Despite challenges, US energy investors, policymaker see energy transition growth

As US power market participants grapple with recent offshore wind industry challenges, there is expectant optimism about the US Inflation Reduction Act shifting to a more actionable phase for investors as further guidance around tax credits emerges, which could help foster a long-term growth trend for distributed energy generation and associated infrastructure, experts said Oct. 30.

With offshore wind projects across the US Northeast struggling due to higher costs than when power purchase agreements were signed, New York regulators in October dismissed a request by several developers to raise the contracted offtake price they accepted in their contracts following competitive solicitations.

"I work in a world where there is some dissonance going on at the moment," Doreen Harris, president and CEO of the New York State Energy Research and Development Authority, said during the S&P Global Financing US Power Conference that was held in New York City.

New York’s landmark climate law, the Climate Leadership and Community Protection Act, mandates 100% zero-emissions power by 2040 and a big part of meeting that target is predicated on 9 GW of offshore wind power capacity by 2035.

The development pipeline for those offshore wind projects was moving ahead fairly smoothly until armed conflict in Europe rippled through global energy markets, Harris said, with significant impacts in New York on things like supply chain costs and bottlenecks.

"As policymakers we recognize that we have to create that durable market signal in order for the markets to invest and that’s really what New York’s climate law has done," she said.

The scoping plan for how to enact the climate law considered "massive load growth – a doubling of our load in the state over the coming decades" and reliance on a 15 GW of zero-emissions dispatchable resources to balance out the renewable generation, Harris said.

The state had built up a 14-GW portfolio of projects that signed power delivery contracts with NYSERDA that would have gotten the state very close to another of its goals which is to have 70% renewable power by 2030.

The global energy crisis of the past few years impacted New York projects due to increases in inflation, supply chain constraints and interest rate volatility that caused problems for project developers, Harris said.

This resulted in most of that 14 GW pipeline of projects seeking to renegotiate their contract terms. "We as a state are making quick work to assess the status of these pipeline projects to determine which could advance, which will not and ultimately backfill any gaps lost through attrition of that portfolio," she said.

There is a proceeding underway at the New York Public Service Commission into what constitutes a zero-emissions dispatchable resource and what policies will be needed to build them.

That proceeding will be "critical" and will "set the stage for the next decade of investments past 2030 … and the massive amount of electrification that will come with it," Harris said.

Infrastructure investment

For renewables to continue penetrating the market, broad support is needed in transmission, smart meters, behind-the-meter technology, and infrastructure for electrifying transport, David Giordano, global head of BlackRock Climate Infrastructure, a division within investment giant Blackrock, said.

"We are looking as a firm at the transition to a low-carbon economy as the greatest movement of capital I would argue any of us will see in our careers from a macro-economic level," he said.

By 2030, $4.5 trillion could be invested in the energy transition in the US. "We’re talking about a massive shift in capital deployed," Giordano said.

Additionally, though often cited as a challenge, interest rate increases could actually create more resilience in projects and the transparency that higher rates will create will result in a more stable investment foundation, he said.

Giordano also said individual and corporate interest in decarbonization appears to be making people more willing to pay to pay a bit more for lower-carbon goods and power.

Globally, people are looking for something that is reliable and to account for the amount of carbon that goes into the goods and services they are consuming which will have an inflationary impact on pricing, but the urgency to decarbonize will counterbalance the pressure on pricing, he said.

Himanshu Saxena, CEO, of Lotus Infrastructure Partners, formerly branded as Starwood Energy, said almost all energy sectors have been impacted by the US Inflation Reduction Act and investors are waiting for some additional information from the US Internal Revenue Service on tax credits for hydrogen and carbon capture.

A lot more can happen next year depending on IRS guidance, it could be a "year of execution," he said.

The last year has been about preparing for new opportunities, Rich Roloff, managing director at LS Power, said. "We see this as probably an eight- or ten-year secular growth cycle from here," Roloff said.

