9 questions, 1 expert -- with Sambit Mohanty, Asia Energy Editor at S&P Global Commodity Insights

Interview with Sambit Mohanty, Asia Energy Editor, S&P Global Commodity Insights

1. What do you think will be one of the main themes for Asian oil markets in the near to medium term?

Asia is expected to account for the bulk of global oil demand growth in 2024, but strong economic growth will help India's demand growth edge past that of China, where economic headwinds will likely keep a lid on appetite for fossil fuels. Our own forecast suggests that South Asian demand will likely increase by 3.2% in 2024, exceeding mainland China's 2.9% in 2024. The International Energy Agency has recently said that India' will become the largest source of demand growth from now until 2030. And in the same period, oil demand growth in developed economies and China will initially slow down and then subsequently go into reverse.

2. Building on what you have already said, India is surely emerging as the brightest spot for oil demand. Many refineries are still pursuing expansion. How will the refining outlook shape up in India over the next few years?

India will be one of the few countries to witness refining capacity growth over the next few years, but expansions will reflect a bigger share of petrochemicals as refiners look to widen their product slate to reduce overdependence on transport fuels. India's state refiners' expansion programs would focus increasingly on boosting conversion ratios from crude to petrochemicals to about 10%-15%, from around 4%-5% currently. But at the same time, there is a need to be conscious of their responsibility to fight climate change. As a result, refiners will need to increasingly use technologies to ensure that emissions are minimized.

3. You recently met with many Indian oil and gas CEOs as part of the India CEO Series by S&P Global Commodity Insights. You also had an interaction with India's petroleum minister Hardeep Singh Puri. What were the key points that emerged from those discussions?

As part of the India CEO Series, I spoke to many government and industry leaders in India's oil and gas sector to get insights on how those companies are planning to strike a balance between traditional and new businesses at a time when energy transition is changing the industry's landscape, while geopolitical turbulence is throwing up new challenges. The key theme that emerged was that India must ensure affordable oil and gas for its citizens by continuing to invest in the sector, while making an orderly transition to clean energy without vilifying fossil fuels. Also, as energy transition gathers pace, India is hoping that gas can act as a bridge fuel, with domestic production going up at a healthy pace. The country is also nurturing ambitions to be a major producer and consumer of green hydrogen. It also expect biofuels to place a crucial role in the country's energy mix.

India's Minister for Petroleum and Natural Gas Hardeep Singh Puri with Asia Energy Editor Sambit Mohanty

4. For Asia as a whole, one of the key themes on the supply side has been the drastic change in oil flows since the Russia-Ukraine war started. If you can share your insights on how the oil flow map has evolved and what's in store for the foreseeable future?

The spotlight will remain on Asia's unwavering appetite for Russian crude which has catered to refiners in India and China in a big way since the start of the Russia-Ukraine war, tilting the balance away from Middle Eastern supplies. Middle Eastern crude share in China's total import basket fell to about 46% in 2023, from nearly 53% in 2022, as Russia took the top supplier position in China. Meanwhile, India's crude imports from Middle Eastern suppliers tumbled 21% in 2023, while Russia contributed over 35% of India's total crude imports. India and China are expected to continue favoring Russian crude in 2024, leaving ample Middle Eastern sour crude supplies available for other Asian buyers, such as Japan and South Korea.

5. Staying on the same supply theme, with OPEC+ deciding to extend its production cuts, do you think there's a reason for Asia to worry?

Asian crude buyers are unlikely to face a supply squeeze following extended production cuts by OPEC+ and Russia's move to slash output by an extra round. This year, there will be plentiful non-OPEC supplies to fill any potential void. While the recent developments have largely laid out a clear near-term supply roadmap for global crude oil for the next few months, a feeble market reaction to those decisions suggests that demand growth, mainly in Asia, may fall short of pick up in overseas supply on the back of rising production in countries, such as the United States and Brazil. The International Energy Agency said that with stronger-than-expected output from key American producers this year, it expected global oil supplies to average a record 103.8 million b/d in 2024.

