year Vintage assessment by S&P Global Commodity Insights reflects Platts assessment of Texas non-Solar Compliance REC Current Year Vintage divided by the average LME value associated with this REC, provided by data company REsurety. They are intended to provide market participants with clarity on the value of a REC based on the intensity of greenhouse gas emissions from power generation displaced by renewables production.ERCOT Emissions Adjusted Green-e Eligible Wind REC Current Year VintagePlatts ERCOT Emissions Adjusted Green-e Eligible Wind REC Current Year Vintage assessment by S&P Global Commodity Insights reflects Platts assessment of Texas Green-e Eligible Wind REC Current Year Vintage divided by the average LME value associated with this REC, provided by data company REsurety. They are intended to provide market participants with clarity on the value of a REC based on the intensity of greenhouse gas emissions from power generation displaced by renewables production.ERCOT Emissions Adjusted SREC Current Year VintagePlatts ERCOT Emissions Adjusted SREC Current Year Vintage assessment by S&P Global Commodity Insights reflects Platts assessment of Texas SREC Current Year Vintage divided by the average LME value associated with this REC, provided by data company REsurety. They are intended to provide market participants with clarity on the value of a REC based on the intensity of greenhouse gas emissions from power generation displaced by renewables production. ERCOT Emissions Adjusted Compliance SREC from CRS Listed Facilities Current Year VintagePlatts ERCOT Emissions Adjusted SREC from CRS Listed Facilities Current Year Vintage assessment by S&P Global Commodity Insights reflects Platts assessment of Texas SREC from CRS Listed Facilities Current Year Vintage divided by the average LME value associated with this REC, provided by data company REsurety. They are intended to provide market participants with clarity on the value of a REC based on the intensity of greenhouse gas emissions from power generation displaced by renewables production.

Platts Decarbonization Index

What is Platts Decarbonization Index?Platts Decarbonization Index represents the theoretical cost to offset residual global emissions using carbon credits from increasingly sought-after segments of the Voluntary Carbon Market such as Nature-based Avoidance and Tech Carbon Capture.Disclaimer*This summary (Heards and Prices) will be available for a limited time only. *If you would like to learn more about gaining access to our range of assessments, please fill in this form .ABZIA00Platts Decarbonization Index $/mtCO2eyes

Platts Platts Guarantees of Origin (GOs) Assessments

What are Platts Platts Guarantees of Origin (GOs) Assessments?Platts Guarantees of Origin (GOs) assessment by S&P Global Commodity Insights is the daily price for electronic certificates that prove the electricity bought and consumed by an end-user comes from renewable source. (The equivalent market in the US is Renewable Energy Certificates).Platts GOs REGOs Credit Assessments HeardsPlatts GOs REGOs Credit Assessments CommentaryDisclaimer*This summary (Heards and Prices) will be available for a limited time only. *If you would like to learn more about gaining access to our range of assessments, please fill in this form .HQNMA00Hydrogen Netherlands PEM Electrolysis (incl CAPEX) MA Eur/KgyesIGYBL00Hydrogen California PEM Electrolysis (incl CAPEX) USD/kgyesIGYFM00Japan Hydrogen PEM Electrolysis (incl CAPEX) $/Kgyes

Hydrogen

What are Platts Hydrogen Price Assessments?The daily price assessments demonstrate the production cost of hydrogen for Steam Methane Reforming (SMR) production methods, including some regions Carbon Capture and Storage (CCS), along with prices for Proton Exchange Membrane (PEM) Electrolysis, Alkaline Electrolysis, Auto Thermal Reforming (ATR), Coal Gasification and Lignite Gasification production pathways, depending on the production hubs. The calculated prices reflect both the commodity production cost and the capital expenditure (CapEx) associated with building a hydrogen facility.Platts Hydrogen Assessment Weekly CommentaryDisclaimer*This summary (Heards and Prices) will be available for a limited time only. *If you would like to learn more about gaining access to our range of assessments, please fill in this form .IGYFY00Japan Hydrogen PEM Electrolysis (incl CAPEX) $/kgyesHYSAJ00Hydrogen Saudi Arabia Alkaline Electrolysis (incl CAPEX) $/kgyesHYNWC00Carbon Neutral Hydrogen Ex Works Northwest Europe $/Kgyes

