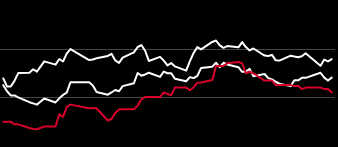

ERCOT Emissions Adjusted REC Prices

/ COMMODITIES

The return of energy security

Events in the last few years have demonstrated that the energy transition depends on energy security to proceed at a steady pace and at scale.

/ COMMODITIES

/ COMMODITIES

Events in the last few years have demonstrated that the energy transition depends on energy security to proceed at a steady pace and at scale.

/ COMMODITIES

Join Michał KurtykaPresidentCOP24 Polish Minister of Climate and Taylor KuykendallSenior Metals and Mining ReporterS P Global Commodity Insights as they reflect on the changes on how the world is navigating the path to net-zero.CERAWeek is taking place from March 18-22 and LIVE will be your all-access pass to the conference. Check back for more insights and cutting-edge coverage.

Join Lance UgglaCEO General AtlanticCo-founder BeyondNetZero as he hits the trending topics of striving for net zero and the abatement of carbon emissions.CERAWeek is taking place from March 18-22 and LIVE will be your all-access pass to the conference. Check back for more insights and cutting-edge coverage.

Join Nicholas FlandersCEO Co-Founder, Twelve as they take a deep dive on the revolutionary technology of teansforming carbon dioxide into jet fuel among other useful products.CERAWeek is taking place from March 18-22 and LIVE is your all-access pass to the conference. Check back for more insights and cutting-edge coverage.

Join Tony PanCEO Co-Founder Modern Hydrogen as they discuss producing clean hydrogen by decarbonizing natural gas and how the technology is further utilized downthe value chain.CERAWeek is taking place from March 18-22 and LIVE is your all-access pass to the conference. Check back for more insights and cutting-edge coverage.

Join Ernest MonizPresident and CEOEnergy Futures Initiative and Taylor KuykendallSenior Metals and Mining ReporterS P Global Commodity Insights as they highlight the possible futures for hydrogen in the energy transition landscape.CERAWeek is taking place from March 18-22 and LIVE will be your all-access pass to the conference. Check back for more insights and cutting-edge coverage.

Listen to Georgy EliseevLead Research Analyst at SP Global Commodity Insights, coming straight from the World Petrochemical ConferenceWPC) in HoustonTXUSA. Georgy brings to you all-things ammonia and its potential as a fuel within the energy transition dynamics. WPC is taking place from March 18-22 and LIVE will be your all-access pass to the conference. Check back for more chemical insights and cutting-edge coverage.

Cyber threats are mounting for utilities' critical infrastructure assets globally. If used by savvy hackers, AI also provides new tools for those trying to disrupt power supply or extract data.Decentralization of assets through the rollout of renewables is growing the attack vector for malign actors, NERC SVP Manny Cancel tells Energy Evolution correspondent Camilla Naschert.Cybersecurity expert Andrew Ginter of Waterfall Security lays out the threat landscape and why IT teams and engineers need to layer their prevention approaches.Subscribe to Energy Evolution to stay current on the energy transition and its implications. The show is co-hosted by veteran journalists Dan Testa and Taylor Kuykendall.More listening options:

India's energy transition strategy encompasses greater adoption of a wide range of renewable fuels to go with baseload coal for decades to come, with new policies on CCUS, carbon markets and power reforms set to play a role in the decarbonization of the third largest greenhouse gas emitter of the world.In this Platts Future Energy podcast, Consulting Executive Director, Energy Transition Gauri Jauhar, Managing Editor, Global Compliance Carbon Pricing Agamoni Ghosh, and Associate Director, Research Mohd. Sahil Ali, join Editor, Energy Transition Ruchira Singh, to discuss the journey so far and the likely future landscape of policies, market development and trends post the mid-2024 general elections.More listening options:

Join Ben WilsonDirector of Products and Solutions for Energy, Amazon Web Services as they discuss all things generative AI and their application in revolutionizing the future of energy.CERAWeek is taking place from March 18-22 and LIVE is your all-access pass to the conference. Check back for more insights and cutting-edge coverage.