6. How important do you think continued investments in upstream oil projects will be for global energy security?

Asian countries will have to keep investing in the upstream sector to ensure higher oil and gas production to avoid possible supply problems or volatile energy prices, but there is a need to embrace technologies that are more environment friendly. On a global scale, there will be a need to pursue multiple pathways to ensure uniform energy transition for all. There is no one-size-fits-all solution to a sustainable energy future.

7. Do you think the Red Sea crisis will prompt Asia to rethink oil policy or near-term supplies are largely intact?

Asia may not witness dramatic changes to near-term oil supplies amid the ongoing Red Sea crisis, but refiners are chalking out alternative plans to ensure steady feedstock flows in the event of an escalation. These developments could potentially inflate insurance costs and crimp refining margins. However, the strategic push among Asia's top importers to massively diversify their import baskets over the years, as well as expanding strategic storage, will come in handy to ensure smooth and uninterrupted flow of feedstocks. That said, a series of attacks on shipping in the Red Sea have compelled traders and suppliers to explore alternative routes via the Cape of Good Hope but crude shipments to countries like India and China have remained largely unaffected.

8. As geopolitical tensions mount, do you think this will make oil storage expansion imperative in Asia -- for example in countries such as India?

India's vulnerability is apparent, especially in the face of recent disruptions, such as those witnessed in the Red Sea or heightened tensions in the Middle East. Any unforeseen situation along the supply route has the potential to jeopardize energy security. This underscores the need for strategic measures and investments to enhance the country's energy resilience and mitigate risks associated with external dependencies. Indian Strategic Petroleum Reserves Ltd. currently have a capacity of 5.33 million mt, providing for about 9.5 days of total net oil imports. In addition, state oil companies hold storage facilities for crude oil and petroleum products for 64.5 days of total net imports. Adding those two numbers the current total national capacity for storage of crude oil and petroleum products stands at 74 days of total net imports. On the other hand, IEA member countries are required to ensure oil stock levels equivalent to no less than 90 days of their net imports.

9.The big debate for Asia is the debate on cleaner vs cheaper fuels. With the region dependent on oil and coal in a big way for its energy needs, do you think Asia's policy dilemma is here to stay for now?

Asia today is relatively better placed to strike a balance between providing affordable and sustainable energy, as well as ensuring energy security, compared to where it was a few years ago. But the biggest headache for policy makers in the region will be that the pace at which Asia can move away from fossil fuels -- oil, gas and even coal -- won't be anywhere near the speed at which the Americas and Europe are embracing the changing energy landscape. Although renewables, such as hydrogen and solar, have started figuring in ambitions of many Asian countries, the region's addiction to oil and coal is something that's not going to go away anytime soon.