Thought Leadership

After decades of slow load growth, surging power demand from electrification of the US economy in a context of increased technical and environmental pressures poses multiple challenges for power markets and utilities, executives said April 16. Some of the executives, speaking at the S&P Global Commodity Insights Global Power Markets event in Las Vegas, suggested ways of meeting those challenges include improved and expanded generation and transmission technology. From about 1990 to about 2007, load growth in the Lower 48 states averaged about 2% a year, said Douglas Giuffre, senior director for North American power markets analysis at S&P Global Commodity Insights, but in the wake of the Great Recession, load growth slowed to about 0.2% a year, as energy efficiency efforts bore fruit. Combining utility projections with consultants employed by regional transmission organizations, “they had consistent load forecasts that over-projected,” Giuffre said. The North American Electric Reliability Corporation noticed this and revised its projected load growth percentages downward to about 0.5% in 2022, but more than doubled that projection in 2023 to about 1.2%, partly because of surging demand from data centers, Giuffre said. “For many parts of the country, this is a dramatic shift from where load growth had been to know what's expected to come,” Giuffre said. “And this is going to require a lot of utilities and RTOs to kind of wrestle with this question: How do you manage to meet this potentially rapidly growing demand that we just haven't seen? … What has changed, clearly, is the sudden discussion of data centers.” Data centers currently consume about 185 TWh a year, “the equivalent to all the residential electricity consumption in Florida and New York today.” Across the various RTOs, data center load is projected to add about 250 TWh, “the equivalent of adding Texas and California residential load,” Giuffre said. 'An uptick in gas' Such surging demand cannot reliably be served, at least in the short term, without adding natural gas-fired generation, Giuffre said. “Natural gas had been obviously for quite some time a leading resource in the market, but we're likely to be at a 25-year low in terms of new gas additions this year,” Giuffre said. However, S&P Global researched the integrated resource plans of several utilities, and “what we’re seeing is an uptick in gas either to replace existing coal-fired generation or as peaking capacity to support renewables.” Vincent Sorgi, president and CEO of PPL, the Allentown, Pennsylvania-based utility holding company, said, “The key to the clean energy transition and getting renewables deployed at scale is natural gas.” “Batteries right now are significantly more expensive than building new natural gas, and the new natural gas units are incredibly efficient,” Sorgi said during a “fireside chat” with Xizhou Zhou, vice president of the Gas, Power and Climate Solutions group at S&P Global. “I think, in general, politicians understand the value of natural gas so they seem to be a lot more amenable” to allowing its growth, Sorgi said, particularly if it is combined with carbon capture and sequestration or alternative fuels such as renewable natural gas or hydrogen. “So, I think you’ll continue to see that in integrated utilities … for more fossil generation,” Sorgi said. Cindy Crane, CEO of PacifiCorp, the Portland, Oregon-based utility holding company, said her company has proposed gas-fired generation to some utility regulators “under the condition that they’re capable to convert to hydrogen.” “We are saying that those are needed to bring that reliability for a longer term in our system,” Crane said. PacifiCorp is also pursuing nuclear power development in the form of a 385-MW small modular reactor pilot project with Bill Gates’ TerraPower, with groundbreaking schedule for June 10 in Caspar, Wyoming, Crane said. Transmission expansion PacifiCorp has also embarked on a 20-year transmission expansion plan involving 345 kV and 500 kV lines estimated to cost about $12 billion, with to of the larger segments resulting in a high-voltage network of more than 1,100 miles of line. “Then, we have several hundred miles more that are scheduled to be coming online between 2025 and 2028,” Crane said. Doug Cannon, president and CEO of NV Energy, which serves significant load centers in Las Vegas, Reno and Carson City, said his company is building more than high-voltage lines along the state’s western border to Reno, east across the middle of the state to Ely and then south to link up with NV Energy’s existing grid. “What you're going to see if you picture Nevada, there's going to be a giant 500-kV triangle that goes around the entire state that is going to improve reliability for our customers [and] dispatch our system in a more efficient way, dropping energy costs for customers,” Cannon said. “It's also going to open up a lot of area that previously could not be developed for renewable energy. There's tremendous solar potential along the west side of the state of Nevada, where there was no transmission. In addition, in the center part of the state, there's more solar potential, as well as improve the geothermal potential.”