Platts European Biomethane Guarantees of Origin (GOs)

What are Platts European Biomethane Guarantees of Origin (GOs)?Platts European Biomethane Guarantees of Origin (GOs) and UK Renewable Gas Guarantees of Origin (RGGOs) assessments by S&P Global Commodity Insights are the daily prices for European GOs and UK RGGOs, electronic tracking certificates that represent the environmental attributes of 1 megawatt hour of biomethane entering the natural gas grid. Biomethane is purified biogas, which itself is an alternative to traditional, fossil fuel-derived natural gas, generated through the processing of organic residues from different feedstocks, many of which may otherwise emit methane into the atmosphere.Platts European Biomethane GOs HeardsPlatts European Biomethane GOs commentaryDisclaimer*This summary (Heards and Prices) will be available for a limited time only. *If you would like to learn more about gaining access to our range of assessments, please fill in this form .HQNMA00Hydrogen Netherlands PEM Electrolysis (incl CAPEX) MA Eur/KgyesIGYBL00Hydrogen California PEM Electrolysis (incl CAPEX) USD/kgyesIGYFM00Japan Hydrogen PEM Electrolysis (incl CAPEX) $/Kgyes

CARBEX powered by Viridios AI Carbon Credit indices

What are CARBEX powered by Viridios AI Carbon Credit indices?In partnership with Viridios AI, Platts is publishing six 'CARBEX' carbon credit indices. The six indices reflect the value of different types of voluntary carbon credits and enhance market transparency in the complex voluntary carbon credit and co-benefit markets. Co-benefits are terms attached to carbon credits that provide evidence of meeting the 17 Sustainable Development Goals, or SDGs, defined by the United Nations General Assembly.Disclaimer*This summary (Heards and Prices) will be available for a limited time only. *If you would like to learn more about gaining access to our range of assessments, please fill in this form .CBXAA00Household Devices CARBEX $/mtCO2e (CBXAA00)yesCBXAB00Soil CARBEX $/mtCO2e (CBXAB00)yesCBXAG00Blue Carbon CARBEX $/mtCO2e (CBXAG00)yes

Platts American Energy Certificates (US RECs)

What are Platts American Energy Certificates (US RECs)?Platts American Energy Certificates (US RECs) assessment by S&P Global Commodity Insights is the weekly price for the REC certificates, issued from electricity generated, and delivered to the electric grid, from a renewable energy resource. As others EACs, a REC sells separately from the actual electricity. The REC owner retains exclusive rights to claim “using” or “being powered by” the renewable electricity associated with that REC.American Energy Certificates commentaryDisclaimer*This summary (Heards and Prices) will be available for a limited time only. *If you would like to learn more about gaining access to our range of assessments, please fill in this form .RECMAC1Massachusetts REC Class 1 Current Year Vintage WklyyesARHAI00NAR Any REC Current Year Vintage WklyyesADJAK00ERCOT Emissions Adjusted SREC Current Year Vintageyes

Platts Biodiesel Assessments

What are Platts Biodiesel Assessments?S&P Global gathers price data from a wide segment of the market, including biodiesel producers and distributors as well as agricultural traders, fuel blenders, retailers and refiners. Biodiesel is an umbrella term that covers a range of potential fuels derived largely by a transesterification process from such diverse feedstocks as rapeseed, palm oil, soybean or even used cooking oil and tallow.Disclaimer*This summary (Heards and Prices) will be available for a limited time only. *If you would like to learn more about gaining access to our range of assessments, please fill in this form . *If you would like to learn more about our assessments and methodology, please email MRTS_AgricultureandFood@spglobal.com.ABPLA00Biodiesel DAP Paulinia R$/cbm (ABPLA00)yes