Thought Leadership

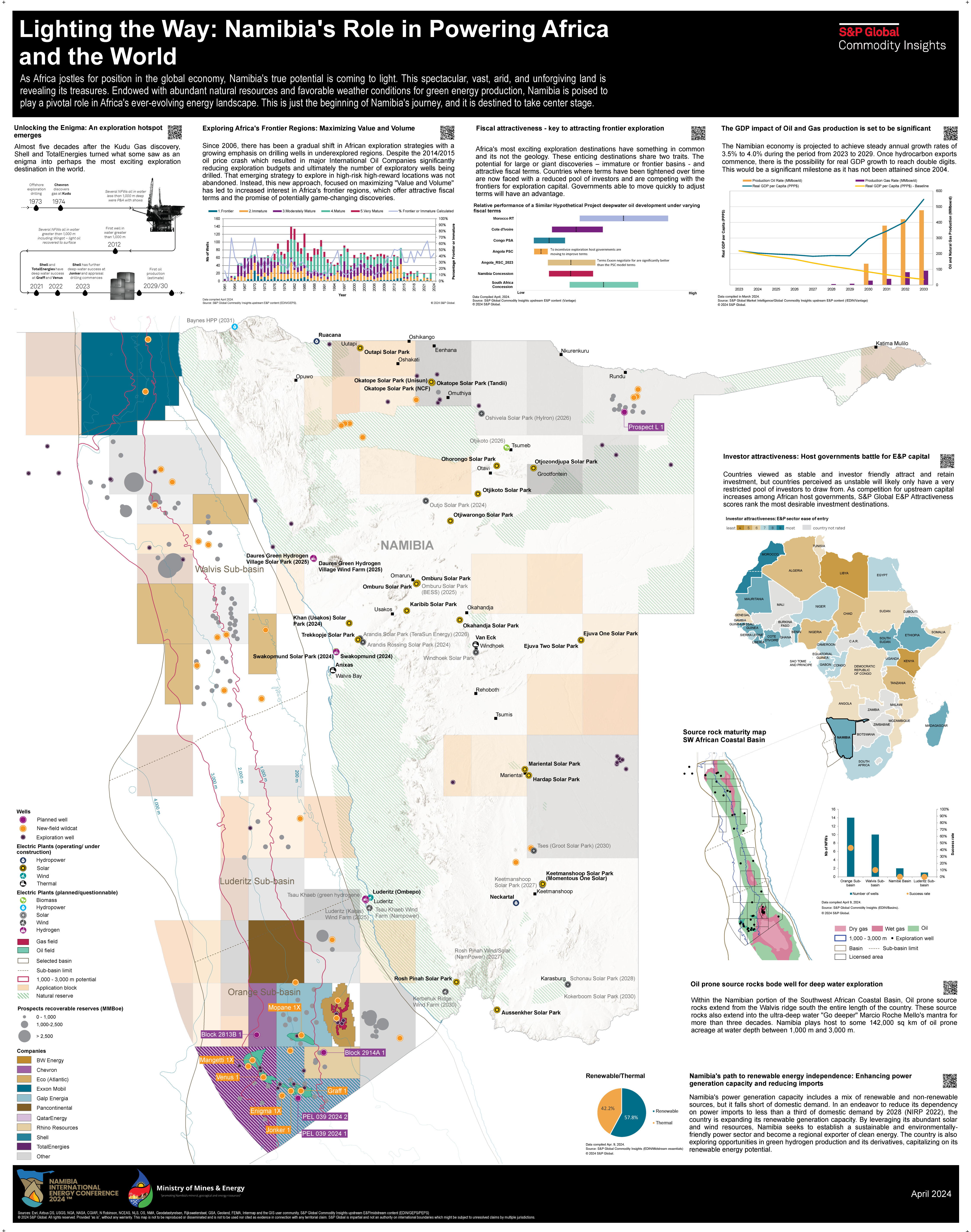

As Africa jostles for position in the global economy, Namibia's true potential is coming to light. This spectacular, vast, arid, and unforgiving land is revealing its treasures. Endowed with abundant natural resources and favorable weather conditions for green energy production, Namibia is poised to play a pivotal role in Africa's ever-evolving energy landscape. This is just the beginning of Namibia's journey, and it is destined to take center stage. The 6th edition of the Namibia International Energy Conference 2024 takes place from 23 – 25 April 2024 in Windhoek, Namibia . Themed ‘ Reimagine Resource-Rich Namibia: Turning Possibilities into Prosperity ,‘ this influential event brings together policymakers, energy stakeholders, investors, and international partners to foster industry growth and position Namibia as a prime investment destination. Convened by RichAfrica Consultancy, the three-day flagship event is held under the patronage of the Ministry of Mines & Energy and in strategic partnership with the African Energy Chamber. S&P Global Commodities Insights in partnership with RichAfrica and the African Energy Chamber will be present at the event delivering insights into Namibia's role in powering Africa and the world. DOWNLOAD INFOGRAPHIC

Thought Leadership

The price wall visualizes 258 of the most important price benchmarks assessed by Platts across various commodities from crude through to chemicals, LNG and carbon. The wall shows the price performance of these benchmarks over 2023 based on their indexed value from the first day of trading. Click on the commodity button to isolate different groups of resources to see which performed best in 2023, a year that saw dramatic changes in trade flows and demand because of sanctions and price caps on Russian commodities and a recovering post-COVID global economy. Isolate individual benchmarks by clicking on the tile to reveal a unique QR code to navigate to specific Platts methodology pages and average price data for 2022 and 2023. Click to start exploring