Join Jacob DeWitteCEO and CO-Founder,OKLO as they discuss nuclear technology and the commercialization of the next generation fission systems and more. CERAWeek is taking place from March 18-22 and LIVE will be your all-access pass to the conference. Check back for more insights and cutting-edge coverage.

Market values of European wind and solar output plummeted in March as oversupply pulled power prices lower, Platts Renewable Energy Price Explorer shows.Spanish wind and solar capture prices were hit hardest, averaging around Eur12/MWh, according to Platts assessments for S&P Global Commodity Insights. Capture rates fell to 56% for Spanish solar and 60% for Spanish wind, the lowest monthly level on record.Germany, Europe’s biggest market for both wind and solar with 16 TWh generated in March, saw average capture prices fall below Eur60/MWh. Capture rates ranging from 81% for solar to 92% for offshore wind.The Explorer shows the "capture price" renewable energy generators receive based on hourly output and pricing data on a monthly basis.As such capture prices take account of the cannibalization effect caused by Europe's growing fleet of solar and wind farms and are a more accurate reflection of value than average day-ahead wholesale power prices.Elsewhere, Italian capture prices remained highest due to the underlying power price premiums. UK wind captured over 100% of wholesale market values in March averaging above Eur70/MWh.Italian wind and solar values averaged highest, but output was the lowest.Overall, gains for solar were not enough to offset lower wind generation, which fell year on year for the first time since June. The 46 TWh generated by the over 330 GW of wind and solar in the five markets was down 4% on year.For further information, see methodology or contact ci.support@spglobal.comThe dial chart shows monthly wind, solar, nuclear, gas and coal-fired generation across Europe's five biggest power markets. Click a segment for more detail.

Join Janice ChanCEOFounder of Kanin Energy as she discuss zero emission technology and waste to heat clean energy solutions.CERAWEEK is taking place from March 18-22 and LIVE will be your all-access pass to the conference. Check back for more insights and cutting-edge coverage.

Login

ERCOT Emissions Adjusted REC Prices

What are ERCOT Emissions Adjusted REC Prices?

ERCOT Emissions Adjusted non-Solar Compliance REC Current Year Vintage Platts ERCOT Emissions Adjusted non-Solar Compliance REC Current Year Vintage assessment by S&P Global Commodity Insights reflects Platts assessment of Texas non-Solar Compliance REC Current Year Vintage divided by the average LME value associated with this REC, provided by data company REsurety. They are intended to provide market participants with clarity on the value of a REC based on the intensity of greenhouse gas emissions from power generation displaced by renewables production.ERCOT Emissions Adjusted Green-e Eligible Wind REC Current Year VintagePlatts ERCOT Emissions Adjusted Green-e Eligible Wind REC Current Year Vintage assessment by S&P Global Commodity Insights reflects Platts assessment of Texas Green-e Eligible Wind REC Current Year Vintage divided by the average LME value associated with this REC, provided by data company REsurety. They are intended to provide market participants with clarity on the value of a REC based on the intensity of greenhouse gas emissions from power generation displaced by renewables production.ERCOT Emissions Adjusted SREC Current Year VintagePlatts ERCOT Emissions Adjusted SREC Current Year Vintage assessment by S&P Global Commodity Insights reflects Platts assessment of Texas SREC Current Year Vintage divided by the average LME value associated with this REC, provided by data company REsurety. They are intended to provide market participants with clarity on the value of a REC based on the intensity of greenhouse gas emissions from power generation displaced by renewables production. ERCOT Emissions Adjusted Compliance SREC from CRS Listed Facilities Current Year VintagePlatts ERCOT Emissions Adjusted SREC from CRS Listed Facilities Current Year Vintage assessment by S&P Global Commodity Insights reflects Platts assessment of Texas SREC from CRS Listed Facilities Current Year Vintage divided by the average LME value associated with this REC, provided by data company REsurety. They are intended to provide market participants with clarity on the value of a REC based on the intensity of greenhouse gas emissions from power generation displaced by renewables production.

Discover

When the competition is fast, you need to be faster. We're giving you access to the latest cross-commodity insight, ET intelligence and market-leading views, so you can stay on the pulse.