Thought Leadership

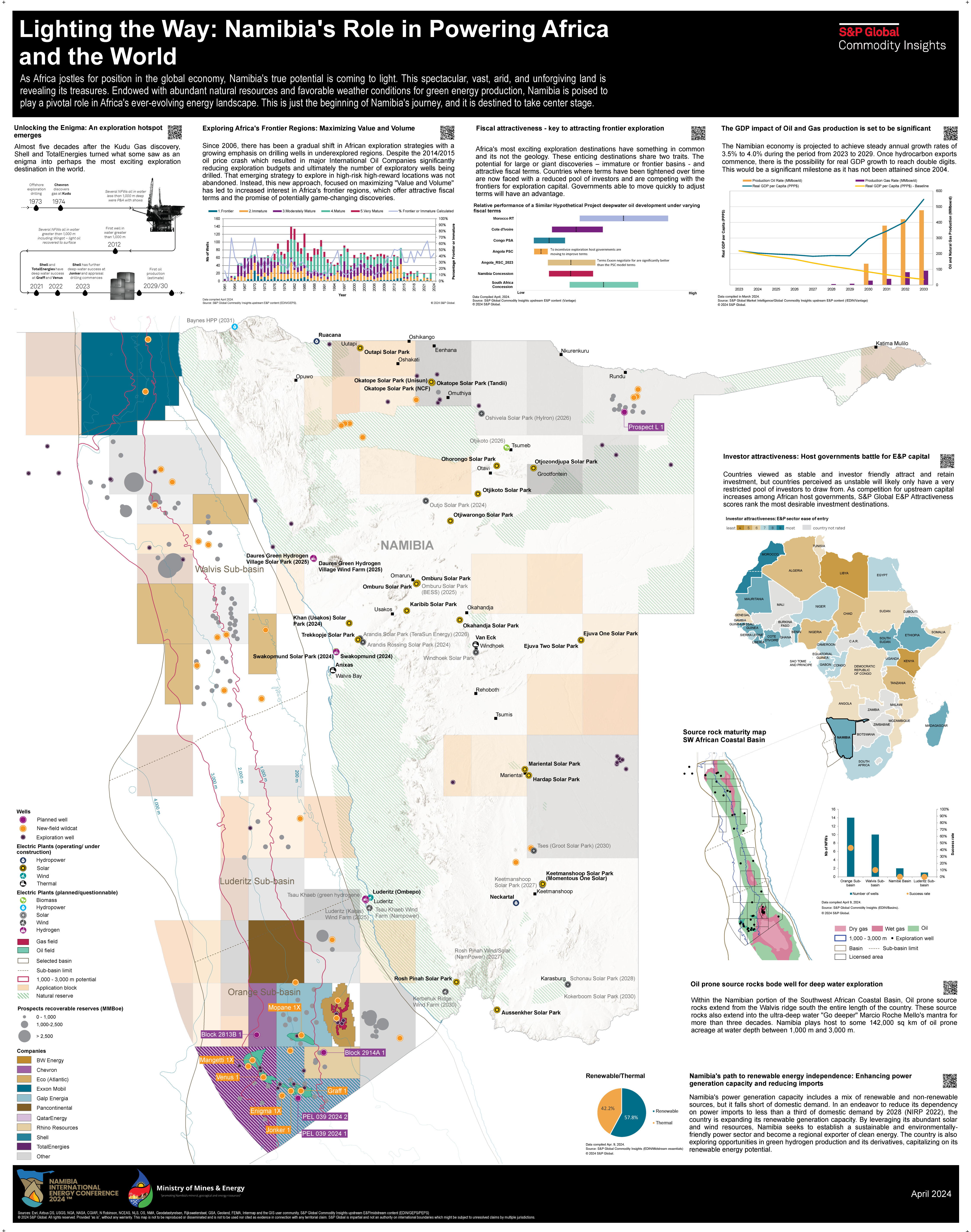

As Africa jostles for position in the global economy, Namibia's true potential is coming to light. This spectacular, vast, arid, and unforgiving land is revealing its treasures. Endowed with abundant natural resources and favorable weather conditions for green energy production, Namibia is poised to play a pivotal role in Africa's ever-evolving energy landscape. This is just the beginning of Namibia's journey, and it is destined to take center stage. The 6th edition of the Namibia International Energy Conference 2024 takes place from 23 – 25 April 2024 in Windhoek, Namibia . Themed ‘ Reimagine Resource-Rich Namibia: Turning Possibilities into Prosperity ,‘ this influential event brings together policymakers, energy stakeholders, investors, and international partners to foster industry growth and position Namibia as a prime investment destination. Convened by RichAfrica Consultancy, the three-day flagship event is held under the patronage of the Ministry of Mines & Energy and in strategic partnership with the African Energy Chamber. S&P Global Commodities Insights in partnership with RichAfrica and the African Energy Chamber will be present at the event delivering insights into Namibia's role in powering Africa and the world. DOWNLOAD INFOGRAPHIC