Thought Leadership

Market values of European wind and solar output plummeted in March as oversupply pulled power prices lower, Platts Renewable Energy Price Explorer shows. Spanish wind and solar capture prices were hit hardest, averaging around Eur12/MWh, according to Platts assessments for S&P Global Commodity Insights. Capture rates fell to 56% for Spanish solar and 60% for Spanish wind, the lowest monthly level on record. Germany, Europe’s biggest market for both wind and solar with 16 TWh generated in March, saw average capture prices fall below Eur60/MWh. Capture rates ranging from 81% for solar to 92% for offshore wind. The Explorer shows the "capture price" renewable energy generators receive based on hourly output and pricing data on a monthly basis. As such capture prices take account of the cannibalization effect caused by Europe's growing fleet of solar and wind farms and are a more accurate reflection of value than average day-ahead wholesale power prices. Elsewhere, Italian capture prices remained highest due to the underlying power price premiums. UK wind captured over 100% of wholesale market values in March averaging above Eur70/MWh. Italian wind and solar values averaged highest, but output was the lowest. Overall, gains for solar were not enough to offset lower wind generation, which fell year on year for the first time since June. The 46 TWh generated by the over 330 GW of wind and solar in the five markets was down 4% on year. For further information, see methodology or contact ci.support@spglobal.com The dial chart shows monthly wind, solar, nuclear, gas and coal-fired generation across Europe's five biggest power markets. Click a segment for more detail.

Thought Leadership

Meet the member. 1. What role do you play or what is your involvement within the team LIVE? I lead our dynamic Ecosystem Marketing team, which is dedicated to positioning us within the right communities to boost visibility, engage with market participants, and ultimately, cultivate both current and future customers. Our mission involves crafting various co-marketing engagement and community growth programs in collaboration with our expanding partner network, including channels, exchanges, strategic partners, influential associations, and our growing digital community on LIVE. Our focus on nurturing a vibrant ecosystem within our sphere is pivotal to our long-term success. 2. Among the elements of LIVE, which one is your favorite and what makes it stand out to you? Conferences on LIVE is one of my personal favorite areas. The synergy between LIVE and events is undeniable—they both revolve around connection, content, and community. Conferences on LIVE provide an ever-present platform for ongoing conversations with our event communities, acting as the glue that binds our key event moments, from Aluminum Symposium to GEA. I'm particularly excited to witness the evolution of this space over time. 3. As we strive towards the goals set for Paris 2050, which future energy development do you perceive as the potential saving grace, and what factors contribute to your belief? Carbon intensity measurement is a key factor in navigating the journey towards cleaner energy systems and achieving the objectives outlined in the Paris Agreement for me. Serving as a GPS for emissions, it illuminates the areas of greatest impact, empowering stakeholders to set smarter goals for emission reduction. This data enables policymakers and businesses to allocate resources effectively, while also shedding light on the environmental impact of different energy sources. With ongoing monitoring, we can stay on course with our emission goals and adjust strategies as needed. Moreover, carbon intensity measurement supports carbon markets, incentivizing cleaner technologies and practices. In essence, carbon intensity measurement serves as the linchpin for realizing the Paris Agreement's objectives, providing insights that drive progress towards a cleaner, greener future. 4. Within your community, what is the trending “hot topic” in discussions or conversations? Undoubtedly, the buzz around CERAWeek 2024 dominates discussions within our community. Bringing together top minds and industry giants, this event serves as a hub for discussing, debating, and collaborating on the most critical issues shaping the future of energy. The excitement surrounding CERAWeek 2024 is palpable and has become the talk of the town. 5. What energy development makes you most excited for the future? While not the most obvious choice, I'm particularly enthusiastic about the impact of derived data for commodity markets using cloud technology. AI gets the limelight, but this advancement presents a range of opportunities for the markets we serve. From making data more accessible and handling big data seamlessly to enabling smarter predictions and bolstering risk management, the potential of derived data with cloud tech is immense. Additionally, the integration of machine learning and AI promises valuable insights, fostering increased transparency and efficiency. Cloud technology's cost-effectiveness for smaller players and resilience further enhance its appeal. Ultimately, I believe that unlocking derived data with cloud tech will revolutionize operations and decision-making in commodity markets, paving the way for a more efficient and resilient future. Daniel Lawson Marketing