Thought Leadership

The price wall visualizes 258 of the most important price benchmarks assessed by Platts across various commodities from crude through to chemicals, LNG and carbon. The wall shows the price performance of these benchmarks over 2023 based on their indexed value from the first day of trading. Click on the commodity button to isolate different groups of resources to see which performed best in 2023, a year that saw dramatic changes in trade flows and demand because of sanctions and price caps on Russian commodities and a recovering post-COVID global economy. Isolate individual benchmarks by clicking on the tile to reveal a unique QR code to navigate to specific Platts methodology pages and average price data for 2022 and 2023. Click to start exploring

Thought Leadership

India must keep investing in the upstream sector to ensure higher oil and gas production to avoid possible supply problems or volatile energy prices, as it embraces technologies that are more environment friendly, Mannish Mahesshwari, CEO of Invenire Energy, told S&P Global Commodity Insights. "Flipping the lens to energy security, sustained under investment in upstream without substitutional capacity and substantial scale in clean and new energy could have far reaching consequences in the journey of just transition," Mahesshwari said on the sidelines of the India Energy Week in Goa. Most of assets of private equity backed Invenire are discovered fields in India that the company has acquired through secondary market purchases from other firms as well as through primary acquisitions directly from the government. The company also has assets in Indonesia and East Africa. The private upstream firm is looking to accelerate production of oil and gas from the discovered fields in its portfolio but has no plans to venture into exploration in the foreseeable future. "We are putting our money where our mind is. As a company, our ability to understand the rocks and the molecules is relatively better than the electrons. We are investing in today's energy system, which is mainly oil and helping in phasing out coal with the help of low-carbon gas," Mahesshwari said. He said that the transition to a world of net zero is more certain today than envisaged in 2015, the year of the Paris Agreement. However, it is the uncertainty around the energy transition pace that adds complexity and risk for upstream projects. The upstream industry has been avoiding spending on projects that would either lock in heavy emissions for years to come or quickly turn into stranded assets. Right focus Invenire currently holds stakes in nine blocks in India. Out of these, four are discovered small fields (DSF) blocks -- one in Assam and three in Mumbai offshore -- comprising a total of about 100 million barrels equivalent of oil and gas. Invenire holds a 100% stake in the four DSF acreages. The company has a small production portfolio of about 12,000 b/d but has plans to boost that volume to 35,000 b/d by 2025. According to S&P Global, Invenire Energy's upstream plans show ambition and promise, considering the wider competitive landscape in India. The company's experience of operating in a tough post-2014 upstream period that saw oil prices slump will certainly influence its post-2023 growth ambitions. For assets outside India, the company might have plans to become a non-operator joint venture partner to take stakes in small-to-medium sized producing assets. The company's focus has been on monetizing discovered resources, having both operator and non-operator portfolios, S&P Global said. Besides India, Invenire has producing fields with 45.55% participating interest in a material acreage located in South Sumatra Basin in Indonesia. "The upstream industry's main focus now is to deliver the supply required to meet demand. Most of the industry's oil and gas investment for the rest of this decade will target advantaged resources -- those with the lowest cost, least risk, and possibly lowest Scope 1 emissions. Beyond this decade, to meet demand, the industry will depend increasingly on late-life reserves growth from legacy supply sources." Mahesshwari said. Similar views Mahesshwari's views echoed comments made by state-run upstream producers ONGC Ltd. and Oil India Ltd. at the IEW conference. ONGC Ltd., which contributes about 74% of India's crude oil and around 63% of its natural gas production, has been actively looking to widen its upstream portfolio as it believes that oil and gas will be a major component of the country's energy mix for the next three decades, while pursuing new crude-to-chemicals projects to prepare for the changing energy landscape, its Chairperson Arun Kumar Singh told the conference. Oil India Ltd. is aiming to double its exploration acreage in the coming years and seeking partnerships to realize the hydrocarbon potential of offshore regions in Indian sedimentary basins, its Chairman and Managing Director Ranjit Rath said. Mahesshwari said that there is a need to take a balanced view of energy transition, adding that any shortfall in upstream investments can add to supply issues and volatile energy prices, as seen in recent years. While it's important to keep looking for opportunities to invest in low-carbon businesses, continuing to responsibly invest in the core upstream business will remain the priority for the company in the foreseeable future. "The potential in carbon capture utilization and storage is enormous, and the oil and gas sector has unique skills that make it ideally placed to lead in reducing CO2 and methane emissions and decarbonize hard-to-abate sectors through carbon upcycling," Mahesshwari said.